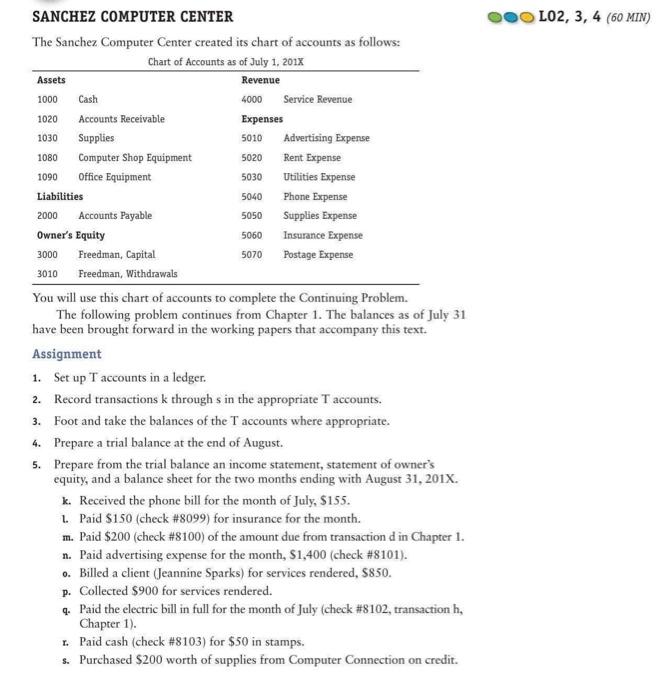

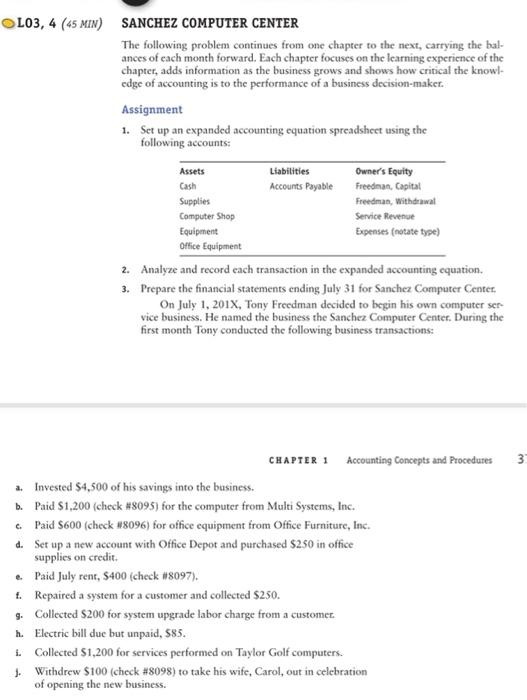

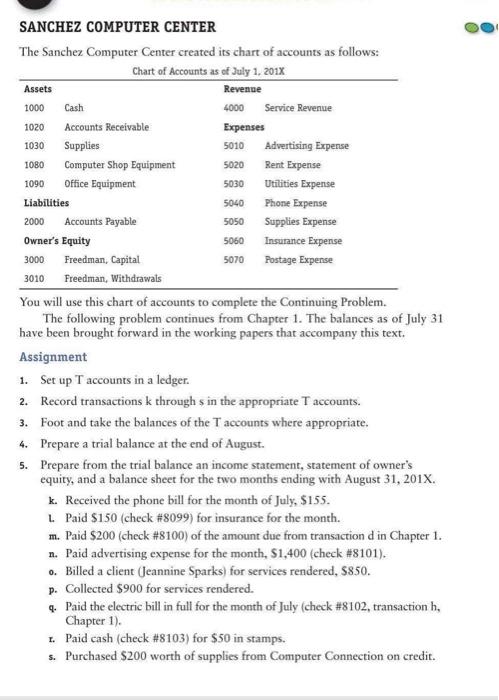

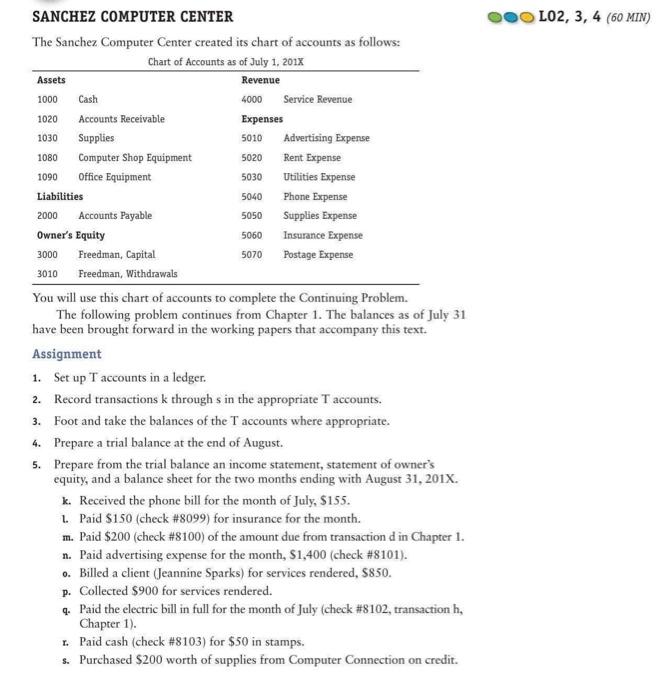

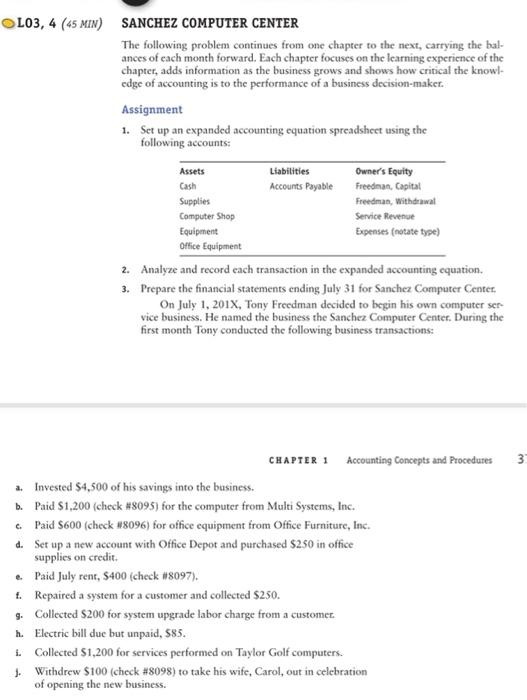

L02, 3, 4 (60 MIN) 1020 1080 5020 1090 2000 SANCHEZ COMPUTER CENTER The Sanchez Computer Center created its chart of accounts as follows: Chart of Accounts as of July 1. 2017 Assets Revenue 1000 Cash 4000 Service Revenue Accounts Receivable Expenses 1030 Supplies 5010 Advertising Expense Computer Shop Equipment Rent Expense Office Equipment 5030 Utilities Expense Liabilities 5040 Phone Expense Accounts Payable 5050 Supplies Expense Owner's Equity 5060 Insurance Expense 3000 Freedman, Capital 5070 Postage Expense 3010 Freedman, Withdrawals You will use this chart of accounts to complete the Continuing Problem. The following problem continues from Chapter 1. The balances as of July 31 have been brought forward in the working papers that accompany this text. Assignment 1. Set up T accounts in a ledger. 2. Record transactions k through s in the appropriate T accounts. 3. Foot and take the balances of the T accounts where appropriate. 4. Prepare a trial balance at the end of August. 5. Prepare from the trial balance an income statement, statement of owner's equity, and a balance sheet for the two months ending with August 31, 201X. k. Received the phone bill for the month of July, $155. 1. Paid $150 (check #8099) for insurance for the month. m. Paid $200 (check #8100) of the amount due from transaction d in Chapter 1. n. Paid advertising expense for the month, $1,400 (check #8101). 6. Billed a client (Jeannine Sparks) for services rendered, $850. p. Collected $900 for services rendered. 4. Paid the electric bill in full for the month of July (check #8102, transaction h, Chapter 1). Paid cash (check #8103) for $50 in stamps. s. Purchased $200 worth of supplies from Computer Connection on credit. Assets L03, 4 (45 MIN) SANCHEZ COMPUTER CENTER The following problem continues from one chapter to the next, carrying the bal- ances of each month forward. Each chapter focuses on the learning experience of the chapter, adds information as the business grows and shows how critical the knowl- edge of accounting is to the performance of a business decision-maker. Assignment 1. Set up an expanded accounting equation spreadsheet using the following accounts: Liabilities Owner's Equity Cash Accounts Payable Freedman Capital Supplies Freedman, Withdrawal Computer Shop Service Revenue Equipment Expenses (notate type) Office Equipment 2. Analyze and record each transaction in the expanded accounting equation 3. Prepare the financial statements ending July 31 for Sanchez Computer Center On July 1, 201X, Tony Freedman decided to begin his own computer ser vice business. He named the business the Sanchez Computer Center. During the first month Tony conducted the following business transactions: 3 CHAPTER 1 Accounting Concepts and Procedures a. Invested $4,500 of his savings into the business. b. Paid $1,200 (check #8095) for the computer from Multi Systems, Inc. & Paid $600 (check #8096) for office equipment from Office Furniture, Inc. d. Set up a new account with Office Depot and purchased $250 in office supplies on credit. e Paid July rent, $400 (check #8097). 6. Repaired a system for a customer and collected $250. 9. Collected $200 for system upgrade labor charge from a customer. h. Electric bill due but unpaid, 585. Collected $1,200 for services performed on Taylor Golf computers. Withdrew $100 (check #8098) to take his wife, Carol, out in celebration of opening the new business. i. OL03, 4 (45 MIN) SANCHEZ COMPUTER CENTER The following problem continues from one chapter to the next, carrying the bal- ances of each month forward. Each chapter focuses on the learning experience of the chapter, adds information as the business grows and shows how critical the knowl- edge of accounting is to the performance of a business decision-maker. Assignment 1. Set up an expanded accounting equation spreadsheet using the following accounts: Liabilities Owner's Equity Accounts Payable Freedman, Capital Supplies Freedman, withdrawal Computer Shop Service Revenue Equipment Expenses (notate type) Office Equipment 2. Analyze and record each transaction in the expanded accounting equation. 3. Prepare the financial statements ending July 31 for Sanchez Computer Center. On July 1, 2017, Tony Freedman decided to begin his own computer ser- vice business. He named the business the Sanchez Computer Center. During the first month Tony conducted the following business transactions: Assets Cash 3 CHAPTER 1 Accounting Concepts and Procedures a. Invested $4,500 of his savings into the business. b. Paid $1,200 (check #8095) for the computer from Multi Systems, Inc. Paid S600 (check #8096) for office equipment from Office Furniture, Inc. d. Set up a new account with Office Depot and purchased $250 in office supplies on credit. e Paid July rent, $400 (check #8097). t. Repaired a system for a customer and collected $250. 9. Collected $200 for system upgrade labor charge from a customer. h. Electric bill due but unpaid, 585. Collected $1,200 for services performed on Taylor Golf computers. * Withdrew S100 (check #8098) to take his wife, Carol, out in celebration of opening the new business. 1. 1020 5060 SANCHEZ COMPUTER CENTER The Sanchez Computer Center created its chart of accounts as follows: Chart of Accounts as of July 1, 2018 Assets Revenue 1000 Cash 4000 Service Revenue Accounts Receivable Expenses 1030 Supplies 5010 Advertising Expense 10BO Computer Shop Equipment 5020 Rent Expense 1090 Office Equipment 5030 Utilities Expense Liabilities 5040 Phone Expense 2000 Accounts Payable 5050 Supplies Expense Owner's Equity Insurance Expense 3000 Freedman, Capital 5070 Postage Expense 3010 Freedman, Withdrawals You will use this chart of accounts to complete the Continuing Problem. The following problem continues from Chapter 1. The balances as of July 31 have been brought forward in the working papers that accompany this text. Assignment 1. Set up T accounts in a ledger. 2. Record transactions k through s in the appropriate T accounts. 3. Foot and take the balances of the Taccounts where appropriate. 4. Prepare a trial balance at the end of August. 5. Prepare from the trial balance an income statement, statement of owner's equity, and a balance sheet for the two months ending with August 31, 2018. k Received the phone bill for the month of July, $155. L Paid $150 (check #8099) for insurance for the month. m. Paid $200 (check #8100) of the amount due from transaction d in Chapter 1. n. Paid advertising expense for the month, $1,400 (check #8101). 0. Billed a client (Jeannine Sparks) for services rendered, 5850. p. Collected $900 for services rendered. 4. Paid the electric bill in full for the month of July (check #8102, transaction h. Chapter 1). 1. Paid cash (check #8103) for $50 in stamps. s. Purchased $200 worth of supplies from Computer Connection on credit