Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is Angela's basis in Property 2 immediately following the distribution? What is Angela's basis in Property 1 immediately following the distribution? The Cartwright

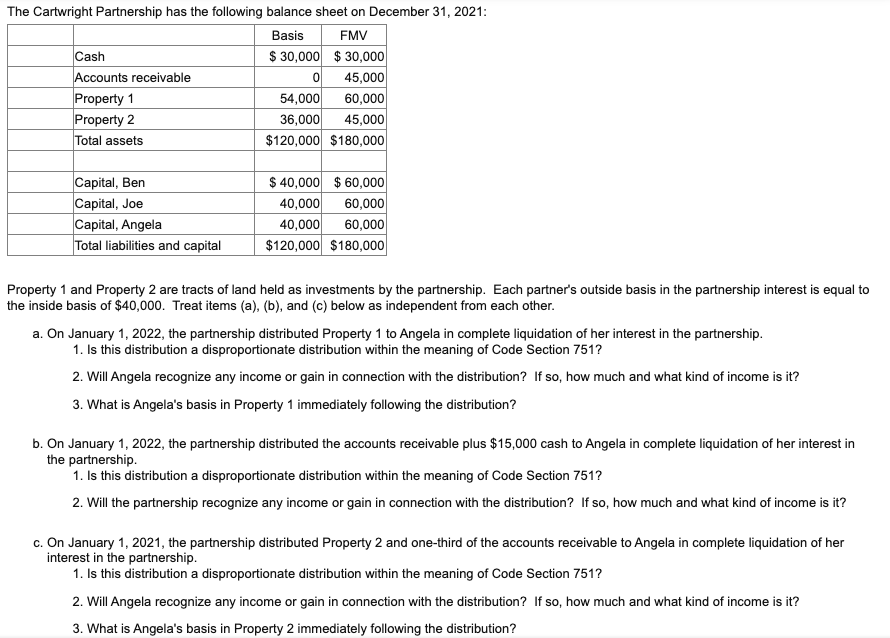

What is Angela's basis in Property 2 immediately following the distribution? What is Angela's basis in Property 1 immediately following the distribution? The Cartwright Partnership has the following balance sheet on December 31, 2021: Basis FMV $ 30,000 $30,000 0 45,000 54,000 60,000 36,000 45,000 $120,000 $180,000 Cash Accounts receivable Property 1 Property 2 Total assets Capital, Ben Capital, Joe Capital, Angela Total liabilities and capital $ 40,000 $60,000 40,000 60,000 40,000 60,000 $120,000 $180,000 Property 1 and Property 2 are tracts of land held as investments by the partnership. Each partner's outside basis in the partnership interest is equal to the inside basis of $40,000. Treat items (a), (b), and (c) below as independent from each other. a. On January 1, 2022, the partnership distributed Property 1 to Angela in complete liquidation of her interest in the partnership. 1. Is this distribution a disproportionate distribution within the meaning of Code Section 751? 2. Will Angela recognize any income or gain in connection with the distribution? If so, how much and what kind of income is it? 3. What is Angela's basis in Property 1 immediately following the distribution? b. On January 1, 2022, the partnership distributed the accounts receivable plus $15,000 cash to Angela in complete liquidation of her interest in the partnership. 1. Is this distribution a disproportionate distribution within the meaning of Code Section 751? 2. Will the partnership recognize any income or gain in connection with the distribution? If so, how much and what kind of income is it? c. On January 1, 2021, the partnership distributed Property 2 and one-third of the accounts receivable to Angela in complete liquidation of her interest in the partnership. 1. Is this distribution a disproportionate distribution within the meaning of Code Section 751? 2. Will Angela recognize any income or gain in connection with the distribution? If so, how much and what kind of income is it? 3. What is Angela's basis in Property 2 immediately following the distribution?

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer To solve this problem we need to analyze the given information and apply the relevant tax pri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started