Answered step by step

Verified Expert Solution

Question

1 Approved Answer

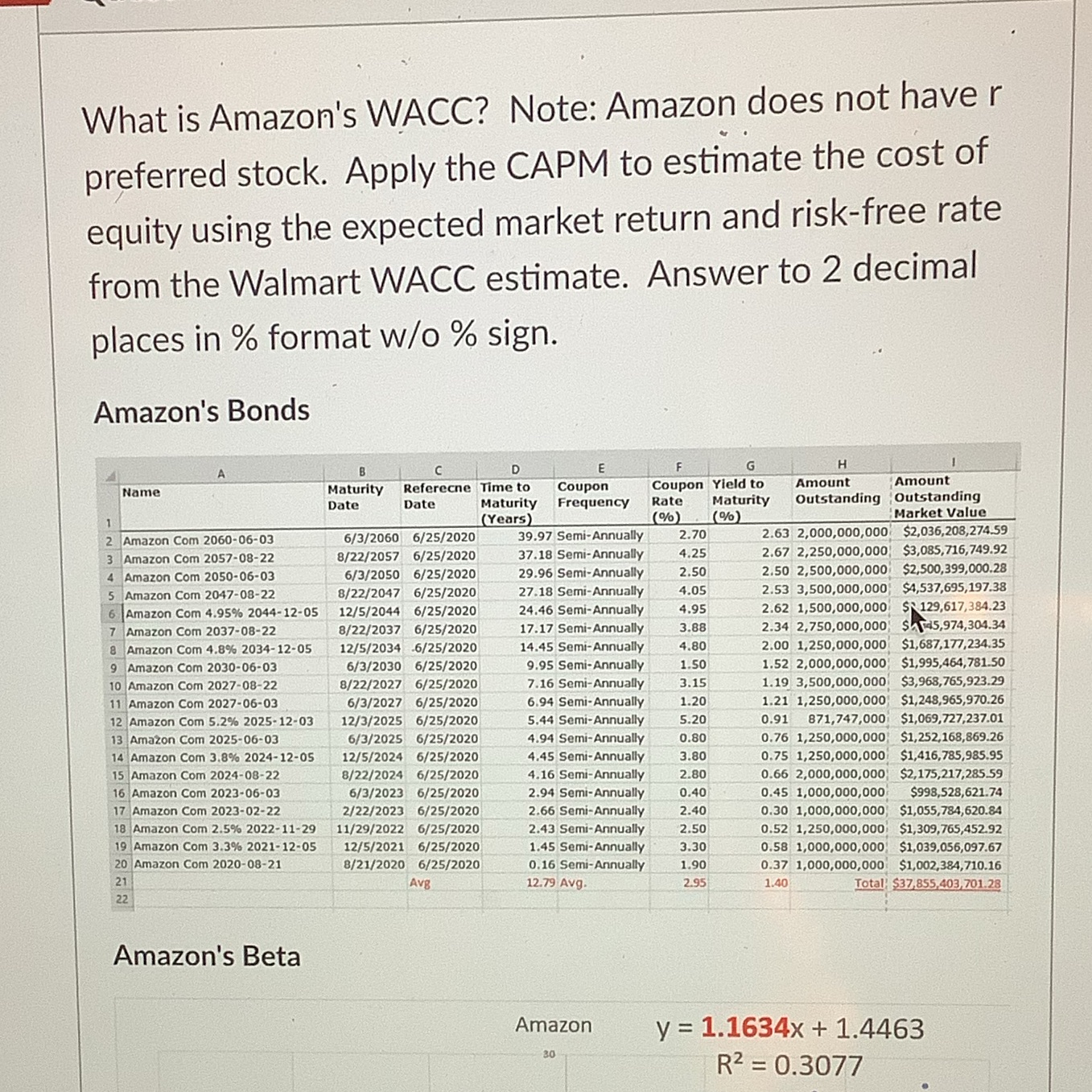

What is Amazon's WACC? Note: Amazon does not have r preferred stock. Apply the CAPM to estimate the cost of equity using the expected

What is Amazon's WACC? Note: Amazon does not have r preferred stock. Apply the CAPM to estimate the cost of equity using the expected market return and risk-free rate from the Walmart WACC estimate. Answer to 2 decimal places in % format w/o % sign. Amazon's Bonds Name A 1 2 Amazon Com 2060-06-03 3 Amazon Com 2057-08-22 4 Amazon Com 2050-06-03 5 Amazon Com 2047-08-22 6 Amazon Com 4.95% 2044-12-05 7 Amazon Com 2037-08-22 8 Amazon Com 4.8% 2034-12-05 9 Amazon Com 2030-06-03 10 Amazon Com 2027-08-22 11 Amazon Com 2027-06-03 12 Amazon Com 5.2% 2025-12-03 13 Amazon Com 2025-06-03 14 Amazon Com 3.8% 2024-12-05 15 Amazon Com 2024-08-22 16 Amazon Com 2023-06-03 17 Amazon Com 2023-02-22 18 Amazon Com 2.5% 2022-11-29 19 Amazon Com 3.3% 2021-12-05 20 Amazon Com 2020-08-21 21 22 Amazon's Beta B Maturity Date D Referecne Time to Date Maturity (Years) 6/3/2060 6/25/2020 8/22/2057 6/25/2020 6/3/2050 6/25/2020 8/22/2047 6/25/2020 12/5/2044 6/25/2020 8/22/2037 6/25/2020 12/5/2034 6/25/2020 6/3/2030 6/25/2020 8/22/2027 6/25/2020 6/3/2027 6/25/2020 12/3/2025 6/25/2020 6/3/2025 6/25/2020 12/5/2024 6/25/2020 8/22/2024 6/25/2020 6/3/2023 6/25/2020 2/22/2023 6/25/2020 11/29/2022 6/25/2020 12/5/2021 6/25/2020 8/21/2020 6/25/2020 Avg E G Coupon Coupon Yield to Frequency Rate Maturity (%) (%) 2.70 39.97 Semi-Annually 4.25 37.18 Semi-Annually 2.50 29.96 Semi-Annually 4.05 27.18 Semi-Annually 4.95 24.46 Semi-Annually 17.17 Semi-Annually 3.88 14.45 Semi-Annually 4.80 9.95 Semi-Annually 1.50 7.16 Semi-Annually 3.15 6.94 Semi-Annually 1.20 5.44 Semi-Annually 5.20 4.94 Semi-Annually 0.80 4.45 Semi-Annually 3.80 4.16 Semi-Annually 2.80 2.94 Semi-Annually 0.40 2.66 Semi-Annually 2.40 2.43 Semi-Annually 2.50 1.45 Semi-Annually 3.30 0.16 Semi-Annually 1.90 12.79 Avg. 2.95 Amazon 30 H Amount Amount Outstanding Outstanding Market Value 2.63 2,000,000,000 $2,036,208,274.59 2.67 2,250,000,000 $3,085,716,749.92 2.50 2,500,000,000 $2,500,399,000.28 2.53 3,500,000,000 $4,537,695,197.38 2.62 1,500,000,000 $129,617,384.23 2.34 2,750,000,000 $45,974,304.34 2.00 1,250,000,000 $1,687,177,234.35 1.52 2,000,000,000 $1,995,464,781.50 1.19 3,500,000,000 $3,968,765,923.29 1.21 1,250,000,000 $1,248,965,970.26 0.91 871,747,000 $1,069,727,237.01 0.76 1,250,000,000 $1,252,168,869.26 0.75 1,250,000,000 $1,416,785,985.95 0.66 2,000,000,000 $2,175,217,285.59 0.45 1,000,000,000 $998,528,621.74 0.30 1,000,000,000 $1,055,784,620.84 0.52 1,250,000,000 $1,309,765,452.92 0.58 1,000,000,000 $1,039,056,097.67 0.37 1,000,000,000 $1,002,384,710.16 1.40 Total: $37,855,403,701.28 y = 1.1634x + 1.4463 R = 0.3077

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculating Amazons WACC Step 1 Calculate the cost of debt We can use the information provided about ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started