What is in YELLOW is what I have to answer. I need help with the calculations, I would like to understand them.

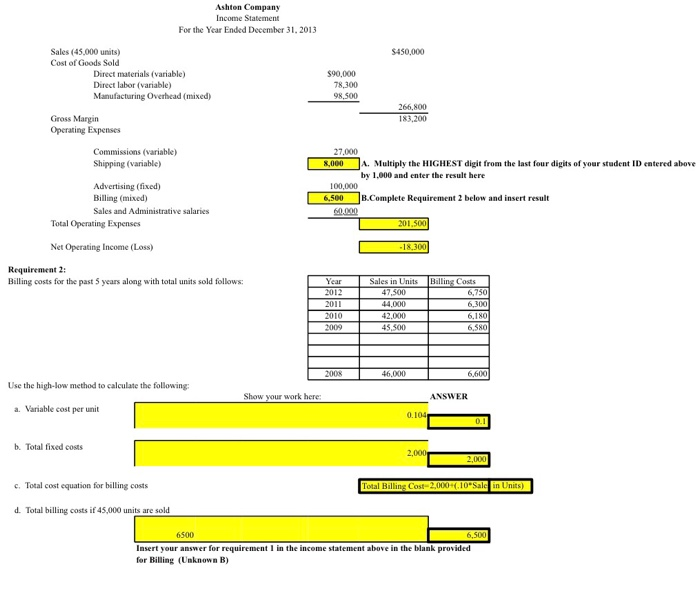

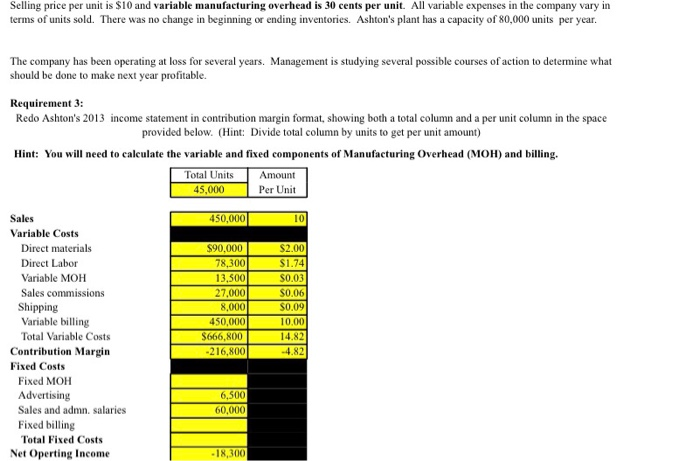

Ashton Company Income Statement For the Year Ended December 31, 2013 Sales (45,000 units) Cost of Goods Sold $450,000 Direct materials (variable) Direct labor (variable) Manufacturing Overhead (mixed) $90,000 78,300 98.500 66,800 183,200 Gross Margin Operating Expenses 27,000 8,000 A. Multiply the HIGHEST digit from the last four digits of your student ID entered above Shipping (variable) by 1,000 and enter the result here Advertising (fixed) Billing(mixed) Sales and Administrative salaries 100,000 6.500 B.Complete Requirement 2 below and insert result 0,000 Total Operating Expenses 201.50 Net Operating Income (Loss) Billing costs for the past 5 years along with total units sold follows 201 47,500 44,000 2009 Use the high-Jow method to calculate the following Show your work here ANSWER a. Variable cost per unit 0.104 b. Total fixed costs 2,000 c. Total cost equation for billing costs d. Total billing costs if 45,000 units are sold 6500 Insert your answer for requirement 1 in the income statement above in the blank provided for Billing (Unknown B) Selling price per unit is $10 and variable manufacturing overhead is 30 cents per unit. All variable expenses in the company vary in terms of units sold. There was no change in beginning or ending inventories. Ashton's plant has a capacity of 80,000 units per year. The company has been operating at loss for several years. Management is studying several possible courses of action to determine what should be done to make next year profitable. Requirement 3: Redo Ashton's 2013 income statement in contribution margin format, showing both a total column and a per unit column in the space provided below. (Hint:Divide total column by units to get per unit amount) Hint: You will need to calculate the variable and fixed components of Manufacturing Overhead (MOH) and billing. Total Units 45,000 Amount Per Unit Sales Variable Costs 450,000 Direct materials Direct Labor Variable MOH Sales commissions Shipping Variable billing Total Variable Costs 90,000 8,300 13,500 27,000 8,000 450,000 $1.74 S0.03 S0,06 S0.09 10,00 14.8 666,800 Contribution Margin Fixed Costs 216,800 Fixed MOH Advertising Sales and admn. salaries Fixed billing Total Fixed Costs 6,500 Net Operting Income 18,300 Ashton Company Income Statement For the Year Ended December 31, 2013 Sales (45,000 units) Cost of Goods Sold $450,000 Direct materials (variable) Direct labor (variable) Manufacturing Overhead (mixed) $90,000 78,300 98.500 66,800 183,200 Gross Margin Operating Expenses 27,000 8,000 A. Multiply the HIGHEST digit from the last four digits of your student ID entered above Shipping (variable) by 1,000 and enter the result here Advertising (fixed) Billing(mixed) Sales and Administrative salaries 100,000 6.500 B.Complete Requirement 2 below and insert result 0,000 Total Operating Expenses 201.50 Net Operating Income (Loss) Billing costs for the past 5 years along with total units sold follows 201 47,500 44,000 2009 Use the high-Jow method to calculate the following Show your work here ANSWER a. Variable cost per unit 0.104 b. Total fixed costs 2,000 c. Total cost equation for billing costs d. Total billing costs if 45,000 units are sold 6500 Insert your answer for requirement 1 in the income statement above in the blank provided for Billing (Unknown B) Selling price per unit is $10 and variable manufacturing overhead is 30 cents per unit. All variable expenses in the company vary in terms of units sold. There was no change in beginning or ending inventories. Ashton's plant has a capacity of 80,000 units per year. The company has been operating at loss for several years. Management is studying several possible courses of action to determine what should be done to make next year profitable. Requirement 3: Redo Ashton's 2013 income statement in contribution margin format, showing both a total column and a per unit column in the space provided below. (Hint:Divide total column by units to get per unit amount) Hint: You will need to calculate the variable and fixed components of Manufacturing Overhead (MOH) and billing. Total Units 45,000 Amount Per Unit Sales Variable Costs 450,000 Direct materials Direct Labor Variable MOH Sales commissions Shipping Variable billing Total Variable Costs 90,000 8,300 13,500 27,000 8,000 450,000 $1.74 S0.03 S0,06 S0.09 10,00 14.8 666,800 Contribution Margin Fixed Costs 216,800 Fixed MOH Advertising Sales and admn. salaries Fixed billing Total Fixed Costs 6,500 Net Operting Income 18,300