Answered step by step

Verified Expert Solution

Question

1 Approved Answer

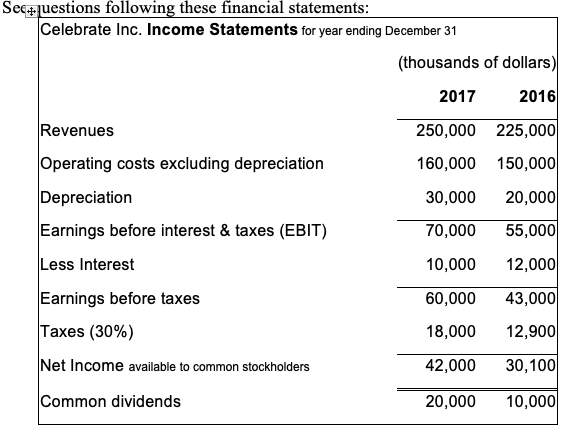

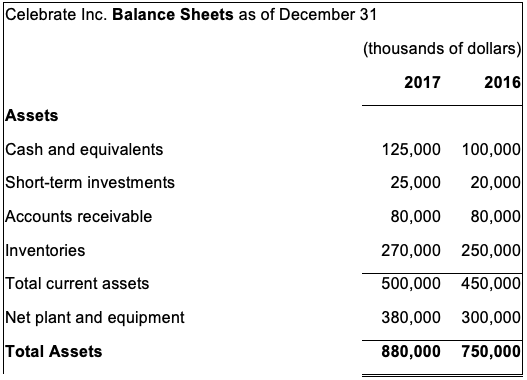

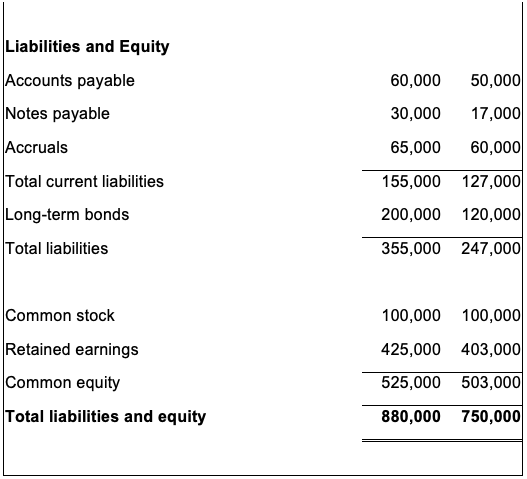

What is: 1) EBIT x (1-tax rate) + noncash expenses equal to for 2017? 2) the change in Working Capital for 2017? 3) Capital Expenditure

What is:

1) EBIT x (1-tax rate) + noncash expenses equal to for 2017?

2) the change in Working Capital for 2017?

3) Capital Expenditure for 2017?

4) Free Cash Flow for 2017?

Secuestions following these financial statements: Celebrate Inc. Income Statements for year ending December 31 (thousands of dollars) 2016 2017 250,000 225,000| Revenues Operating costs excluding depreciation 160,000 150,000 Depreciation 20,000 30,000 55,000 Earnings before interest & taxes (EBIT) 70,000 Less Interest 12,000 10,000 Earnings before taxes 43,000 60,000 Taxes (30%) 12,900 18,000 30,100 Net Income available to common stockholders 42,000 Common dividends 10,000 20,000 Celebrate Inc. Balance Sheets as of December 31 (thousands of dollars) 2016 2017 Assets Cash and equivalents 125,000 100,000| Short-term investments 20,000 25,000 Accounts receivable 80,000 80,000 Inventories 270,000 250,000| 500,000 450,000 Total current assets Net plant and equipment 380,000 300,000| 880,000 750,000 Total Assets Liabilities and Equity Accounts payable 50,000 60,000 Notes payable 17,000 30,000 Accruals 60,000 65,000 Total current liabilities 155,000 127,000 200,000 120,000| Long-term bonds Total liabilities 355,000 247,000| Common stock 100,000 100,000| Retained earnings 425,000 403,000| Common equity 525,000 503,000| Total liabilities and equity 880,000 750,000|Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started