What is Elixirs business model and what are its target customers, marketing and distribution strategies?

Q.2 Why might banks in advanced and emerging markets be interested in Elixirs mobile banking app? Why might banks agree on a rebate of 50% fee to finance to fund Milmo?

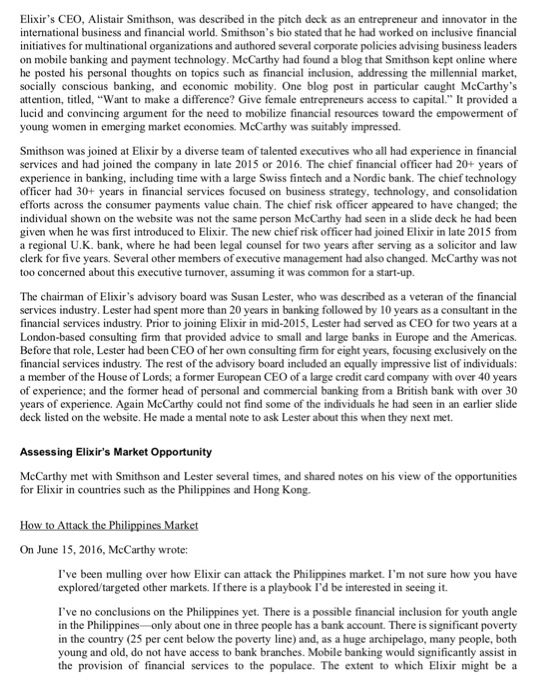

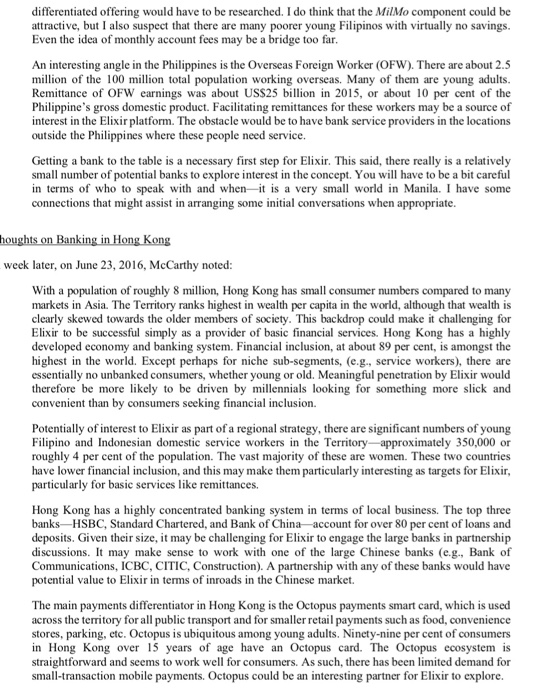

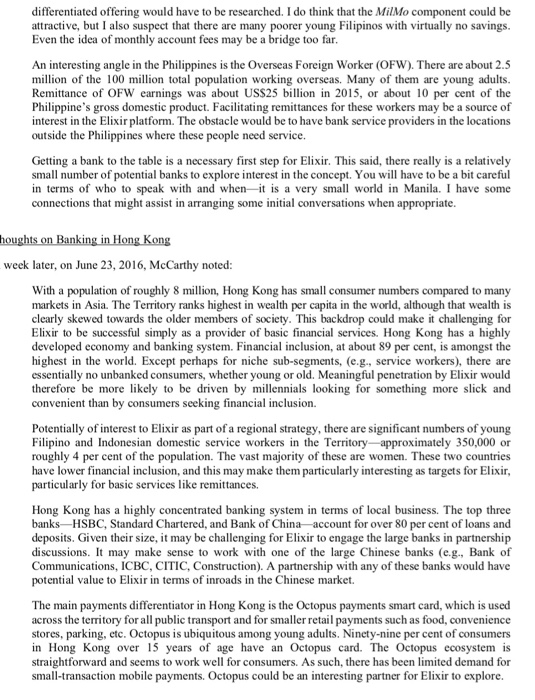

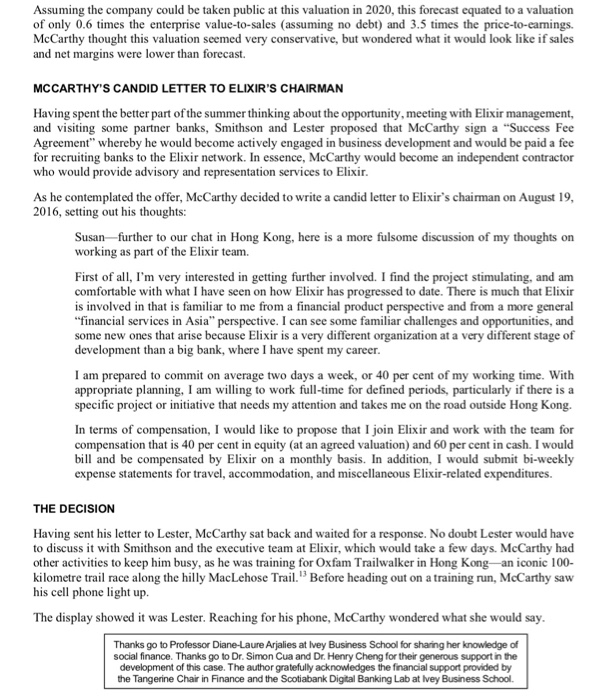

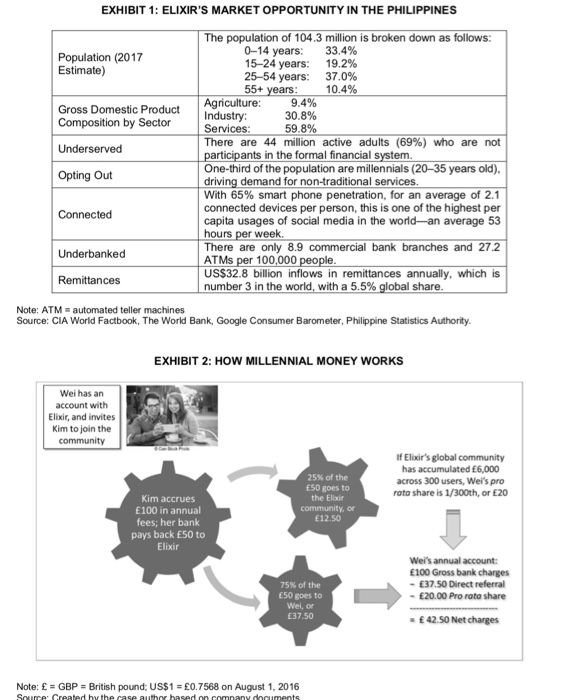

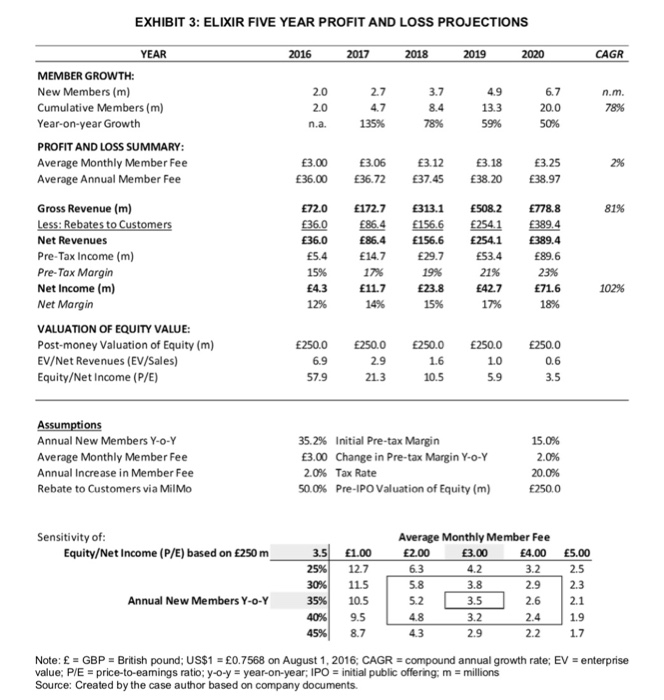

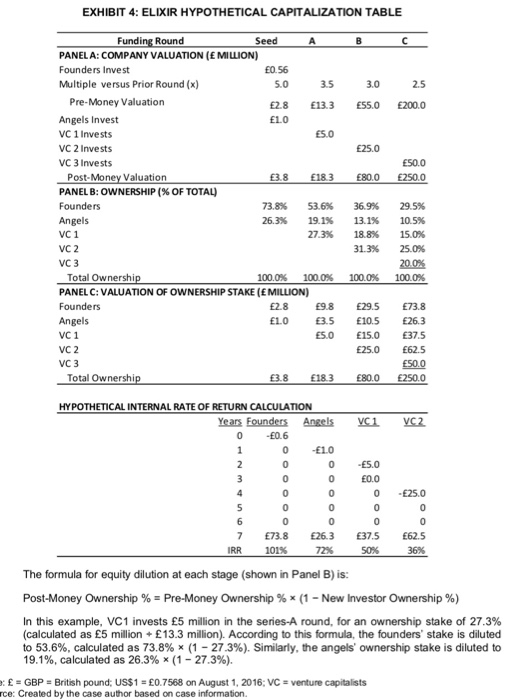

In August of 2016, U.K.-born banker Frank McCarthy was sitting at home in Hong Kong, considering the offer that had been recently presented to him. Earlier in the summer, McCarthy had been invited to join the management team of a financial technology (fintech) start-up called Elixir. Elixir had developed a social banking application (app) to provide a unique suite of mobile banking services to young adults around the world. The start-up was actively marketing its app to a network of partner banks in developed and emerging markets. Elixir's vision was to expand into 20 countries and attract 20 million users by 2020. As a technology company in the social finance space, Elixir could use the strategic and operational advice of an experienced banker to help turn this vision into a reality as finding it very difficult to make a decision. The market opportunity was not the issue, as he could see the customer need for this product in both developed and emerging markets, but getting involved with a start-up would take him out of his comfort zone. McCarthy had been conducting due diligence for the company all summer, examining Elixir's strategy, its business model, and its leadership. He needed to decide whether or not to pursue the opportunity and whether or not to invest some of his own savings in Elixir's equity at the same time. He was attracted by Elixir's goal of targeting young adults and the underbanked to provide them with low-cost mobile financial services. While he was impressed with the team and technology, he still had nagging concerns about their strategy and value proposition. Now it was time to make a decision FINTECH AND SOCIAL FINANCE: DEMOCRATIZING BANKING The term fintech was a portmanteau for financial technologies." While the word fintech was first used in the mid-1980s and early 1990s to refer to technologies sold to financial services firms (such as automated teller machines, or ATMs), it became widely adopted following the 2008-09 global financial crisis to re to the provision of financial services online or via mobile phone to individuals and small businesses. Fintech start-ups used emerging technologies to connect the various stakeholders of the investment chain in a ne way, usually by avoiding established gatekeepers (i.e., banks). When describing different fintech business models, practitioners typically segmented them into different business lines based on the primary product or service: digital banking, equity crowdfunding, peer-to-peer (P2P) lending, digital wealth management (also called robo-advice), cryptocurrencies and payments, and financial infrastructure (such as blockchain and digital identity Fintechs in these business lines leveraged a variety of existing or emerging technologies to provide financial services at a lower cost with a better customer experience, including smart phones, cloud computing, P2P networks, digitization, big data, automated programming interfaces, artificial intelligence, and machine learning. Elixir was a fintech start-up focused on digital banking. Elixir's business model fell into a category called social finance -an umbrella term that referred to a style of investing or banking that sought to earn a social return along with an economic return. A social return was an investment that benefited society, such as reducing poverty, advancing challenged segments of the population, or supporting the environment. Social finance was a broad term covering a variety of activities and organizations, including charities and non- governmental organizations, impact-focused organizations, socially responsible investment, microfinance, and green bonds. In this case, Elixir was promoting financial inclusion through the delivery of financial services at an affordable cost to customers who were economically disadvantaged and over-represented in low-income segments of society The number of fintech start-ups in the social finance space was growing rapidly, though the reality of the cial" in these approaches varied. Broadly speaking, these start-ups fell into two groups: (1) those who used technology to make a profit while providing a service to an underserved customer segment, and (2) those who used technology to disrupt the power of the traditional financial incumbents The first category of social finance fintechs included early success stories such as M-Pesa in Kenya and SoFi in the United States. Launched in 2007, M-Pesa provided cheap and accessible banking using widely- available, cheap mobile phones via text messages and a network of local representatives from the telecom company Safaricom.2 SoFi was an online finance company founded in 2011 that initially provided loans on favourable borrowing terms to students attending the most reputable U.S. universities and colleges, initially using funding from alumni who screened applicants. By 2016, SoFi had provided more than USS12 billio in student loans to 175,000 members. For both M-Pesa and SoFi, technology provided a means to an end, namely, creating shareholder value by providing a superior customer experience at a lower cost to an unbanked segment of the population. The second group of social finance fintechs had a more ambitious goal: to democratize finance by disintermediating the traditional gatekeepers and disrupting their monopoly rents. Ironically, many elites from the financial and technology sectors viewed fintech as a means by which the financial industry could be changed. This attitude was behind cryptocurrencies such as Bitcoin, which provided a digital currency that was not controlled by a central bank or government authority.5 It encapsulated the approach of fintech start-ups such as TransferWise that provided a cheaper, faster alternative for cross-border currency transfers that avoided the hidden costs charged by banks. It motivated P2P lending platforms such as Zopa that provided loans on ethical terms to individuals to help them grow, not hold them back. And it was part of the philosophy of robo-advisors such as Wealthsimple Inc., whose mission was to "bring smarter financial services to everybody, regardless of age or net worth." While many of these fintechs had an explicit societal agenda, others did not. McCarthy had been watching the growth of fintechs, particularly as Hong Kong was a big regional hub. He was attracted to the idea of social finance. Like many of his peers, McCarthy had witnessed first-hand the unfolding of the Global Financial Crisis and the terrible impact of the subsequent economic recession (dubbed the Great Recession) on society. Individuals lost their jobs, their homes, and their savings. Bankers were stigmatized their role in causing and prolonging the crisis by social movements such as Occupy Wall Street with its slogan "We are the 99 percent."McCarthy felt a moral obligation to help address these imbalances in society ELIXIR Elixir was entrepreneurs focused on financial inclusion. Elixir had created a mobile app that provided a suite of core banking, payment, and money transfer services at a low cost. While Elixir provided the technology platform, the underlying financial services were provided by partner banks operating in different countries. At the time Elixir approached McCarthy, it was gearing up for a launch in Malaysia, the Philippines, the United Kingdom, Poland, and Chile a London-headquartered start-up established in 2014 by a group of socially-minded The idea for Elixir was born after a two-year online survey project that highlighted the dissatisfaction of young adults around the world with traditional consumer banking services. Elixir's goal was to revolutionize the delivery of financial services by providing a suite of attractive products to the young adult or"millennial" population globally. Millennials, also known as Generation Y, were the demographic cohort following Generation X. While there were no precise dates for this cohort, they were typically born between the early 1980s and the early 2000s. This growing segment was often disenfranchised from the current banking system, either by choice or by circumstance. These individuals could be found in developed and emerging markets alike. Elixir's mobile app had a clear market opportunity in emerging and advanced countries, as was illustrated by the Philippines (see Exhibit 1) Strategy and Business Model Elixir's strategy differentiated from other mobile banking apps in several ways. First, Elixi developing a global network of partner banks who shared the vision of providing financial services to the underserved and underbanked particularly millennials. Elixir offered these banks a new channel to acquire new customers and long-term deposits. Elixir's cloud-based digital platform provided a low-cost solution to onboard unprofitable customers at the time while promoting financial inclusiveness Partner banks would have the ability to cross-sell other bank and insurance products a ounger adults. Second, Elixir had partnered with a number of established technology companies to deliver a sophisticated mobile experience to customers and a turnkey solution for partner banks. Elixir's tech partners included a database operator, an international payments provider, a mobile deposit capture and identity verification company, a digital identity management company, and a personal credit-risk scoring company. Each brought expertise that Elixir aggregated into its app. The digital identity company, for example, provided biometric verification with an optional fingerprint recognition feature for instant customer onboarding. Third, Elixir's innovative mobile app provided customers with low-cost access to a wide range of financial services: a deposit account, a debit card for payments, an interest-bearing savings account, and very l cost fund transfers between Elixir users across the world. This fund transfer feature was particularly attractive to customers who sent remittances to family and friends both locally and cross-border. Elixir promised no hidden extra fees besides its monthly fixed fee (which varied by market), and a maximum 2 per-cent foreign exchange fee per internal P2P transfer. Elixir estimated that traditional banks charged E1001 to 250 for a similar bundle of services and said it would ensure that its fee would always be less. Fourth, Elixir's slogan was "Earn with Your Generation." Elixir offered a product called MillennialMoney, or MilMo, which gave users the opportunity to earn income in return for growing the number of Elixir subscribers. Based on such popular "one-for-one" models as TOMS Shoes and tentree, MilMo was funded by Elixir's partner banks, who agreed to return 50 per cent of the monthly fees charged to the Elixir community. For every 2 of the monthly fees, partner banks would pay l back to the Elixir social community-75 percent of this 1 would go directly to the individual who referred a new customer, while 25 per cent would go into a global pool for the Elixir community. This global pool was shared pro rata with each subscriber based on how many users they had introduced to the Elixir community. Effectively, this "give and get" social finance banking model allowed Elixir subscribers to offset their own annual fees and earn a recurring income stream through their referrals of family and friends (see Exhibit 2). While McCarthy thought the MilMo system was interesting, he also saw risks in this marketing strategy Some customers could view MilMo as multi-level marketin lead customers to push Elixir's mobile app on friends and family members. McCarthy was aware that some eme r worse, a pyramid scheme that would rging market economies had already banned multi-level marketing, including China.12 MCCARTHY'S DUE DILIGENCE McCarthy had spent more than two decades at a large European international bank and at one time had been based in Hong Kong as the Asian chief executive officer (CEO) for the bank. He had then relocated to London to run the bank's global credit card franchise for a decade, before retiring and moving back to Hong Kong. In 2016 he was looking for a change and Elixir's business model was intriguing. He would just need to get comfortable with working for a technology start-up As a lifelong banker who had worked in a large, regulated, publicly-listed company, McCarthy had spent his career in a world where trust was paramount, brand reputation was your biggest asset, and managing risk was the name of the game. When vetting a new client, a business opportunity, or a transaction, bankers made sure to do their homework. This was formally called "due diligence" but roughly meant to look before you leap." Even though an opportunity could seem attractive, bankers knew they had to check all of the "boxes" before agreeing to move forward. The golden rule was that you only took risks that you understood; you assessed all sides of a situation before coming to a decision. This concept was encapsulated in the Latin phrase caveat emptor, which translated as "let the buyer beware. With this mindset, McCarthy decided to move cautiously before committing his reputation, his time, and his money to this venture. He committed to conducting his own due diligence of () Elixir's leadership, (2) the market opportunity, and (3) Elixir's financial projections and valuation. Assessing Elixir's Leadership When he was first introduced in mid-2016, McCarthy went online and browsed through Elixir's website, which included a number of pages describing both Elixir's executive team and its advisory board. Elixir's CEO, Alistair Smithson, was described in the pitch deck as an entrepreneur and innovator in the international business and financial world. Smithson's bio stated that he had worked on inclusive financial initiatives for multinational organizations and authored several corporate policies advising business leaders on mobile banking and payment technology. McCarthy had found a blog that Smithson kept online where he posted his personal thoughts on topics such as financial inclusion, addressing the millennial market, socially conscious banking, and economic mobility. One blog post in particular caught McCarthy's attention, titled, Want to make a difference? Give female entrepreneurs access to capital." It provided a lucid and convincing argument for the need to mobilize financial resources toward the empowerment of young women in emerging market economies. McCarthy was suitably impressed. Smithson was joined at Elixir by a diverse team of talented executives who all had experience in financial services and had joined the company in late 2015 or 2016-The chief financial officer had 20+ years of experience in banking, including time with a large Swiss fintech and a Nordic bank. The chief technology officer had 30+ years in financial services focused on business strategy, technology, and consolidation efforts across the consumer payments value chain. The chief risk officer appeared to have changed; the individual shown on the website was not the same person McCarthy had seen in a slide deck he had been given when he was first introduced to Elixir. The new chief risk officer had joined Elixir in late 2015 from a regional U.K. bank, where he had been legal counsel for two years after serving as a solicitor and law clerk for five years. Several other members of executive management had also changed. McCarthy was not too concerned about this executive turnover, assuming it was common for a start-up. The chairman of Elixir's advisory board was Susan Lester, who was described as a veteran of the financial services industry. Lester had spent more than 20 years in banking followed by 10 years as a consultant in the financial services industry. Prior to joining Elixir in mid-2015, Lester had served as CEO for two years at a London-based consulting firm that provided advice to small and large banks in Europe and the Americas. Before that role, Lester had been CEO of her own consulting firm for eight years, focusing exclusively on the financial services industry. The rest of the advisory board included an equally impressive list of individuals: a member of the House of Lords; a former European CEO of a large credit card company with over 40 yeans of experience; and the former head of personal and commercial banking from a British bank with over 30 years of experience. Again McCarthy could not find some of the individuals he had seen in an earlier slide deck listed on the website. He made a mental note to ask Lester about this when they next met. Assessing Elixir's Market Opportunity McCarthy met with Smithson and Lester several times, and shared notes on his view of the opportunities for Elixir in countries such as the Philippines and Hong Kong. On June 15, 2016, McCarthy wrote: I've been mulling over how Elixir can attack the Philippines market. I'm not sure how you have explored/targeted other markets. If there is a playbook I'd be interested in seeing it. I've no conclusions on the Philippines yet. There is a possible financial inclusion for youth angle in the Philippines only about one in three people has a bank account. There is significant poverty in the country (25 per cent below the poverty line) and, as a huge archipelago, many people, both young and old, do not have access to bank branches. Mobile banking would significantly assist in the provision of financial services to the populace. The extent to which Elixir might bea differentiated offering would have to be researched. I do think that the MilMo component could be attractive, but I also suspect that there are many poorer young Filipinos with virtually no savings. Even the idea of monthly account fees may be a bridge too far An interesting angle in the Philippines is the Overseas Foreign Worker (OFW). There are about 2.5 million of the 100 million total population working overseas. Many of them are young adults. Remittance of OFW earnings was about USS25 billion in 2015, or about 10 per cent of the Philippine's gross domestic product. Facilitating remittances for these workers may be a source of interest in the Elixir platform. The obstacle would be to have bank service providers in the locations outside the Philippines where these people need service. Getting a bank to the table is a necessary first step for Elixir. This said, there really is a relatively small number of potential banks to explore interest in the concept. You will have to be a bit careful in terms of who to speak with and when is a very small world in Manila. I have some connections that might assist in arranging some initial conversations when appropriate. week later, on June 23, 2016, McCarthy noted With a population of roughly 8 million, Hong Kong has small consumer numbers compared to many markets in Asia. The Territory ranks highest in wealth per capita in the world, although that wealth is clearly skewed towards the older members of society. This backdrop could make it challenging for Elixir to be successful simply as a provider of basic financial services. Hong Kong has a highly developed economy and banking system. Financial inclusion, at about 89 per cent, is amongst the highest in the world. Except perhaps for niche sub-segments, (e.g., service workers), there are essentially no unbanked consumers, whether young or old. Meaningful penetration by Elixir would therefore be more likely to be driven by millennials looking for something more slick and convenient than by consumers seeking financial inclusion. Potentially of interest to Elixir as part of a regional strategy, there are significant numbers of young Filipino and Indonesian domestic service workers in the Territory approximately 350,000 or roughly 4 per cent of the population. The vast majority of these are women. These two countries have lower financial inclusion, and this may make them particularly interesting as targets for Elixir particularly for basic services like remittances. Hong Kong has a highly concentrated banking system in terms of local business. The top three banks- HSBC, Standard Chartered, and Bank of China account for over 80 per cent of loans and deposits. Given their size, it may be challenging for Elixir to engage the large banks in partnership discussions. It may make sense to work with one of the large Chinese banks (e.g. Bank of Communications, ICBC, CITIC, Construction). A partnership with any of these banks would have potential value to Elixir in terms of inroads in the Chinese market. The main payments differentiator in Hong Kong is the Octopus payments smart card, which is used across the territory for all public transport and for smaller retail payments such as food, convenience stores, parking, etc. Octopus is ubiquitous among young adults. Ninety-nine per cent of consumers in Hong Kong over 15 years of age have an Octopus card. The Octopus ecosystem is straightforward and seems to work well for consumers. As such, there has been limited demand for small-transaction mobile payments. Octopus could be an interesting partner for Elixir to explore. Assuming the company could be taken public at this valuation in 2020, this forecast equated to a valuation of only 0.6 times the enterprise value-to-sales (assuming no debt) and 3.5 times the price-to-earnings. McCarthy thought this valuation seemed very conservative, but wondered what it would look like if sales and net margins were lower than forecast. MCCARTHY'S CANDID LETTER TO ELIXIR'S CHAIRMAN Having spent the better part ofthe summer thinking about the opportunity, meeting with Elixir management, and visiting some partner banks, Smithson and Lester proposed that McCarthy sign a Success Fee Agreement" whereby he would become actively engaged in business development and would be paid a fee for recruiting banks to the Elixir network. In essence, McCarthy would become an independent contractor who would provide advisory and representation services to Elixir As he contemplated the offer, McCarthy decided to write a candid letter to Elixir's chairman on August 19 2016, setting out his thoughts: Susan further to our chat in Hong Kong, here is a more fulsome discussion of my thoughts on working as part of the Elixir team. First of al, I'm very interested in getting further involved. I find the project stimulating, and am comfortable with what I have seen on how Elixir has progressed to date. There is much that Elixir is involved in that is familiar to me from a financial product perspective and from a more general "financial services in Asia" perspective. I can see some familiar challenges and opportunities, and some new ones that arise because Elixir is a very different organization at a very different stage of development than a big bank, where I have spent my career I am prepared to commit on average two days a week, or 40 per cent of my working time. With appropriate planning, I am willing to work full-time for defined periods, particularly if there is a specific project or initiative that needs my attention and takes me on the road outside Hong Kong. In terms of compensation, I would like to propose that I join Elixir and work with the team for compensation that is 40 per cent in equity (at an agreed valuation) and 60 per cent in cash. I would bill and be compensated by Elixir on a monthly basis. In addition, I would submit bi-weekly expense statements for travel, accommodation, and miscellaneous Elixir-related expenditures. THE DECISION Having sent his letter to Lester, McCarthy sat back and waited for a to discuss it with Smithson and the executive team at Elixir, which would take a few days. McCarthy hacd other activities to keep him busy, as he was training for Oxfam Trailwalker in Hong Kong an iconic 100- kilometre trail race along the hilly MacLehose Trail. Before heading out on a training run, McCarthy saw his cell phone light up response. No doubt Lester would have The display showed it was Lester. Reaching for his phone, McCarthy wondered what she would say Thanks go to Professor Diane-Laure Arjalies at Ivey Business School for sharing her knowledge of social finance. Thanks go to Dr. Simon Cua and Dr. Henry Cheng for their generous support in the development of this case. The author gratefully acknowledges the financial support provided by the Tangerine Chair in Finance and the Scotiabank Digital Banking Lab at Ivey Business School. EXHIBIT 1: ELIXIR'S MARKET OPPORTUNITY IN THE PHILIPPINES The population of 104.3 million is broken down as follows: Population (2017 Estimate) 0-14 years: 15-24 years: 25-54 years: 55+ 33.4% 19.2% 37.0% 10.4% 9.4% 30.8% 59.8% Agriculture: Gross Domestic Product Composition by Sector Services Industry: There are 44 million active adults (69%) who are not ants in the formal financial s One-third of the population are millennials (20-35 years old), driving demand for non-traditional services. With 65% smart phone penetration, for an average of 2.1 connected devices per person, this is one of the highest per capita usages of social media in the world-an average 53 hours per week There are only 8.9 commercial bank branches and 27.2 ATMs per 100,000 US$32.8 billion inflows in remittances annually, which is number 3 in the world, with a 5.5% Opting Out Connected Underbanked Remittances Note: ATM automated teller machines Source: CIA World Factbook, The World Bank, Google Consumer Barometer, Philippine Statistics Authority EXHIBIT 2: HOW MILLENNIAL MONEY WORKS Wei has an account with Elixir, and invites Kim to join the community If Elixir's global community has accumulated E6,000 across 300 users, Weli's pro 25% of the ESO goes to the Elxir roto share is 1/300th, or 20 Kim accrues 100 in annual fees; her bank pays back ESO to Elixir E12.50 Wei's annual account: 100 Gross bank charges - 37.50 Direct referral - 20.00 Pro rato share 75% of the SO goes to Wei, or E37.50 42.50 Net charges Note: E GBP British pound: US$1 0.7568 on August 1, 2016 EXHIBIT 3: ELIXIR FIVE YEAR PROFIT AND LOSS PROJECTIONS YEAR 2016 2017 2018 2019 CAGR MEMBER GROWTH: New Members (m) Cumulative Members (m) Year-on-year Growth PROFIT AND LOSS SUMMARY: Average Monthly Member Fee Average Annual Member Fee 2.0 2.0 2.7 4.7 3.7 8.4 6.7 20.0 50% n.m. 13.3 3.25 E36.00 E36.72 E37.45 38.20 38.97 E3.00 E3.06 E3.12 3.18 Gross Revenue (m) E72.01727 313.1E508.2 778.8 g3606.4S66 E2541 E3894 86.4 156.6 E254.1 E389.4 E89.6 23% E71.6 81% Net Revenues Pre-Tax Income (m) Pre-Tax Margin Net Income (m) Net Margin E36.0 14.7 17% 11.7 ES3.4 21% E42.7 17% E29.7 E4.3 23.8 VALUATION OF EQUITY VALUE: Post-money Valuation of Equity (m) EV/Net Revenues (EV/Sales) Equity/Net Income (P/E) E250.0 250.0 250.0 E250.0 250.0 0.6 3.5 6.9 57.9 2.9 21.3 1.6 10.5 1.0 5.9 ssum Annual New Members Y-o-Y Average Monthly Member Fee Annual Increase in Member Fee Rebate to Customers via MilMo 35.2% initial Pre-tax Margin E3.00 Change in Pre-tax Margin Y-o-Y 2.0% Tax Rate 50.0% Pre-IPO Valuation of Equity (m) 15.0% 2.0% 20.0% 250.0 Sensitivity of Average Monthly Member Fee E3.00 Equity/Net Income (P/E) based on 250 m E4.00 ES.00 3.5 1.00 25%| 127 30%| 11.5 35% 10.5 40%| 9.5 45%) 8.7 2.00 3.2 2.9 2.5 2.3 2.1 3.8 Annual New Members Y-o-Y 4.8 4.3 2.9 2.2 1.7 Note: value; P/E-price-to-eamings ratio: y-o-y year-on-year; IPO-initial public offering;m Source: Created by the case author based on company documents. GBP = British pound: US$1 :: 0.7568 on August 1, 2016; CAGR compound annual growth rate; E-enterprise millions EXHIBIT 4: ELIXIR HYPOTHETICAL CAPITALIZATION TABLE Funding Round Seed PANELA: COMPANY VALUATION (E MILLION) Founders Invest Multiple versus Prior Round (x) EO.56 5.0 3.5 3.0 2.5 Pre-Money Valuation Angels Invest VC 1 Invests VC 2 Invests VC 3 Invests 2.8 E13.3 E55.0 200.0 E10 25.0 ES0.0 3.8 E183 80.0 E250.0 Post PANEL B: OWNERSHIP (% OF TOTAL) Founders Angels VC 1 VC 2 VC 3 Valuation 73.8% 53.6% 19.1% 27.3% 36.9% 13.1% 18.8% 31.3% 29.5% 10.5% 15.0% 25.0% 26.3% Total Ownershi PANELC:VALUATION OF OWNERSHIP STAKE (E MILLION) Founders Angels VC 1 VC 2 VC 3 100.0% 100.0% 100.0% 100.0% E2.8 9.8 29.5 73.8 3.5 E10.5 26.3 E5.O15.0 E37.5 25.0 E62.5 E1.0 Total Ownershi E3.8 E183 E80.0 E250.0 HYPOTHETICAL INTERNAL RATE OF RETURN CALCULATION Years Founders AngelsVC1 VC2 0 0.6 0 E1.0 0 ES.0 E0.0 0 0 25.0 7E73.8 26.3 E37.5 E62.5 36% IRR 101% 72% 50% The formula for equity dilution at each stage (shown in Panel B) is: Post-Money Ownership 962 Pre-Money Ownership 96 x (1-New Investor Ownership %) In this example, VC1 invests 5 million in the series-A round, for an ownership stake of 27.3% (calculated as 5 million 13.3 million). According to this formula, the founders' stake is diluted to 53.6%, calculated as 73.8% x (1-27.3%). Similarly, the angels' ownership stake is diluted to 19.1%, calculated as 26.3% (1-27.3%). GBP British pound: US$1 0.7568 on August 1, 2016: VC rce: Created by the case author based on case information. venture capitalists