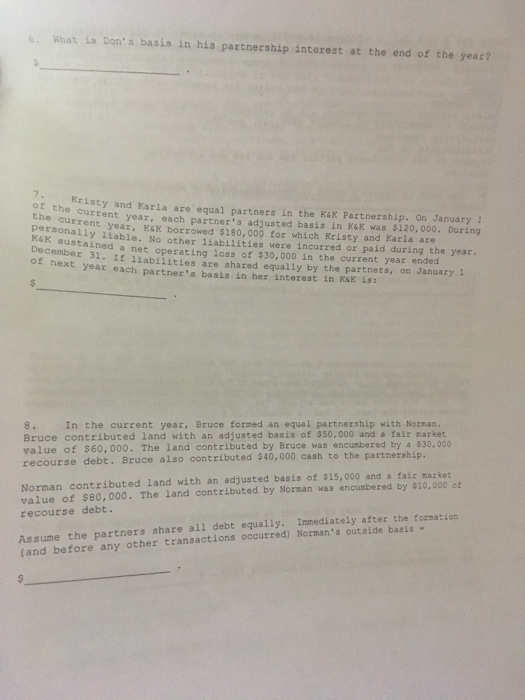

What is Don's basis in his partnership interest at the end of the year? $ _____. Kristy and Karla are equal partners in the K & K Partnership. On January 1 of the current year, each partner's adjusted basis in K&K was $120,000. During the current year, K&K borrowed $180,000 for which Kristy and Karla are personally liable. No other liabilities were incurred or paid during the year. K&K sustained a net operating loss of $30,000 in the current year ended December 31. If liabilities are shared equally by the partners, on January 1 of next year each partner's basis in her Interest in K&K is: $ _____. In the current year, Bruce formed an equal partnership with Norman. Bruce contributed land with an adjusted basis of $50,000 and a fair market value of $60,000. The land contributed by Bruce was encumbered by a $30,000 recourse debt. Bruce also contributed $40,000 cash to the partnership. Norman contributed land with an adjusted basis of $15,000 and a fair market value of $80,000. The land contributed by Norman was encumbered by $10,000 of recourse debt. Assume the partners share all debt equally. Immediately after the formation (and before any other transactions occurred) Norman's outside basis = $ _____. What is Don's basis in his partnership interest at the end of the year? $ _____. Kristy and Karla are equal partners in the K & K Partnership. On January 1 of the current year, each partner's adjusted basis in K&K was $120,000. During the current year, K&K borrowed $180,000 for which Kristy and Karla are personally liable. No other liabilities were incurred or paid during the year. K&K sustained a net operating loss of $30,000 in the current year ended December 31. If liabilities are shared equally by the partners, on January 1 of next year each partner's basis in her Interest in K&K is: $ _____. In the current year, Bruce formed an equal partnership with Norman. Bruce contributed land with an adjusted basis of $50,000 and a fair market value of $60,000. The land contributed by Bruce was encumbered by a $30,000 recourse debt. Bruce also contributed $40,000 cash to the partnership. Norman contributed land with an adjusted basis of $15,000 and a fair market value of $80,000. The land contributed by Norman was encumbered by $10,000 of recourse debt. Assume the partners share all debt equally. Immediately after the formation (and before any other transactions occurred) Norman's outside basis = $ _____