Answered step by step

Verified Expert Solution

Question

1 Approved Answer

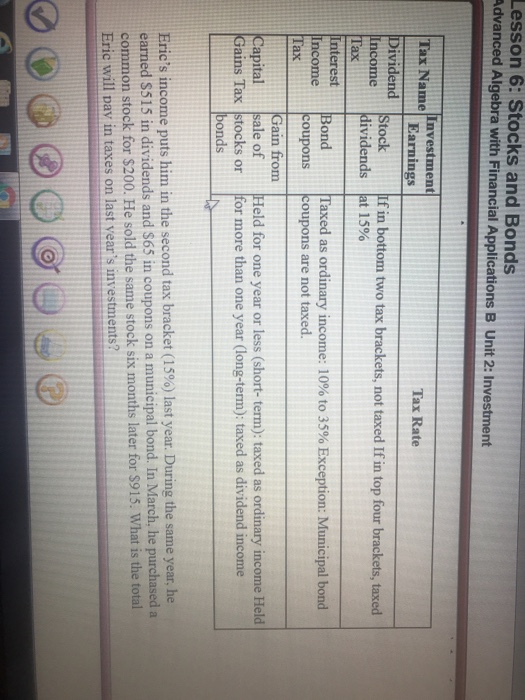

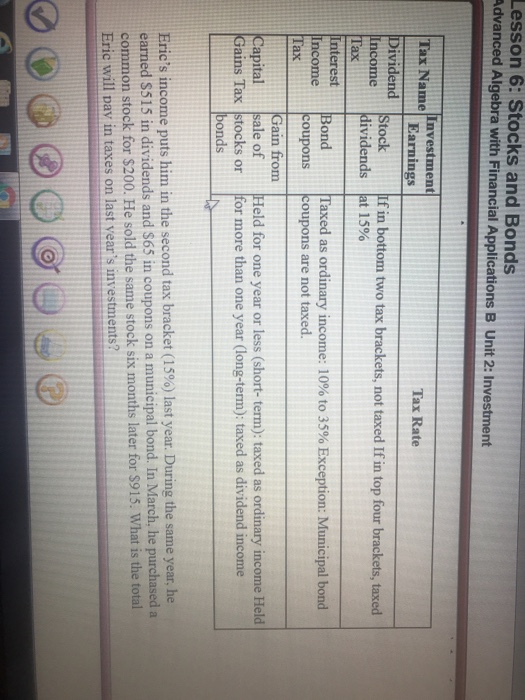

What is final value of a share Lesson 6: Stocks and Bonds Advanced Algebra with Financial Applications B Unit 2: Investment Tax Name Dividend Income

What is final value of a share

Lesson 6: Stocks and Bonds Advanced Algebra with Financial Applications B Unit 2: Investment Tax Name Dividend Income laividends !at 15% Tax Rate ngs Stock If in bottom two tax brackets, not taxed If in top four brackets, taxed ?? Interest Bond Income Taxed as ordinary income: 10% to 35% Exception: Municipal bond couponscoupons are not taxed. ax Gain from Capital sale of Held for one year or less (short- term): taxed as ordinary income Held Gains Tax stocks or for more than one year (long-term): taxed as dividend income bonds Eric's income puts him in the second tax bracket (15%) last year. During the same year, he earned S515 in dividends and S65 in coupons on a municipal bond. In March, he purchased a common stock for $200. He sold the same stock six months later for $915. What is the total Eric will pay in taxes on last year 's investments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started