Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what information do you need? this is the whole question. Statement of Comprehensive Income B Ltd ($) C Ltd ($) Statement of Fiancial Position B

what information do you need? this is the whole question.

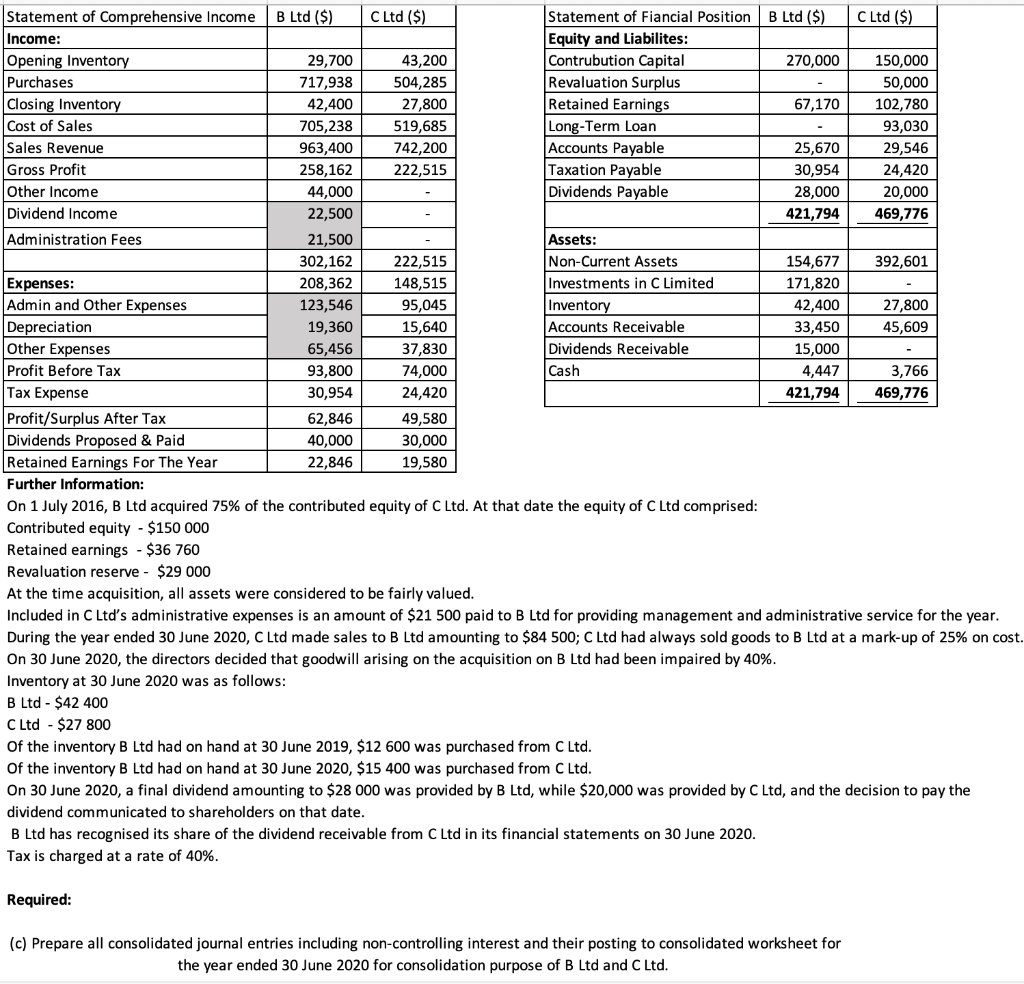

Statement of Comprehensive Income B Ltd ($) C Ltd ($) Statement of Fiancial Position B Ltd ($) C Ltd ($) Income: Equity and Liabilites: Opening Inventory 29,700 43,200 Contrubution Capital 270,000 150,000 Purchases 717,938 504,285 Revaluation Surplus 50,000 Closing Inventory 42,400 27,800 Retained Earnings 67,170 102,780 Cost of Sales 705,238 519,685 Long-Term Loan 93,030 Sales Revenue 963,400 742,200 Accounts Payable 25,670 29,546 Gross Profit 258,162 222,515 Taxation Payable 30,954 24,420 Other Income 44,000 Dividends Payable 28,000 20,000 Dividend Income 22,500 421,794 469,776 Administration Fees 21,500 Assets: 302,162 222,515 Non-Current Assets 154,677 392,601 Expenses: 208,362 148,515 Investments in C Limited 171,820 Admin and Other Expenses 123,546 95,045 Inventory 42,400 27,800 Depreciation 19,360 15,640 Accounts Receivable 33,450 45,609 Other Expenses 65,456 37,830 Dividends Receivable 15,000 Profit Before Tax 93,800 74,000 Cash 4,447 3,766 Tax Expense 30,954 24,420 421,794 469,776 Profit/Surplus After Tax 62,846 49,580 Dividends Proposed & Paid 40,000 30,000 Retained Earnings For The Year 22,846 19,580 Further Information: On 1 July 2016, B Ltd acquired 75% of the contributed equity of C Ltd. At that date the equity of C Ltd comprised: Contributed equity - $150 000 Retained earnings - $36 760 Revaluation reserve - $29 000 At the time acquisition, all assets were considered to be fairly valued. Included in C Ltd's administrative expenses is an amount of $21 500 paid to B Ltd for providing management and administrative service for the year. During the year ended 30 June 2020, C Ltd made sales to B Ltd amounting to $84 500; C Ltd had always sold goods to B Ltd at a mark-up of 25% on cost. On 30 June 2020, the directors decided that goodwill arising on the acquisition on B Ltd had been impaired by 40%. Inventory at 30 June 2020 was as follows: B Ltd - $42 400 C Ltd - $27 800 Of the inventory B Ltd had on hand at 30 June 2019, $12 600 was purchased from C Ltd. Of the inventory B Ltd had on hand at 30 June 2020, $15 400 was purchased from C Ltd. On 30 June 2020, a final dividend amounting to $28 000 was provided by B Ltd, while $20,000 was provided by C Ltd, and the decision to pay the dividend communicated to shareholders on that date. B Ltd has recognised its share of the dividend receivable from C Ltd in its financial statements on 30 June 2020. Tax is charged at a rate of 40%. Required: (c) Prepare all consolidated journal entries including non-controlling interest and their posting to consolidated worksheet for the year ended 30 June 2020 for consolidation purpose of B Ltd and C Ltd. Statement of Comprehensive Income B Ltd ($) C Ltd ($) Statement of Fiancial Position B Ltd ($) C Ltd ($) Income: Equity and Liabilites: Opening Inventory 29,700 43,200 Contrubution Capital 270,000 150,000 Purchases 717,938 504,285 Revaluation Surplus 50,000 Closing Inventory 42,400 27,800 Retained Earnings 67,170 102,780 Cost of Sales 705,238 519,685 Long-Term Loan 93,030 Sales Revenue 963,400 742,200 Accounts Payable 25,670 29,546 Gross Profit 258,162 222,515 Taxation Payable 30,954 24,420 Other Income 44,000 Dividends Payable 28,000 20,000 Dividend Income 22,500 421,794 469,776 Administration Fees 21,500 Assets: 302,162 222,515 Non-Current Assets 154,677 392,601 Expenses: 208,362 148,515 Investments in C Limited 171,820 Admin and Other Expenses 123,546 95,045 Inventory 42,400 27,800 Depreciation 19,360 15,640 Accounts Receivable 33,450 45,609 Other Expenses 65,456 37,830 Dividends Receivable 15,000 Profit Before Tax 93,800 74,000 Cash 4,447 3,766 Tax Expense 30,954 24,420 421,794 469,776 Profit/Surplus After Tax 62,846 49,580 Dividends Proposed & Paid 40,000 30,000 Retained Earnings For The Year 22,846 19,580 Further Information: On 1 July 2016, B Ltd acquired 75% of the contributed equity of C Ltd. At that date the equity of C Ltd comprised: Contributed equity - $150 000 Retained earnings - $36 760 Revaluation reserve - $29 000 At the time acquisition, all assets were considered to be fairly valued. Included in C Ltd's administrative expenses is an amount of $21 500 paid to B Ltd for providing management and administrative service for the year. During the year ended 30 June 2020, C Ltd made sales to B Ltd amounting to $84 500; C Ltd had always sold goods to B Ltd at a mark-up of 25% on cost. On 30 June 2020, the directors decided that goodwill arising on the acquisition on B Ltd had been impaired by 40%. Inventory at 30 June 2020 was as follows: B Ltd - $42 400 C Ltd - $27 800 Of the inventory B Ltd had on hand at 30 June 2019, $12 600 was purchased from C Ltd. Of the inventory B Ltd had on hand at 30 June 2020, $15 400 was purchased from C Ltd. On 30 June 2020, a final dividend amounting to $28 000 was provided by B Ltd, while $20,000 was provided by C Ltd, and the decision to pay the dividend communicated to shareholders on that date. B Ltd has recognised its share of the dividend receivable from C Ltd in its financial statements on 30 June 2020. Tax is charged at a rate of 40%. Required: (c) Prepare all consolidated journal entries including non-controlling interest and their posting to consolidated worksheet for the year ended 30 June 2020 for consolidation purpose of B Ltd and C Ltd Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started