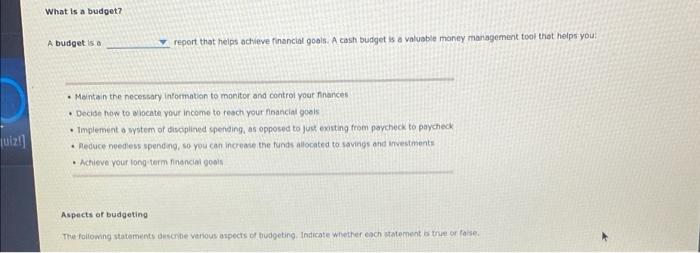

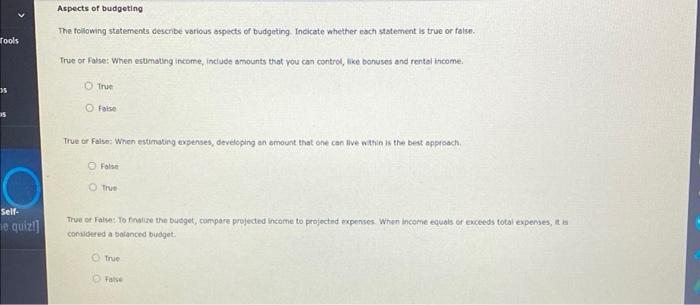

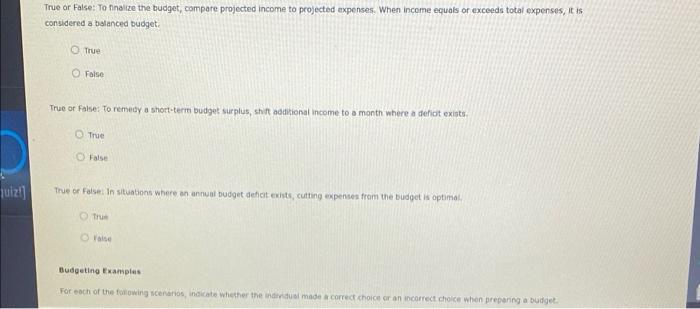

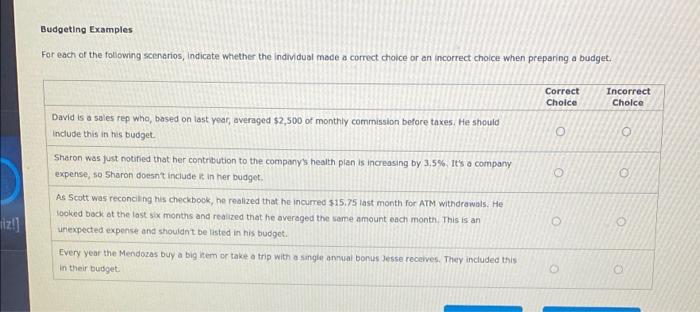

What is a budget? A budget is a report that helps achieve financial goals. A cash budget is a valuable money management tool that helps you! Maintain the necessary information to monitor and control your finances . Decide how to locate your income to reach your financial goals Implementowystem of disciplined spending, as opposed to just existing from paycheck to paycheck Reduce needless spending, so you can increase the funds allocated to savings and investments Achieve your long term Tinancial goals quiz Aspects of budgeting The following statements describe anos aspects of budgeting, indicate whether each statement is true or false Aspects of budgeting The following statements describe various aspects of budgeting Indicate whether each statement is true or false. fools True or False: When estimating income, include amounts that you can control, like bonuses and rental income 35 True False True or False: When estimating expenses, developing an amount that one can live within is the best approach False a Tue Sell e quizl] True or False Tornare the budget, compare projected Income to projected expenses. When income equals or exceeds total expenses, considered a balanced budget True True or False: To finalize the budget, compare projected Income to projected expenses. When Income equals or exceeds total expenses, it is considered a balanced budget True False True or Falser To remedy a short-term budget surplus, shift boditional income to a month where a defit exists True False quiz!) True or False in situations where an annual budget deficit exists, cutting expenses from the budget is optimal thus Budgeting Examples For each of the following scenarios, indicate whether the individual made a correct choice or an incorrect choice when preparing a budget Budgeting Examples For each of the following scenarios, indicate whether the individual made a correct choice or an incorrect choice when preparing a budget Correct Choice Incorrect Choice o David is a sales rep who, based on last year, averaged $2,500 of monthly commission before taxes. He should include this in his budget Sharon was just notified that her contribution to the company's health plan is increasing by 3.5%. It's a company expense, so Sharon doesn't include it in her budget. niz!] As Scott was reconciling his checkbook, he realized that he incurred $15.75 last month for ATM withdrawals. He looked back at the last six months and realized that he averaged the same amount each month. This is an unexpected expense and shouldn't be listed in his budget. Every year the Mendozas buy a big item or take a trip with a single annual bonus Jesse receives. They included this in their budget