Question

What is Crane's net income in 20227 Assume a 35% tax rate in all years. Net Income $ 200020 . Compute the cumulative effect to

Net Income $200020.

Compute the cumulative effect to retained earnings for 2022 of the change in accounting principle from weighted average to FIFO inventory pricing

Net Effect $ .

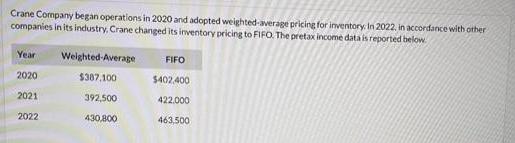

Crane Company began operations in 2020 and adopted weighted-average pricing for inventory. In 2022, in accordance with other companies in its industry, Crane changed its inventory pricing to FIFO. The pretax income data is reported below. Year Weighted-Average FIFO 2020 $387.100 $402.400 2021 392,500 422.000 2022 430,800 463,500

Step by Step Solution

3.58 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation 01 Net Income bretak 463500 x 35 tax tax 162225 Net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: J. David Spiceland, Wayne Thomas, Don Herrmann

2nd Edition

0078110823, 9780078110825

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App