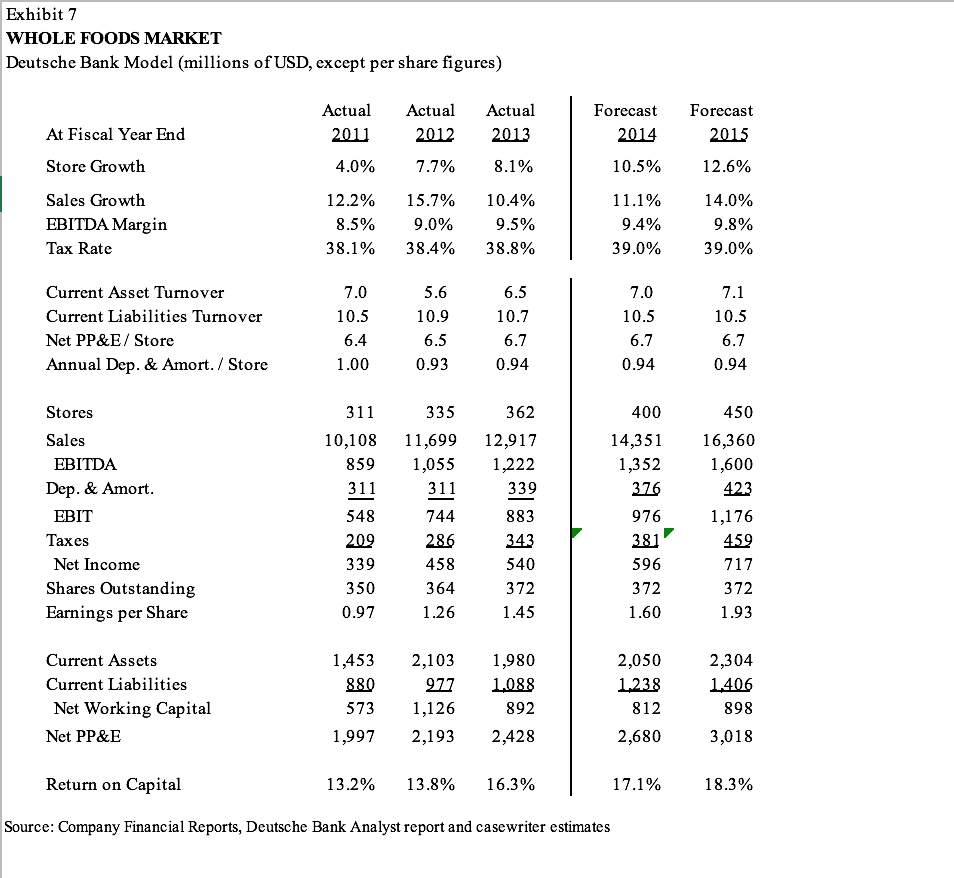

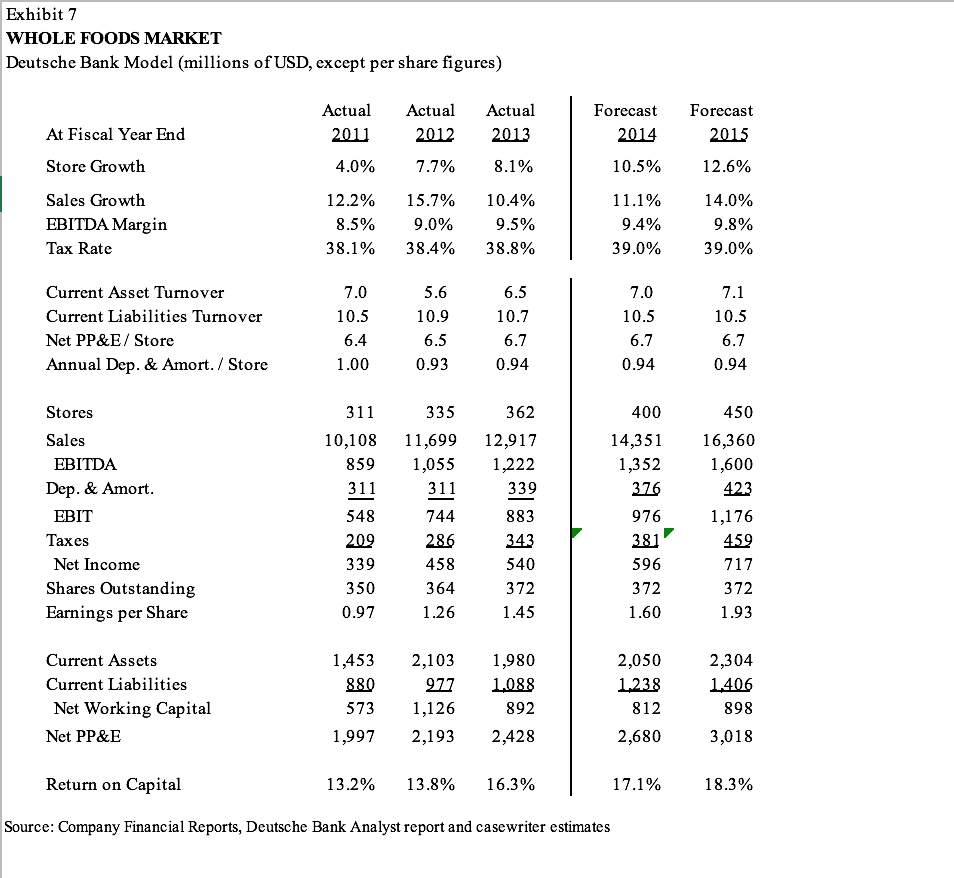

What is going on at Whole Foods Market, and how does that affect Short? Use Exhibit 7 to comment on the forecasted return on capital (ROC). Identify and comment on whether the forecast is optimistic, pessimistic, or just right. Exhibit 7 WHOLE FOODS MARKET Deutsche Bank Model (millions of USD, except per share figures) Forecast Actual 2011 4.0% Actual 2012 Actual 2013 Forecast 2014 10.5% 2015 7.7% 8.1% 12.6% At Fiscal Year End Store Growth Sales Growth EBITDA Margin Tax Rate 12.2% 8.5% 38.1% 15.7% 9.0% 38.4% 10.4% 9.5% 38.8% 11.1% 9.4% 39.0% 14.0% 9.8% 39.0% 7.1 Current Asset Turnover Current Liabilities Turnover Net PP&E/ Store Annual Dep. & Amort / Store 7.0 10.5 6.4 1.00 5.6 10.9 6.5 0.93 6.5 10.7 6.7 0.94 7.0 10.5 6.7 0.94 10.5 6.7 0.94 Stores Sales EBITDA Dep. & Amort. 311 10,108 859 335 11,699 1,055 362 12,917 1,222 339 883 450 16,360 1,600 423 1,176 459 311 400 14,351 1,352 376 976 381 596 311 EBIT 744 286 458 343 548 209 339 350 0.97 Taxes Net Income Shares Outstanding Earnings per Share 717 364 540 372 1.45 372 372 1.26 1.60 1.93 2,304 1.406 Current Assets Current Liabilities Net Working Capital Net PP&E 1,453 880 573 1,997 2,103 977 1,126 2,193 1,980 1.088 892 2,428 2,050 1.238 812 2,680 898 3,018 Return on Capital 13.2% 13.8% 16.3% 17.1% 18.3% Source: Company Financial Reports, Deutsche Bank Analyst report and casewriter estimates What is going on at Whole Foods Market, and how does that affect Short? Use Exhibit 7 to comment on the forecasted return on capital (ROC). Identify and comment on whether the forecast is optimistic, pessimistic, or just right. Exhibit 7 WHOLE FOODS MARKET Deutsche Bank Model (millions of USD, except per share figures) Forecast Actual 2011 4.0% Actual 2012 Actual 2013 Forecast 2014 10.5% 2015 7.7% 8.1% 12.6% At Fiscal Year End Store Growth Sales Growth EBITDA Margin Tax Rate 12.2% 8.5% 38.1% 15.7% 9.0% 38.4% 10.4% 9.5% 38.8% 11.1% 9.4% 39.0% 14.0% 9.8% 39.0% 7.1 Current Asset Turnover Current Liabilities Turnover Net PP&E/ Store Annual Dep. & Amort / Store 7.0 10.5 6.4 1.00 5.6 10.9 6.5 0.93 6.5 10.7 6.7 0.94 7.0 10.5 6.7 0.94 10.5 6.7 0.94 Stores Sales EBITDA Dep. & Amort. 311 10,108 859 335 11,699 1,055 362 12,917 1,222 339 883 450 16,360 1,600 423 1,176 459 311 400 14,351 1,352 376 976 381 596 311 EBIT 744 286 458 343 548 209 339 350 0.97 Taxes Net Income Shares Outstanding Earnings per Share 717 364 540 372 1.45 372 372 1.26 1.60 1.93 2,304 1.406 Current Assets Current Liabilities Net Working Capital Net PP&E 1,453 880 573 1,997 2,103 977 1,126 2,193 1,980 1.088 892 2,428 2,050 1.238 812 2,680 898 3,018 Return on Capital 13.2% 13.8% 16.3% 17.1% 18.3% Source: Company Financial Reports, Deutsche Bank Analyst report and casewriter estimates