WHAT INFORMATION IS THAT YOU NEED. I HAVE PAID SUBSCRIPTION HERE WHY SHOULD I PAY AGAIN

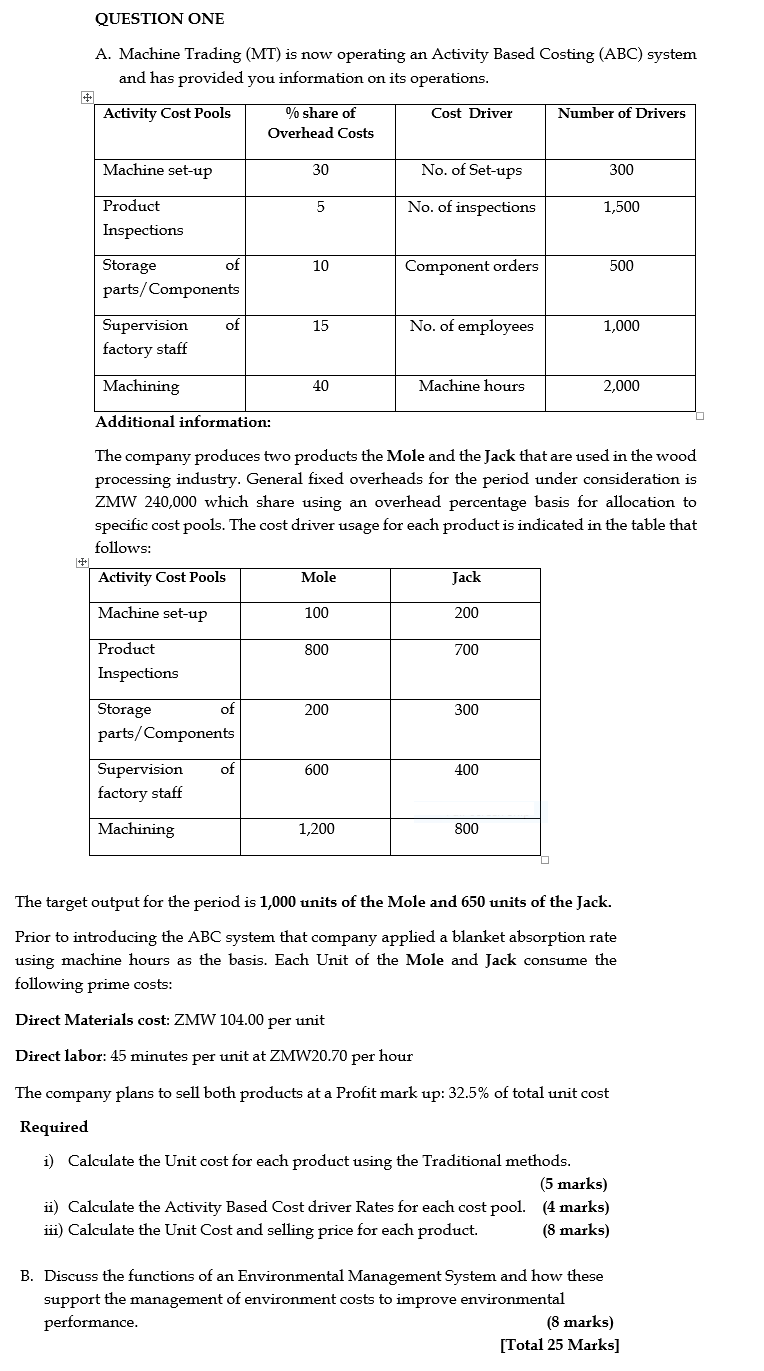

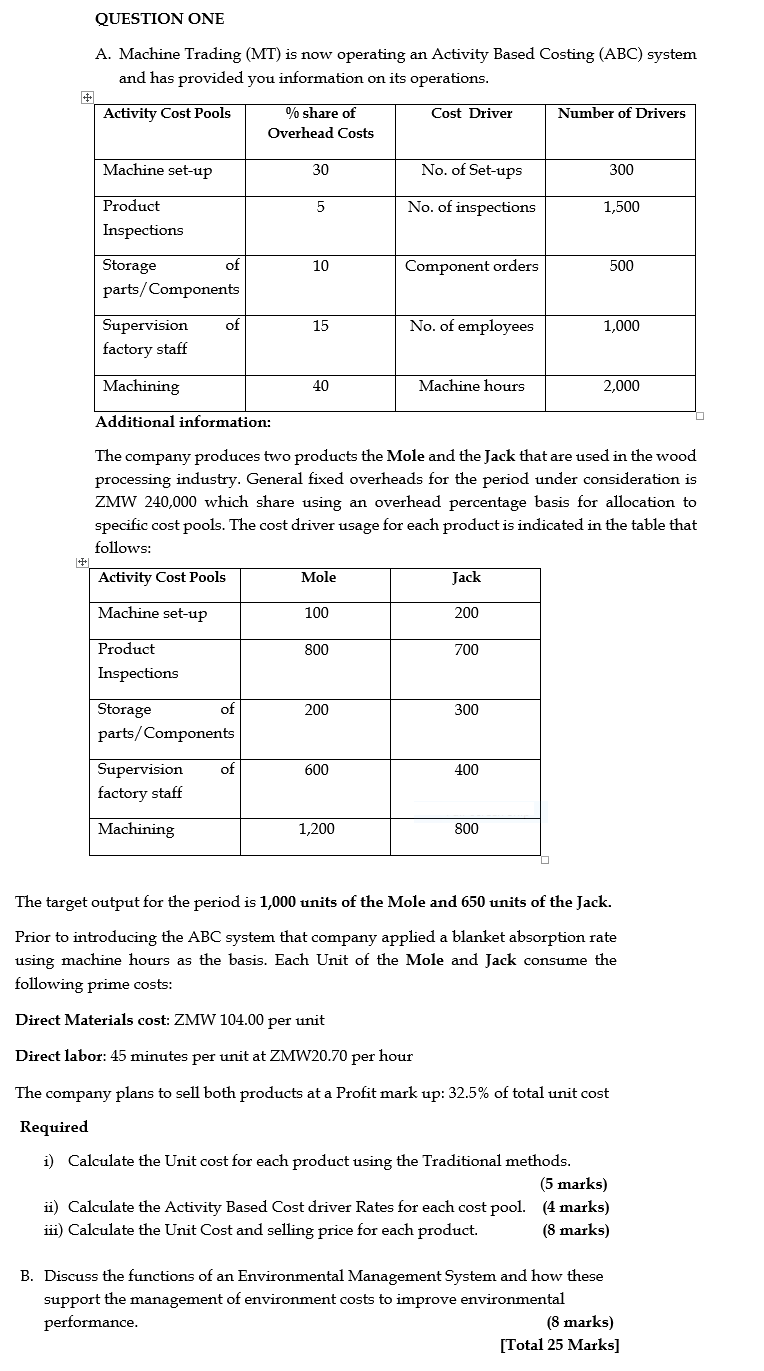

A. Machine Trading (MT) is now operating an Activity Based Costing (ABC) system and has provided you information on its operations. The company produces two products the Mole and the Jack that are used in the wood processing industry. General fixed overheads for the period under consideration is ZMW 240,000 which share using an overhead percentage basis for allocation to specific cost pools. The cost driver usage for each product is indicated in the table that follows: The target output for the period is 1,000 units of the Mole and 650 units of the Jack. Prior to introducing the ABC system that company applied a blanket absorption rate using machine hours as the basis. Each Unit of the Mole and Jack consume the following prime costs: Direct Materials cost: ZMW 104.00 per unit Direct labor: 45 minutes per unit at ZMW20.70 per hour The company plans to sell both products at a Profit mark up: 32.5% of total unit cost Required i) Calculate the Unit cost for each product using the Traditional methods. (5 marks) ii) Calculate the Activity Based Cost driver Rates for each cost pool. (4 marks) iii) Calculate the Unit Cost and selling price for each product. (8 marks) B. Discuss the functions of an Environmental Management System and how these support the management of environment costs to improve environmental performance. (8 marks) [Total 25 Marks] A. Machine Trading (MT) is now operating an Activity Based Costing (ABC) system and has provided you information on its operations. The company produces two products the Mole and the Jack that are used in the wood processing industry. General fixed overheads for the period under consideration is ZMW 240,000 which share using an overhead percentage basis for allocation to specific cost pools. The cost driver usage for each product is indicated in the table that follows: The target output for the period is 1,000 units of the Mole and 650 units of the Jack. Prior to introducing the ABC system that company applied a blanket absorption rate using machine hours as the basis. Each Unit of the Mole and Jack consume the following prime costs: Direct Materials cost: ZMW 104.00 per unit Direct labor: 45 minutes per unit at ZMW20.70 per hour The company plans to sell both products at a Profit mark up: 32.5% of total unit cost Required i) Calculate the Unit cost for each product using the Traditional methods. (5 marks) ii) Calculate the Activity Based Cost driver Rates for each cost pool. (4 marks) iii) Calculate the Unit Cost and selling price for each product. (8 marks) B. Discuss the functions of an Environmental Management System and how these support the management of environment costs to improve environmental performance. (8 marks) [Total 25 Marks]