Answered step by step

Verified Expert Solution

Question

1 Approved Answer

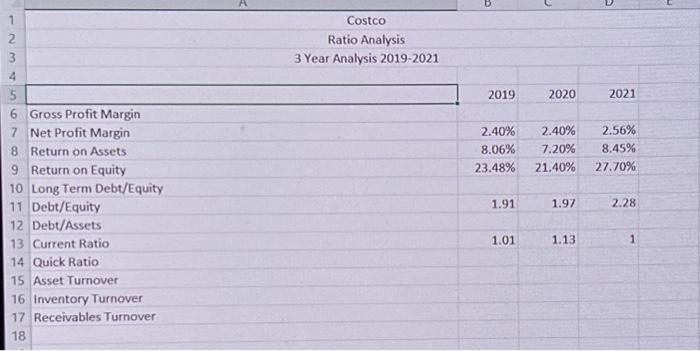

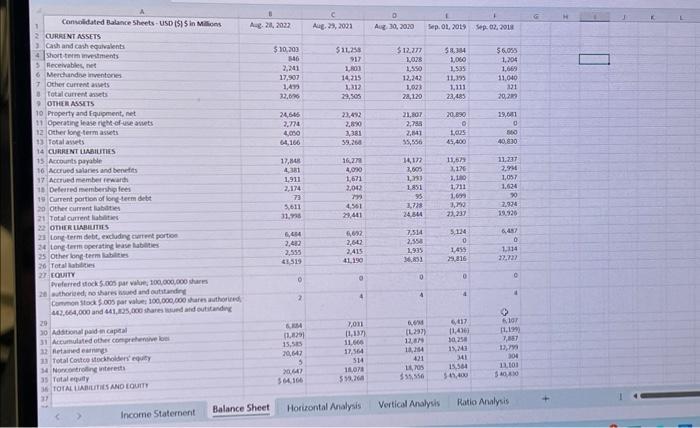

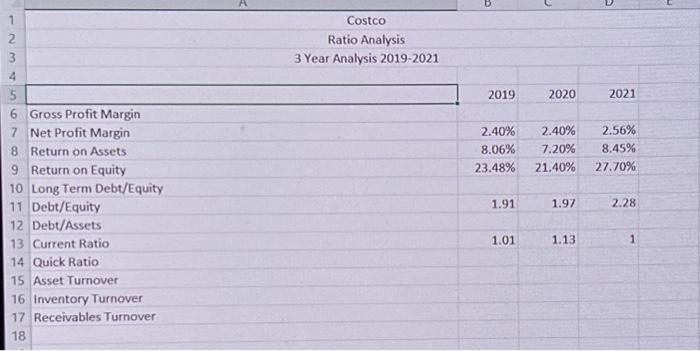

what is. Gross profit margin Net profit margin return on assets return on equity Long-term debt/equity debt/equity debt/asset current ratio quick ratio asset turn over

what is.

Gross profit margin

Net profit margin

return on assets

return on equity

Long-term debt/equity

debt/equity

debt/asset

current ratio

quick ratio

asset turn over

inventory turnover

receivables turnover

for 3 years 2019-2021

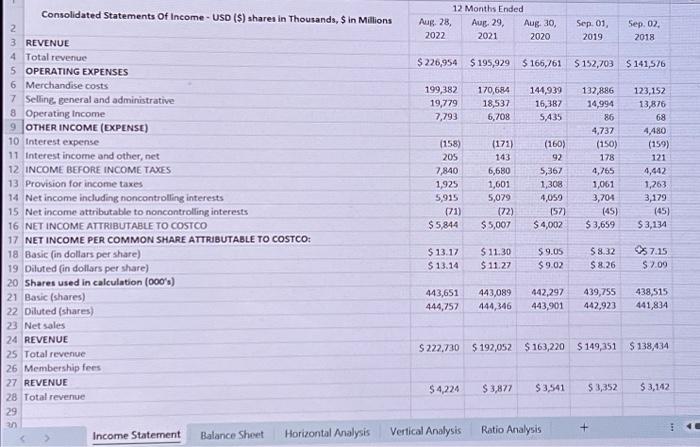

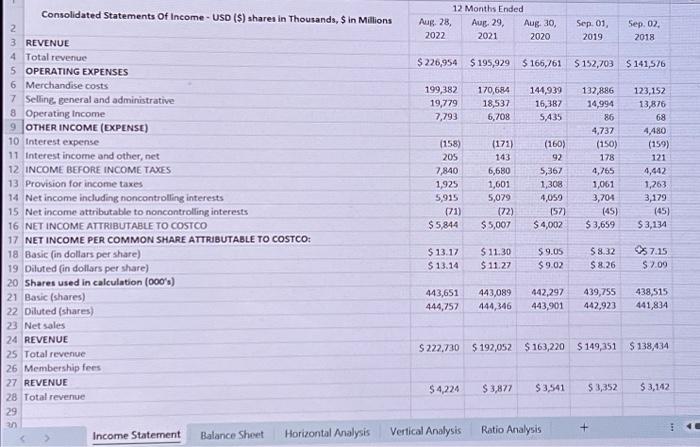

2 Consolidated Statements Of Income- USD ($) shares in Thousands, $ in Millions 3 REVENUE 4 Total revenue 5 OPERATING EXPENSES 6 Merchandise costs 7 Selling, general and administrative 8 Operating Income 9 OTHER INCOME (EXPENSE) 10 Interest expense 11 Interest income and other, net 12 INCOME BEFORE INCOME TAXES 13 Provision for income taxes 12 Months Ended Aug. 28, Aug. 29, 2022 2021 Aug. 30, 2020 Sep. 01, Sep. 02, 2019 2018 $226,954 $195,929 $166,761 $152,703 $141,576 199,382 170,684 144,939 132,886 123,152 19,779 18,537 16,387 14,994 13,876 7,793 6,708 5,435 86 68 4,737 4,480 (158) (171) (160) (150) (159) 205 143 92 178 121 7,840 6,680 5,367 4,765 4,442 1,925 1,601 1,308- 1,061 1,263 14 Net income including noncontrolling interests 5,915 5,079 4,059 3,704 3,179 15 Net income attributable to noncontrolling interests (71) (72) (57) (45) (45) 16 NET INCOME ATTRIBUTABLE TO COSTCO $5,844 $5,007 $ 4,002 $3,659 $3,134 17 NET INCOME PER COMMON SHARE ATTRIBUTABLE TO COSTCO: 18 Basic (in dollars per share) 19 Diluted (in dollars per share) $13.17 $13.14 $11.30 $9.05 $8.32 7.15 $11.27 $9.02 $8.26 $7.09 20 Shares used in calculation (000's) 21 Basic (shares) 443,651 444,757 443,089 442,297 439,755 438,515 444,346 443,901 442,923 441,834 22 Diluted (shares) 23 Net sales 24 REVENUE 25 Total revenue 26 Membership fees 27 REVENUE 28 Total revenue. 29 $222,730 $192,052 $163,220 $149,351 $138,434 $4,224 $3,877 $3,541 $3,352 $3,142 Income Statement Balance Sheet Horizontal Analysis Vertical Analysis Ratio Analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started