Question

What is Acorns maximum cost recovery deduction in the current yearAcorn Construction (calendar year-end C-corporation) has had rapid expansion during the last half of the

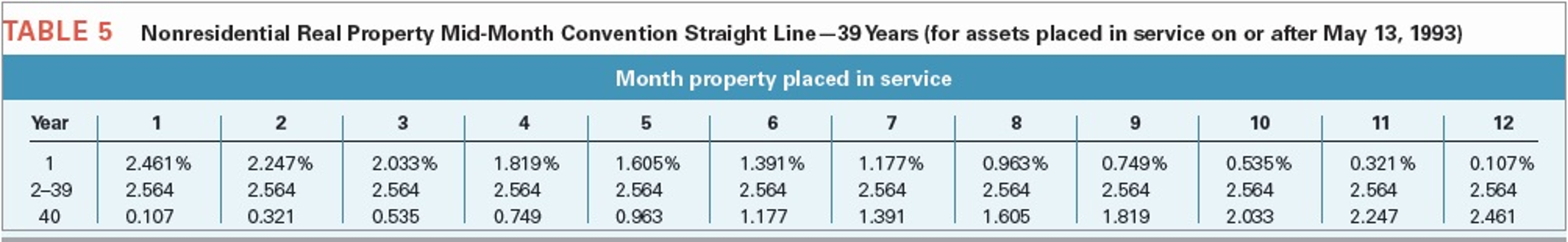

What is Acorns maximum cost recovery deduction in the current yearAcorn Construction (calendar year-end C-corporation) has had rapid expansion during the last half of the current year due to the housing market's recovery. The company has record income and would like to maximize its cost recovery deduction for the current year. (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Round your answer to the nearest whole dollar amount.) Acorn provided the following information:

Asset Placed in Service Basis

New equipment and tools August 20 $ 800,000

Used light duty trucks October 17 1,200,000

Used machinery November 6 525,000

Total $ 2,525,000

What is Acorns maximum cost recovery deduction in the current year?

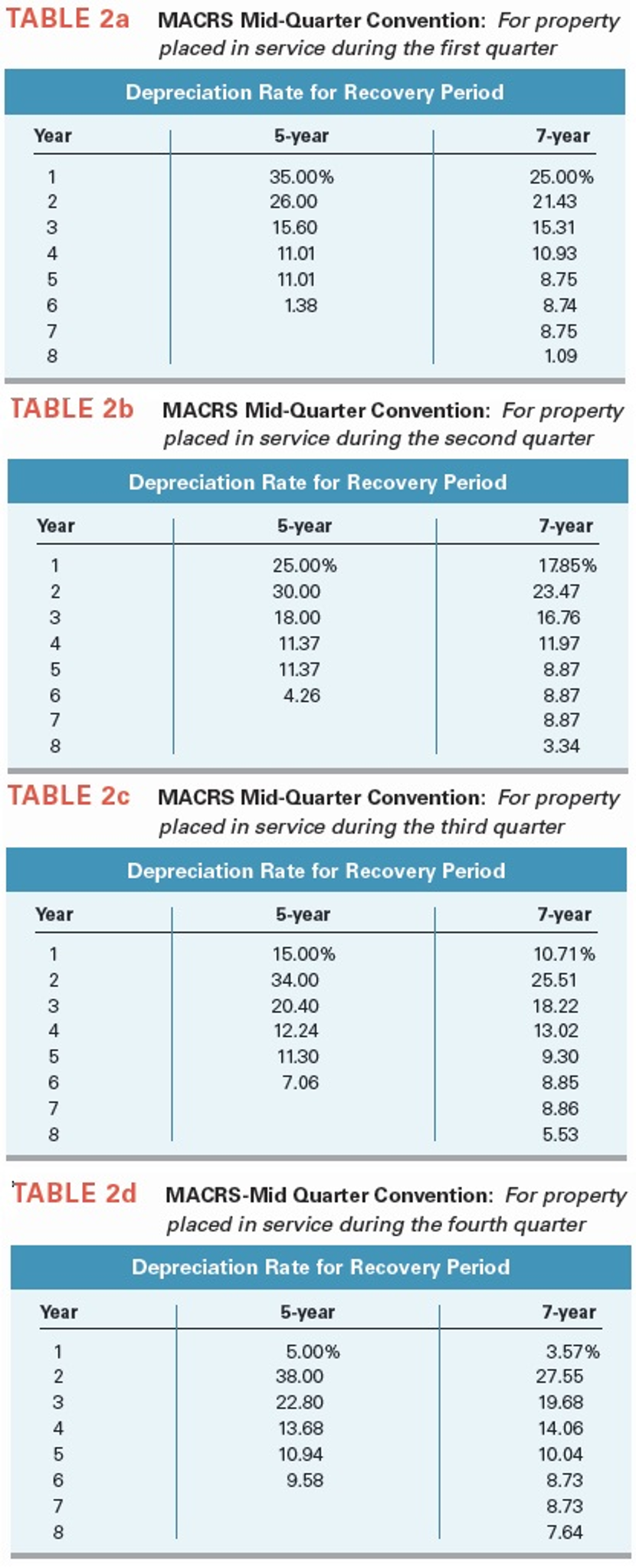

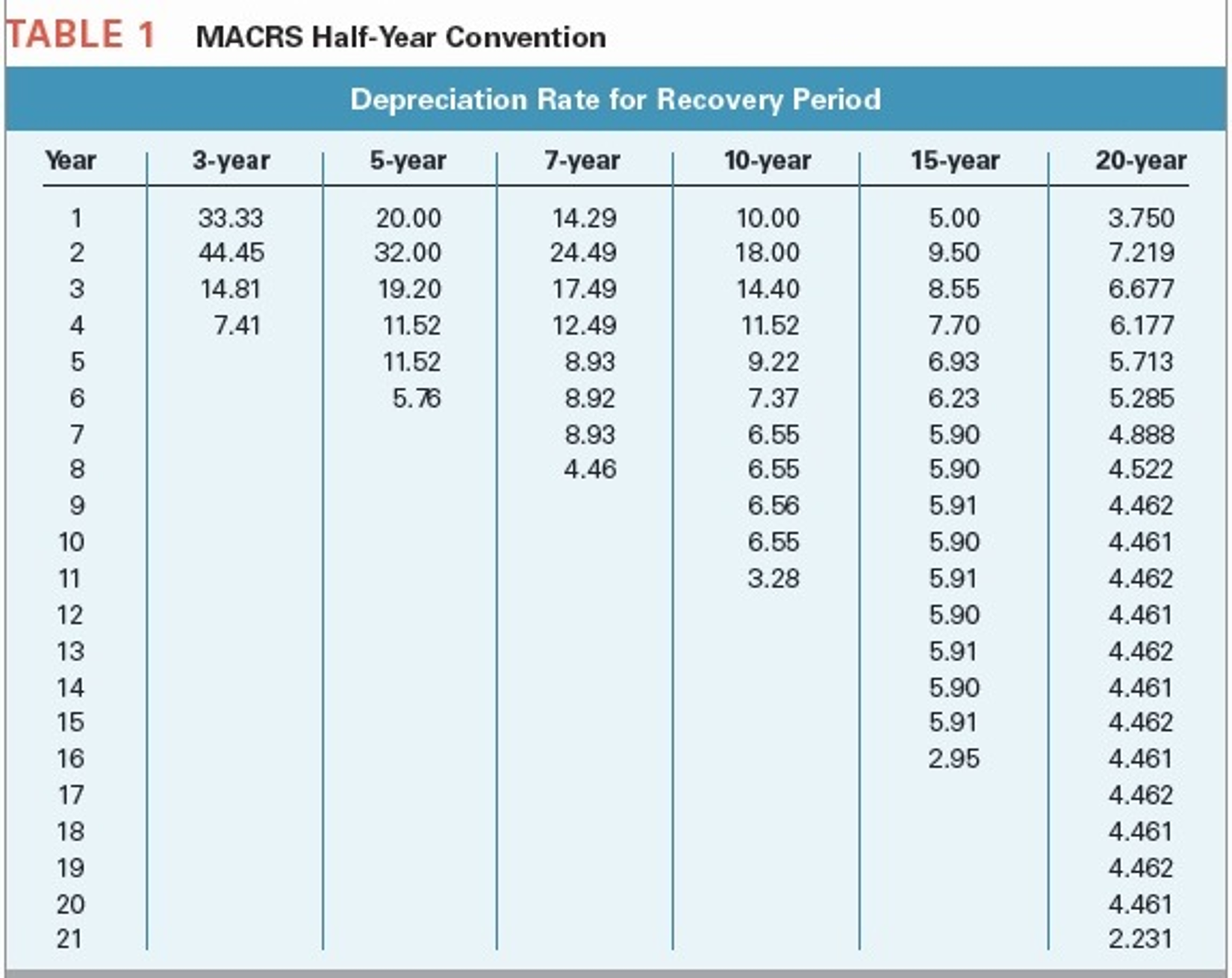

TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter Depreciation Rate for Recovery Period Year b-year 7-year 35.00% 26.00 15.60 11.01 11.01 1.38 25.00% 21.43 15.31 10.93 8.75 8.74 8.75 1.09 4 6 8 TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter Depreciation Rate for Recovery Period 7-year 1 785% 23.47 16.76 11.97 8.87 8.87 8.87 3.34 Year b-year 25.00% 30.00 18.00 11.37 11.37 4.26 4 TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter Depreciation Rate for Recovery Period Year b-year 7-year 15.00% 34.00 20.40 12.24 11.30 7.06 10.71% 25.51 18.22 13.02 9.30 8.85 8.86 5.53 4 8 TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter Depreciation Rate for Recovery Period Year b-year 7-year 5.00% 3.57% 38.00 22.80 13.68 10.94 9.58 27.55 19.68 14.06 10.04 8.73 8.73 7.64 4 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started