Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is D ?? Lewis Company manufactures a line of lightweight running shoes. CEO Edward Lewis estimated that the company would incur $2,520,000 in manufacturing

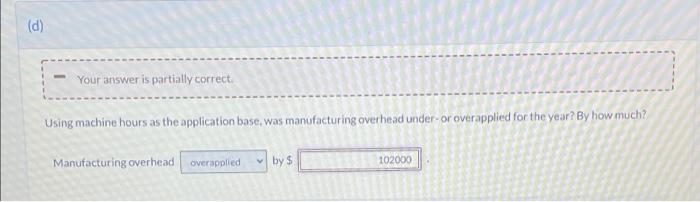

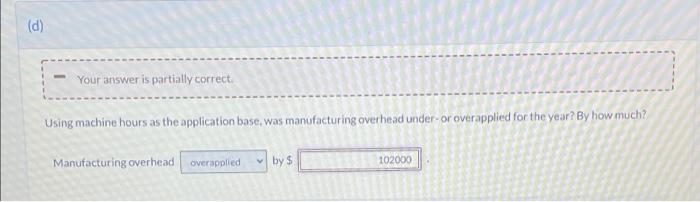

what is D ??

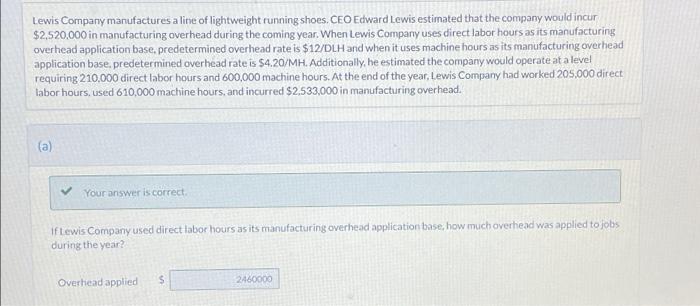

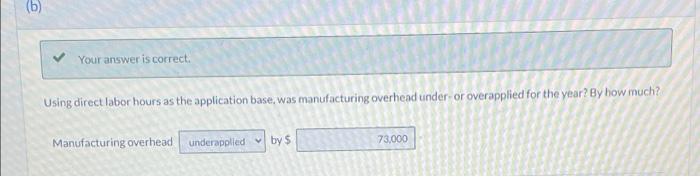

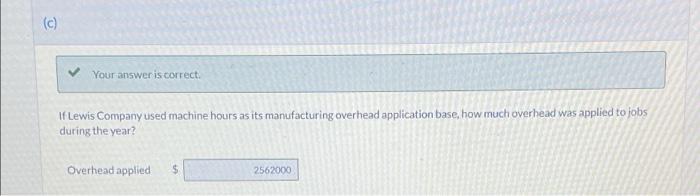

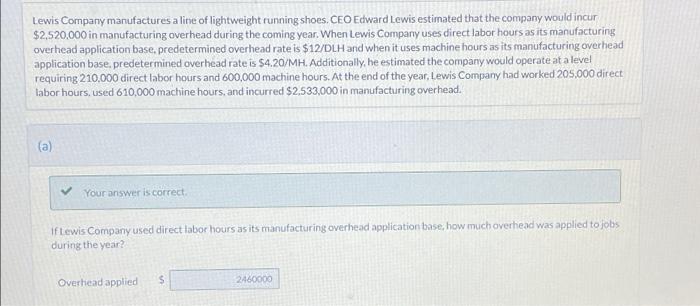

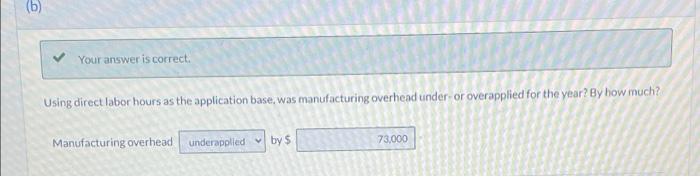

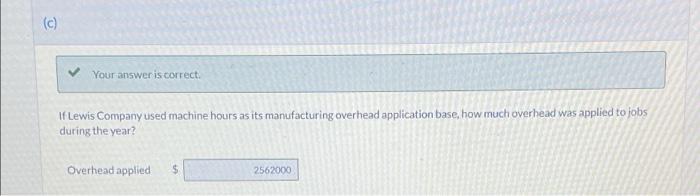

Lewis Company manufactures a line of lightweight running shoes. CEO Edward Lewis estimated that the company would incur $2,520,000 in manufacturing overhead during the coming year. When Lewis Company uses direct labor hours as its manufacturing overhead application base, predetermined overhead rate is $12/DLH and when it uses machine hours as its manufacturing overhead application base, predetermined overhead rate is $4.20/MH. Additionally, he estimated the company would operate at a level requiring 210,000 direct labor hours and 600,000 machine hours. At the end of the year, Lewis Company had worked 205,000 direct labor hours, used 610,000 machine hours, and incurred $2,533,000 in manufacturing overhead. (a) ) Your answer is correct if Lewis Company used direct labor hours as its manufacturing overhead application base how much overhead was applied to jobs during the year? S Overhead applied 2460000 (6) Your answer is correct. Using direct labor hours as the application base, was manufacturing overhead under or overapplied for the year? By how much? Manufacturing overhead underapplled by $ 73.000 0 Your answeris correct. If Lewis Company used machine hours as its manufacturing overhead application base, how much overhead was applied to jobs during the year? Overhead applied $ 2562000 (d) Your answer is partially correct. Using machine hours as the application base, was manufacturing overhead under-or overapplied for the year? By how much? Manufacturing overhead overapplied by $ 102000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started