Answered step by step

Verified Expert Solution

Question

1 Approved Answer

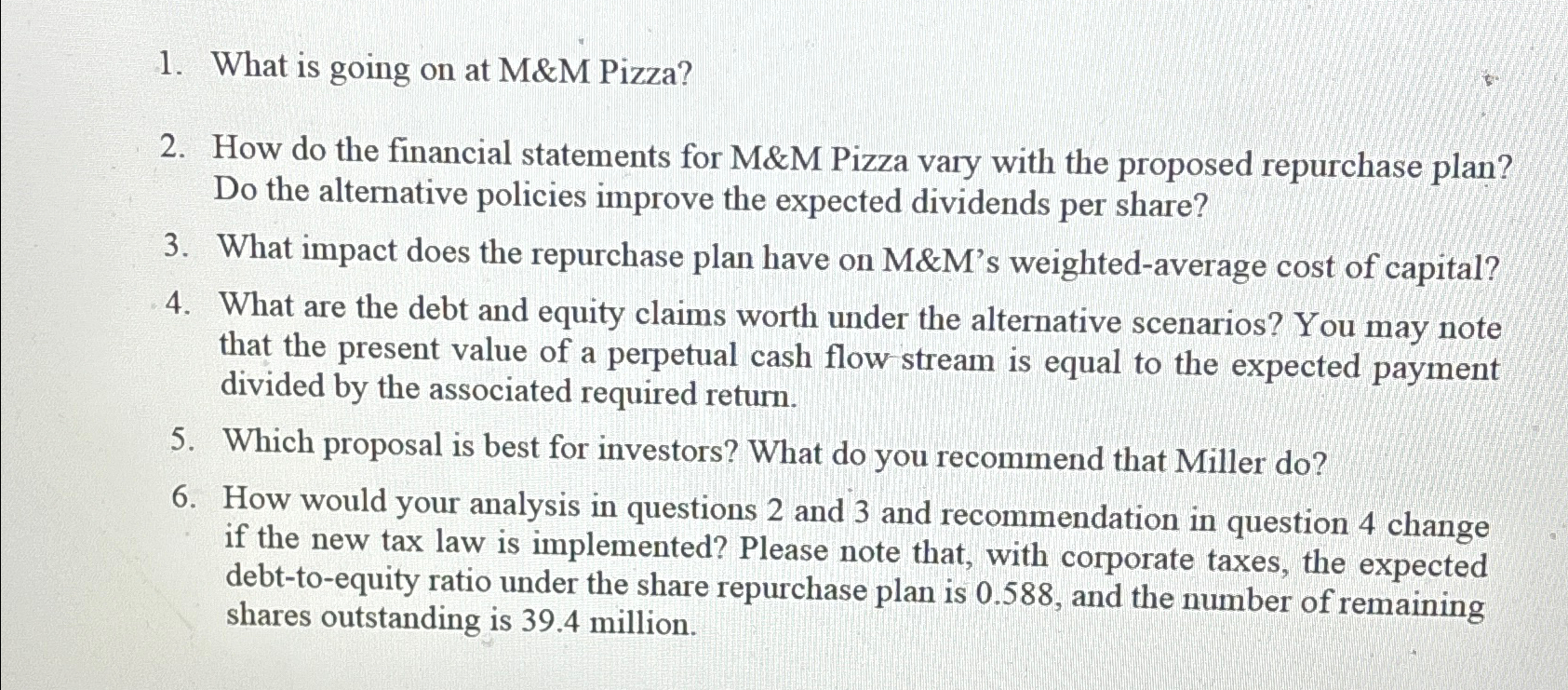

What is going on at M&M Pizza? How do the financial statements for M&M Pizza vary with the proposed repurchase plan? Do the alternative policies

What is going on at M&M Pizza?

How do the financial statements for M&M Pizza vary with the proposed repurchase plan? Do the alternative policies improve the expected dividends per share?

What impact does the repurchase plan have on M&Ms weightedaverage cost of capital?

What are the debt and equity claims worth under the alternative scenarios? You may note that the present value of a perpetual cash flow stream is equal to the expected payment divided by the associated required return.

Which proposal is best for investors? What do you recommend that Miller do

How would your analysis in questions and and recommendation in question change if the new tax law is implemented? Please note that, with corporate taxes, the expected debttoequity ratio under the share repurchase plan is and the number of remaining shares outstanding is million.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started