Answered step by step

Verified Expert Solution

Question

1 Approved Answer

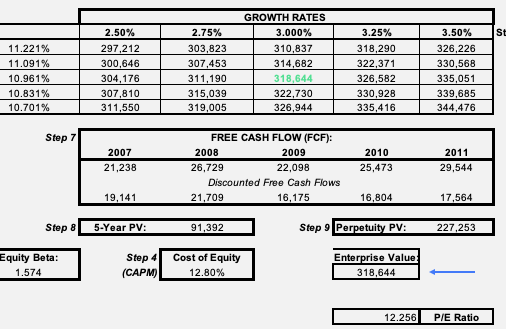

WHAT IS IS THE IRR of THIS PROJECT? St 11.221% 11.091% 10.961% 10.831% 10.701% 2.50% 297,212 300,646 304,176 307,810 311,550 2.75% 303,823 307,453 311,190 315,039

WHAT IS IS THE IRR of THIS PROJECT?

St 11.221% 11.091% 10.961% 10.831% 10.701% 2.50% 297,212 300,646 304,176 307,810 311,550 2.75% 303,823 307,453 311,190 315,039 319,005 GROWTH RATES 3.000% 310,837 314,682 318.644 322,730 326,944 3.25% 318,290 322,371 326,582 330,928 335,416 3.50% 326,226 330,568 335,051 339,685 344,476 Step 7 2007 21,238 FREE CASH FLOW (FCF): 2008 2009 26,729 22,098 Discounted Free Cash Flows 21,709 16,175 2010 25,473 2011 29,544 19,141 16,804 17,564 Step 8 5-Year PV: 91,392 Step 9 Perpetuity PV: 227,253 Equity Beta: 1.574 Step 4 (CAPM) Cost of Equity 12.80% Enterprise Value 318,644 12.256 P/E Ratio St 11.221% 11.091% 10.961% 10.831% 10.701% 2.50% 297,212 300,646 304,176 307,810 311,550 2.75% 303,823 307,453 311,190 315,039 319,005 GROWTH RATES 3.000% 310,837 314,682 318.644 322,730 326,944 3.25% 318,290 322,371 326,582 330,928 335,416 3.50% 326,226 330,568 335,051 339,685 344,476 Step 7 2007 21,238 FREE CASH FLOW (FCF): 2008 2009 26,729 22,098 Discounted Free Cash Flows 21,709 16,175 2010 25,473 2011 29,544 19,141 16,804 17,564 Step 8 5-Year PV: 91,392 Step 9 Perpetuity PV: 227,253 Equity Beta: 1.574 Step 4 (CAPM) Cost of Equity 12.80% Enterprise Value 318,644 12.256 P/E RatioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started