Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is amount of income reported on the income statement when Paulson translates these accounts into U.S. dollars? Paulson Incorporated acquired all of the common

What is amount of income reported on the income statement when Paulson translates these accounts into U.S. dollars?

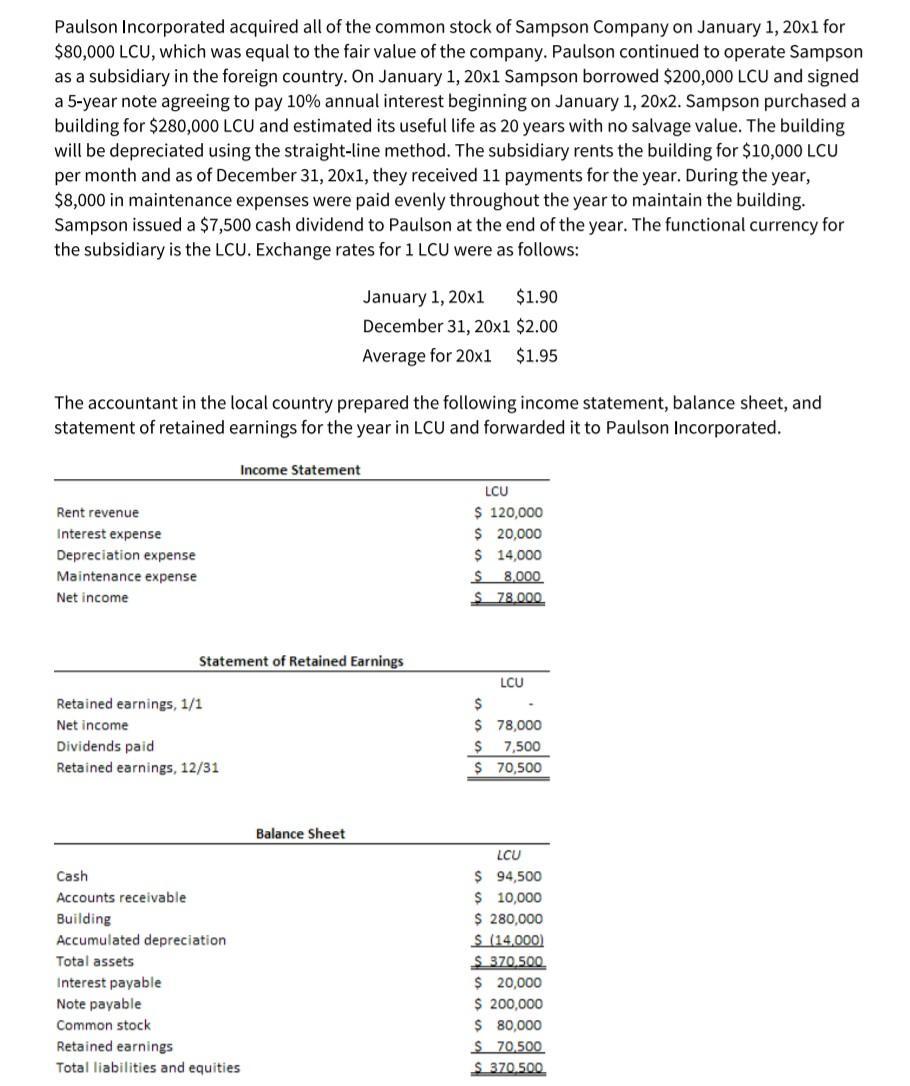

Paulson Incorporated acquired all of the common stock of Sampson Company on January 1, 20x1 for $80,000 LCU, which was equal to the fair value of the company. Paulson continued to operate Sampson as a subsidiary in the foreign country. On January 1, 20x1 Sampson borrowed $200,000 LCU and signed a 5-year note agreeing to pay 10% annual interest beginning on January 1, 20x2. Sampson purchased a building for $280,000 LCU and estimated its useful life as 20 years with no salvage value. The building will be depreciated using the straight-line method. The subsidiary rents the building for $10,000 LCU per month and as of December 31, 20x1, they received 11 payments for the year. During the year, $8,000 in maintenance expenses were paid evenly throughout the year to maintain the building. Sampson issued a $7,500 cash dividend to Paulson at the end of the year. The functional currency for the subsidiary is the LCU. Exchange rates for 1 LCU were as follows: The accountant in the local country prepared the following income statement, balance sheet, and statement of retained earnings for the year in LCU and forwarded it to Paulson Incorporated. Rent revenue Interest expense Depreciation expense Maintenance expense Net income Retained earnings, 1/1 Net income Dividends paid Retained earnings, 12/31 Statement of Retained Earnings Cash Accounts receivable Building Accumulated depreciation January 1, 20x1 $1.90 December 31, 20x1 $2.00 Average for 20x1 $1.95 Income Statement Total assets Interest payable Note payable Common stock Retained earnings Total liabilities and equities Balance Sheet LCU $ 120,000 $ 20,000 $ 14,000 $ 8,000 $78.000 LCU $ $ 78,000 $ 7,500 $ 70,500 - LCU $ 94,500 $ 10,000 $ 280,000 $ (14.000) $370.500 $ 20,000 $ 200,000 $ 80,000 $ 70,500 S 370.500

Step by Step Solution

★★★★★

3.38 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Paulson Incorporation Income Statement For the period 11x13112x...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started