Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is be the budgetary comparaison schedule for the two different funds? In this chapter we continue to record the 20X4 transactions of the General

what is be the budgetary comparaison schedule for the two different funds?

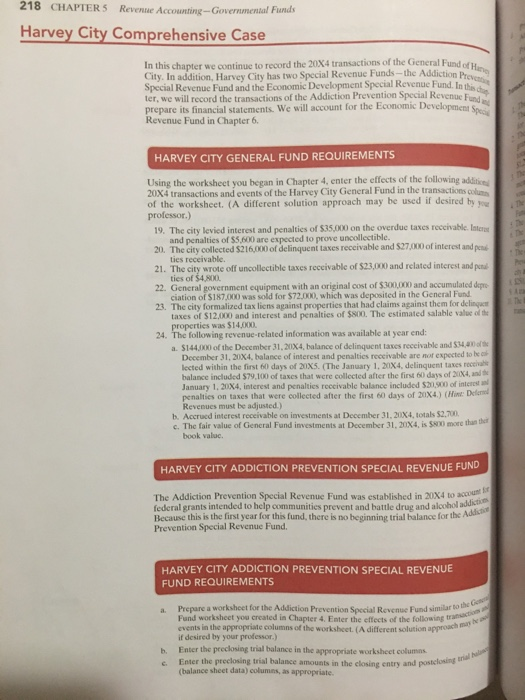

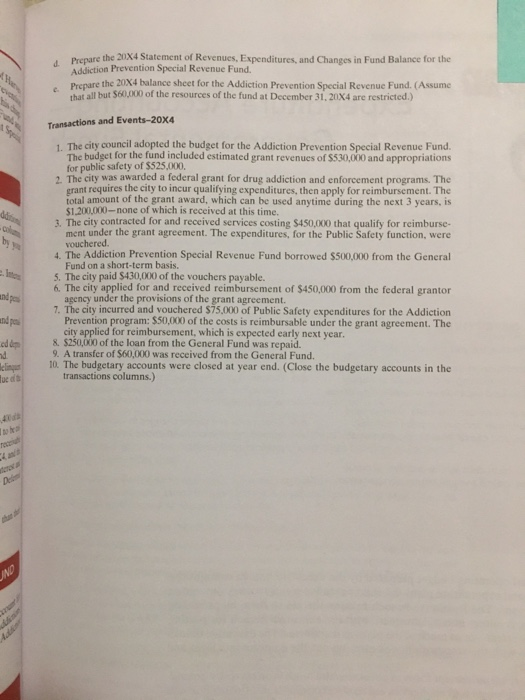

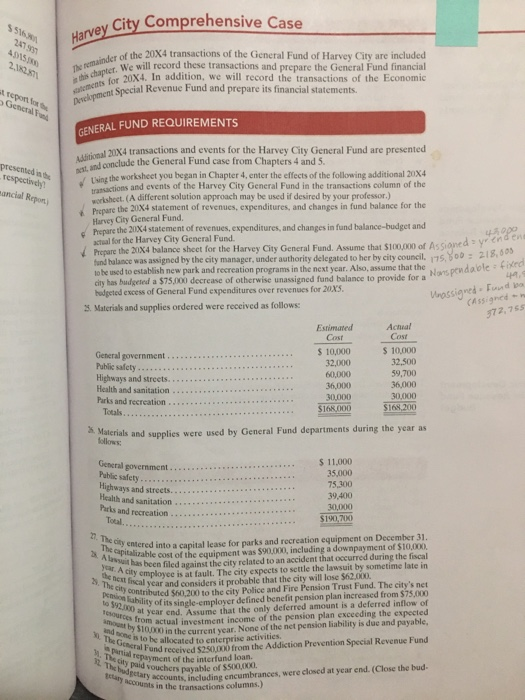

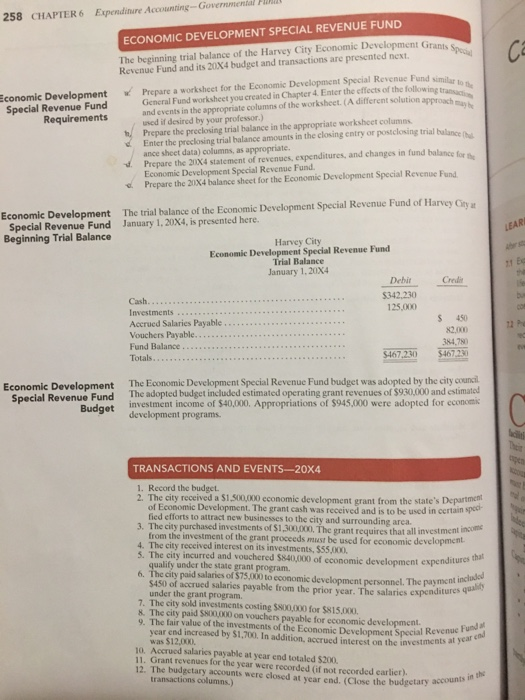

In this chapter we continue to record the 20X4 transactions of the General Fund of Wang City. In addition, Harvey City has two Special Revenue Funds--the Addiction Prev Prepare a worksheet for the Addiction Prevention Special Revenue Fund similar to the Fund worksheet you created in Chapter 4 Enter the effects of the following events in the appropriate columns of the worksheet. A different solution approach Enter the preclosing trial balance amounts in the closing entry and postcontra 218 CHAPTER 5 Revente Accounting --Governmental Funds Harvey City Comprehensive Case Special Revenue Fund and the Economic Development Special Revenue Fund. In this can ter, we will record the transactions of the Addiction Prevention Special Revenue Fund prepare its financial statements. We will account for the Economic Development Specs Revenue Fund in Chapter 6. HARVEY CITY GENERAL FUND REQUIREMENTS Using the worksheet you began in Chapter 4, enter the effects of the following additice 20x4 transactions and events of the Harvey City General Fund in the transactions columns of the worksheet. (A different solution approach may be used if desired by you professor.) 19. The city levied interest and penalties of $35,000 on the overdue taxes receivable. Interea and penalties of $5.00 are expected to prove uncollectible. 20. The city collected $216,000 of delinqueni taxes receivable and $27,000 of interest and peni ties receivable 21. The city wrote off uncollectible taxes receivable of $23,000 and related interest and peal ties of $4.800 22. General government equipment with an original cost of $300,000 and accumulated depre ciation of $187.000 was sold for $72,000, which was deposited in the General Fund. 23. The city formalized tax lions against properties that had claims against them for delinquent taxes of $12,000 and interest and penalties of $800. The estimated salable value of the properties was $14,000 24. The following revenue-related information was available at year end: a. $144,00 of the December 31, 20X4, balance of delinquent taxes receivable and 534,00 December 31, 20X4, balance of interest and penalties receivable are not expected to be lected within the first 60 days of 20X5. (The January 1, 20X4, delinquent taxes receive balance included 579,100 of taxes that were collected after the first 60 days of 26X4, and January 1, 20X4, interest and penalties receivable balance included $20.900 of interest penalties on taxes that were collected after the first to days of 20X4) (line Delesed Revenues must be adjusted) b. Accrued interest receivable on investments at December 31, 20X4, totals 52.700 c. The fair value of General Fund investments at December 31, 20X4, is so more than the book value HARVEY CITY ADDICTION PREVENTION SPECIAL REVENUE FUND The Addiction Prevention Special Revenue Fund was established in 20x4 to account federal grants intended to help communities prevent and battle drug and alcohol addiction Because this is the first year for this fund, there is no beginning trial balance for the Addiction Prevention Special Revenue Fund, HARVEY CITY ADDICTION PREVENTION SPECIAL REVENUE FUND REQUIREMENTS if desired by your professor.) b. Enter the preclosing trial balance in the appropriate worksheet columns (balance sheet data) columns, as appropriate Prepare the 20X4 Statement of Revenues, Expenditures, and Changes in Fund Balance for the Addiction Prevention Special Revenue Fund. Prepare the 20X4 balance sheet for the Addiction Prevention Special Revenue Fund. (Assume that all but $60,000 of the resources of the fund at December 31, 20X4 are restricted.) Transactions and Events-20X4 1. The city council adopted the budget for the Addiction Prevention Special Revenue Fund, The budget for the fund included estimated grant revenues of $530,000 and appropriations for public safety of $525,000 2. The city was awarded a federal grant for drug addiction and enforcement programs. The grant requires the city to incur qualifying expenditures, then apply for reimbursement. The total amount of the grant award, which can be used anytime during the next 3 years, is $1.200,000-none of which is received at this time. 3. The city contracted for and received services costing $450,000 that qualify for reimburse- ment under the grant agreement. The expenditures, for the Public Safety function, were vouchered. 4. The Addiction Prevention Special Revenue Fund borrowed $500,000 from the General Fund on a short-term basis. 5. The city paid $430,000 of the vouchers payable. 6. The city applied for and received reimbursement of $450,000 from the federal grantor agency under the provisions of the grant agreement. 7. The city incurred and vouchered $75,000 of Public Safety expenditures for the Addiction Prevention program: $50,000 of the costs is reimbursable under the grant agreement. The city applied for reimbursement, which is expected early next year. 8. $250,000 of the loan from the General Fund was repaid. 9. A transfer of $60,000 was received from the General Fund. 10. The budgetary accounts were closed at year end. (Close the budgetary accounts in the transactions columns.) ed nd The remainder of the 20x4 transactions of the General Fund of Harvey City are included statements for 20X4. In addition, we will record the transactions of the Economic this chapter. We will record these transactions and prepare the General Fund financial Derekyment Special Revenue Fund and prepare its financial statements. Aditional 20X4 transactions and events for the Harvey City General Fund are presented est, and conclude the General Fund case from Chapters 4 and 5. 2. The city entered into a capital lease for parks and recreation equipment on December 31. The capitalizable cost of the equipment was $90,000, including a downpayment of $10,000 Alnit has been filed against the city related to an accident that occurred during the fiscal year. A city employee is at fault. The city expects to settle the lawsuit by sometime late in the entical year and consider it probable that the city will lose $52. The city contributed $60,200 to the city Police and Fire Pension Trust Fund. The city's net probability of its single-cmployer defined benefit pension plan increased from $75,000 to year end. Assume that the only deferred amount is a deferred inflow of from actual investment income of the pension plan exceeding the expected smoby S10 in the current year. None of the net pension liability is due and payable odon is to be allocated to enterprise activities The Gel Fund received $250 from the Addiction Prevention Special Revenue Fund Sparepayment of the interfund loan. They paid vouchers payable of SSL Thcodecary accounts, including encumbrances, were closed at year end. (Close the bud. Ty counts in the transactions columns.) SS 2015 ASS 2.32 Gel Harvey City Comprehensive Case city has budgeted a $75,000 decrease of otherwise unassigned fund balance to provide for a Nors poudable fixed GENERAL FUND REQUIREMENTS Using the worksheet you began in Chapter 4, enter the effects of the following additional 20X4 transactions and events of the Harvey City General Fund in the transactions column of the worksheet. (A different solution approach may be used if desired by your professor.) Prepare the 20X4 statement of revenues, expenditures, and changes in fund balance for the Harvey City General Fund Prepare the 21X4 statement of revenues, expenditures, and changes in fund balance-budget and 000 fund balance was assigned by the city manager, under authority delegated to her by city council. 175.800 : 218,000 Prepare the 2184 balance sheet for the Harvey City General Fund. Assume that $100,600 of Assigned a yo endere to be used to establish new park and recreation programs in the next year. Also, assume that the budgeted excess of General Fund expenditures over revenues for 20X5. 2. Materials and supplies ordered were received as follows: presented in respectively ancial Report Vrassigned. Fund be (Assigned 372, 755 Estimated Acha! Cost Cosi General government $ 10,000 $ 10,000 Public safety 32,000 32.500 Highways and streets 60,000 59,700 Health and sanitation 36,000 36.000 Parks and recreation 30,000 30,000 Totals. $16.000 $168.200 * Materials and supplies were used by General Fund departments during the year as General government Public safety Highways and streets Health and sanitation Parks and recreation Total. $ 11,000 35.000 75.300 39,400 30,000 $190,00 9. The fair value of the investments of the Economic Development Special Revenue Fund year and increased by S1,700. In addition, accrued interest on the investments at year ECONOMIC DEVELOPMENT SPECIAL REVENUE FUND LEARI The beginning trial balance of the Harvey City Economic Development Grants Spo Prepare a worksheet for the Economic Development Special Revenue Fundimit the General Fund worksheet you created in Chapter 4. Enter the effects of the following this 6. The city paid salaries of $75.000 to economic development personnel. The payment included 12. The budgetary accounts were closed at year end. (Close the budgetary accounts in the 258 CHAPTER 6 Expenditure Accounting-Governmental and Revenue Fund and its 20X4 budget and transactions are presented next. Economic Development Special Revenue Fund Requirements and events in the appropriate columns of the worksheet. (A different solution approach to Prepare the preclosing trial balance in the appropriate worksheet columns Enter the preclosing trial balance amounts in the closing entry or postclosing trial balance de Prepare the 21X4 statement of revenues, expenditures, and changes in fund balance for me Prepare the 2014 balance sheet for the Economic Development Special Revenue Fund Economic Development The trial balance of the Economic Development Special Revenue Fund of Harvey City Special Revenue Fund January 1, 20X4, is presented here. Beginning Trial Balance Harvey City Economic Development Special Revenue Fund Trial Balance January 1, 20X4 Dehir Credit Cash $342.230 Investments 125.000 Accrued Salaries Payable $ 450 Vouchers Payable 82.000 Fund Balance 384.780 Totals. $467.230 $46720 Economic Development The Economic Development Special Revenue Fund budget was adopted by the city council Special Revenue Fund The adopted budget included estimated operating grant revenues of $930,000 and estimated Budget investment income of $40,000. Appropriations of $945,000 were adopted for economi development programs. TRANSACTIONS AND EVENTS-20X4 1. Record the budget 2. The city received a $1,500,000 economic development grant from the state's Department of Economic Development. The grant cash was received and is to be used in certain speck fied efforts to attract new businesses to the city and surrounding area. 3. The city purchased investments of $1,300,000. The grant requires that all investment income from the investment of the grant proceeds must be used for economic development 4. The city received interest on its investments, $55.000 3. The city incurred and vouchered $841,000 of economic development expenditures that qualify under the state grant program. under the grant program 7. The city sold investments costing $800,000 for $815.000 & The city paid So on vouchers payable for economic development was $12,000. transactions columns.) 10. Accrued salarios payable at year end totaled $200 11. Grant revenues for the year were recorded (if not recorded earlier) Based on the following How can you find the budgetary statements for the AP and Ed Soe's In this chapter we continue to record the 20X4 transactions of the General Fund of Wang City. In addition, Harvey City has two Special Revenue Funds--the Addiction Prev Prepare a worksheet for the Addiction Prevention Special Revenue Fund similar to the Fund worksheet you created in Chapter 4 Enter the effects of the following events in the appropriate columns of the worksheet. A different solution approach Enter the preclosing trial balance amounts in the closing entry and postcontra 218 CHAPTER 5 Revente Accounting --Governmental Funds Harvey City Comprehensive Case Special Revenue Fund and the Economic Development Special Revenue Fund. In this can ter, we will record the transactions of the Addiction Prevention Special Revenue Fund prepare its financial statements. We will account for the Economic Development Specs Revenue Fund in Chapter 6. HARVEY CITY GENERAL FUND REQUIREMENTS Using the worksheet you began in Chapter 4, enter the effects of the following additice 20x4 transactions and events of the Harvey City General Fund in the transactions columns of the worksheet. (A different solution approach may be used if desired by you professor.) 19. The city levied interest and penalties of $35,000 on the overdue taxes receivable. Interea and penalties of $5.00 are expected to prove uncollectible. 20. The city collected $216,000 of delinqueni taxes receivable and $27,000 of interest and peni ties receivable 21. The city wrote off uncollectible taxes receivable of $23,000 and related interest and peal ties of $4.800 22. General government equipment with an original cost of $300,000 and accumulated depre ciation of $187.000 was sold for $72,000, which was deposited in the General Fund. 23. The city formalized tax lions against properties that had claims against them for delinquent taxes of $12,000 and interest and penalties of $800. The estimated salable value of the properties was $14,000 24. The following revenue-related information was available at year end: a. $144,00 of the December 31, 20X4, balance of delinquent taxes receivable and 534,00 December 31, 20X4, balance of interest and penalties receivable are not expected to be lected within the first 60 days of 20X5. (The January 1, 20X4, delinquent taxes receive balance included 579,100 of taxes that were collected after the first 60 days of 26X4, and January 1, 20X4, interest and penalties receivable balance included $20.900 of interest penalties on taxes that were collected after the first to days of 20X4) (line Delesed Revenues must be adjusted) b. Accrued interest receivable on investments at December 31, 20X4, totals 52.700 c. The fair value of General Fund investments at December 31, 20X4, is so more than the book value HARVEY CITY ADDICTION PREVENTION SPECIAL REVENUE FUND The Addiction Prevention Special Revenue Fund was established in 20x4 to account federal grants intended to help communities prevent and battle drug and alcohol addiction Because this is the first year for this fund, there is no beginning trial balance for the Addiction Prevention Special Revenue Fund, HARVEY CITY ADDICTION PREVENTION SPECIAL REVENUE FUND REQUIREMENTS if desired by your professor.) b. Enter the preclosing trial balance in the appropriate worksheet columns (balance sheet data) columns, as appropriate Prepare the 20X4 Statement of Revenues, Expenditures, and Changes in Fund Balance for the Addiction Prevention Special Revenue Fund. Prepare the 20X4 balance sheet for the Addiction Prevention Special Revenue Fund. (Assume that all but $60,000 of the resources of the fund at December 31, 20X4 are restricted.) Transactions and Events-20X4 1. The city council adopted the budget for the Addiction Prevention Special Revenue Fund, The budget for the fund included estimated grant revenues of $530,000 and appropriations for public safety of $525,000 2. The city was awarded a federal grant for drug addiction and enforcement programs. The grant requires the city to incur qualifying expenditures, then apply for reimbursement. The total amount of the grant award, which can be used anytime during the next 3 years, is $1.200,000-none of which is received at this time. 3. The city contracted for and received services costing $450,000 that qualify for reimburse- ment under the grant agreement. The expenditures, for the Public Safety function, were vouchered. 4. The Addiction Prevention Special Revenue Fund borrowed $500,000 from the General Fund on a short-term basis. 5. The city paid $430,000 of the vouchers payable. 6. The city applied for and received reimbursement of $450,000 from the federal grantor agency under the provisions of the grant agreement. 7. The city incurred and vouchered $75,000 of Public Safety expenditures for the Addiction Prevention program: $50,000 of the costs is reimbursable under the grant agreement. The city applied for reimbursement, which is expected early next year. 8. $250,000 of the loan from the General Fund was repaid. 9. A transfer of $60,000 was received from the General Fund. 10. The budgetary accounts were closed at year end. (Close the budgetary accounts in the transactions columns.) ed nd The remainder of the 20x4 transactions of the General Fund of Harvey City are included statements for 20X4. In addition, we will record the transactions of the Economic this chapter. We will record these transactions and prepare the General Fund financial Derekyment Special Revenue Fund and prepare its financial statements. Aditional 20X4 transactions and events for the Harvey City General Fund are presented est, and conclude the General Fund case from Chapters 4 and 5. 2. The city entered into a capital lease for parks and recreation equipment on December 31. The capitalizable cost of the equipment was $90,000, including a downpayment of $10,000 Alnit has been filed against the city related to an accident that occurred during the fiscal year. A city employee is at fault. The city expects to settle the lawsuit by sometime late in the entical year and consider it probable that the city will lose $52. The city contributed $60,200 to the city Police and Fire Pension Trust Fund. The city's net probability of its single-cmployer defined benefit pension plan increased from $75,000 to year end. Assume that the only deferred amount is a deferred inflow of from actual investment income of the pension plan exceeding the expected smoby S10 in the current year. None of the net pension liability is due and payable odon is to be allocated to enterprise activities The Gel Fund received $250 from the Addiction Prevention Special Revenue Fund Sparepayment of the interfund loan. They paid vouchers payable of SSL Thcodecary accounts, including encumbrances, were closed at year end. (Close the bud. Ty counts in the transactions columns.) SS 2015 ASS 2.32 Gel Harvey City Comprehensive Case city has budgeted a $75,000 decrease of otherwise unassigned fund balance to provide for a Nors poudable fixed GENERAL FUND REQUIREMENTS Using the worksheet you began in Chapter 4, enter the effects of the following additional 20X4 transactions and events of the Harvey City General Fund in the transactions column of the worksheet. (A different solution approach may be used if desired by your professor.) Prepare the 20X4 statement of revenues, expenditures, and changes in fund balance for the Harvey City General Fund Prepare the 21X4 statement of revenues, expenditures, and changes in fund balance-budget and 000 fund balance was assigned by the city manager, under authority delegated to her by city council. 175.800 : 218,000 Prepare the 2184 balance sheet for the Harvey City General Fund. Assume that $100,600 of Assigned a yo endere to be used to establish new park and recreation programs in the next year. Also, assume that the budgeted excess of General Fund expenditures over revenues for 20X5. 2. Materials and supplies ordered were received as follows: presented in respectively ancial Report Vrassigned. Fund be (Assigned 372, 755 Estimated Acha! Cost Cosi General government $ 10,000 $ 10,000 Public safety 32,000 32.500 Highways and streets 60,000 59,700 Health and sanitation 36,000 36.000 Parks and recreation 30,000 30,000 Totals. $16.000 $168.200 * Materials and supplies were used by General Fund departments during the year as General government Public safety Highways and streets Health and sanitation Parks and recreation Total. $ 11,000 35.000 75.300 39,400 30,000 $190,00 9. The fair value of the investments of the Economic Development Special Revenue Fund year and increased by S1,700. In addition, accrued interest on the investments at year ECONOMIC DEVELOPMENT SPECIAL REVENUE FUND LEARI The beginning trial balance of the Harvey City Economic Development Grants Spo Prepare a worksheet for the Economic Development Special Revenue Fundimit the General Fund worksheet you created in Chapter 4. Enter the effects of the following this 6. The city paid salaries of $75.000 to economic development personnel. The payment included 12. The budgetary accounts were closed at year end. (Close the budgetary accounts in the 258 CHAPTER 6 Expenditure Accounting-Governmental and Revenue Fund and its 20X4 budget and transactions are presented next. Economic Development Special Revenue Fund Requirements and events in the appropriate columns of the worksheet. (A different solution approach to Prepare the preclosing trial balance in the appropriate worksheet columns Enter the preclosing trial balance amounts in the closing entry or postclosing trial balance de Prepare the 21X4 statement of revenues, expenditures, and changes in fund balance for me Prepare the 2014 balance sheet for the Economic Development Special Revenue Fund Economic Development The trial balance of the Economic Development Special Revenue Fund of Harvey City Special Revenue Fund January 1, 20X4, is presented here. Beginning Trial Balance Harvey City Economic Development Special Revenue Fund Trial Balance January 1, 20X4 Dehir Credit Cash $342.230 Investments 125.000 Accrued Salaries Payable $ 450 Vouchers Payable 82.000 Fund Balance 384.780 Totals. $467.230 $46720 Economic Development The Economic Development Special Revenue Fund budget was adopted by the city council Special Revenue Fund The adopted budget included estimated operating grant revenues of $930,000 and estimated Budget investment income of $40,000. Appropriations of $945,000 were adopted for economi development programs. TRANSACTIONS AND EVENTS-20X4 1. Record the budget 2. The city received a $1,500,000 economic development grant from the state's Department of Economic Development. The grant cash was received and is to be used in certain speck fied efforts to attract new businesses to the city and surrounding area. 3. The city purchased investments of $1,300,000. The grant requires that all investment income from the investment of the grant proceeds must be used for economic development 4. The city received interest on its investments, $55.000 3. The city incurred and vouchered $841,000 of economic development expenditures that qualify under the state grant program. under the grant program 7. The city sold investments costing $800,000 for $815.000 & The city paid So on vouchers payable for economic development was $12,000. transactions columns.) 10. Accrued salarios payable at year end totaled $200 11. Grant revenues for the year were recorded (if not recorded earlier) Based on the following How can you find the budgetary statements for the AP and Ed Soe's Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

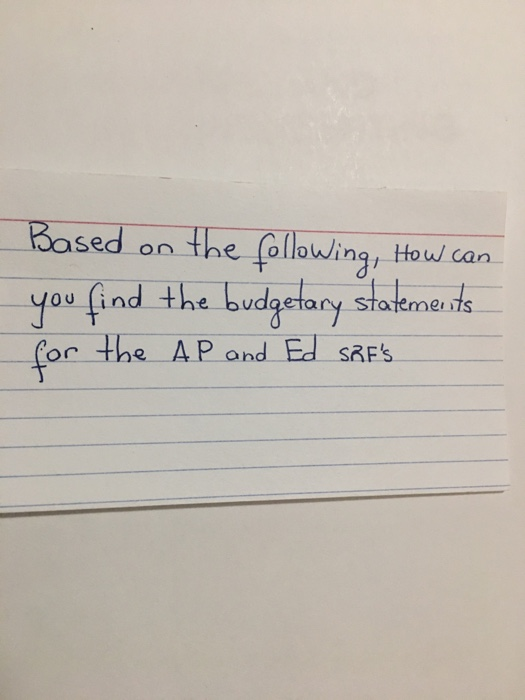

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started