Answered step by step

Verified Expert Solution

Question

1 Approved Answer

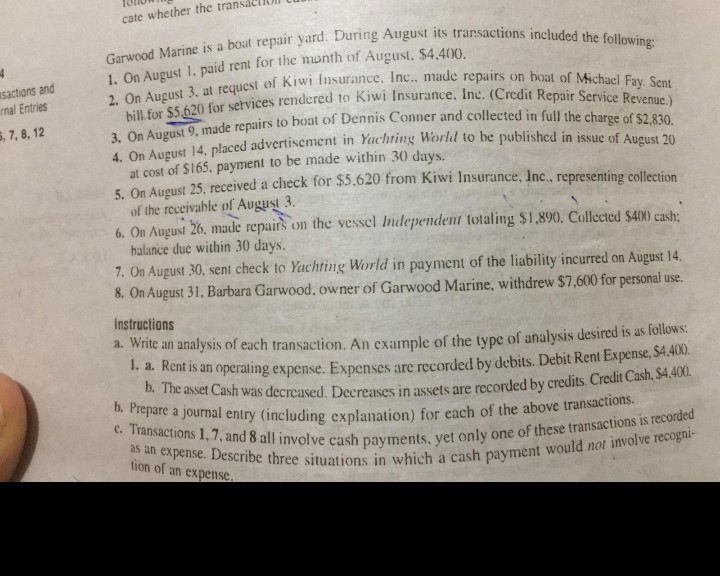

What is its general journal, ledger, trail, balance, income statment and balance sheet cate whether the transl Garwood Marine is a boat repair yard. During

What is its general journal, ledger, trail, balance, income statment and balance sheet

cate whether the transl Garwood Marine is a boat repair yard. During August its transactions included the following: 1, On August 1. paid rent for the nonth of August, $4,400. 2. On August 3, at request of Kiwi Insurance. Inc., made repairs on boat of Michael Fay. Sent bill for $5,620 for services rendered to Kiwi Insurance. Inc. (Crcdit Repair Service Revenue.) 3. On August 9, made repairs to hoat of Dennis Conner and collected in full the charge of $2,830. 4. On August 14. placed advertisement in Yachting World to be published in issue of August 20 at cost of $165, payment to be made within 30 days 5On August 25, received a check for $5,620 from Kiwi Insurance, Inc., representing collection of the receivable of August 3. 6. On August 26, made repairs halanice duc within 30 days. 7. On August 30, sent check to Yachting World in payment of the liability incurred on 8. On August 31. Barbara Garwood. owner of Garwood Marine, withdrew $7,600 for personal 4 sactions and nal Entries s, 7, 8, 12 on the vessel Independent totaling $1,890. Collected $400 cash; August 14 use. Instructions a. Write an analysis of each transaction. An cxample of the type of analysis desired is as follows 1. a. Rent is an operating expense. Expenses are recorded by debits. Debit Rent Expense, $4.400. b. The asset Cash was decreased. Decreases in assets are b. Prepare a joural entry (including explanation) for each of the above transactions. c. Transactions 1,7, and 8 all involve cash payments, yet only o recorded by credits Credit Cash, $4,400 as an expense. Describe three situations in which a cash payment would not involve recogni- one of these transactions is recorded tion of an expense. cate whether the transl Garwood Marine is a boat repair yard. During August its transactions included the following: 1, On August 1. paid rent for the nonth of August, $4,400. 2. On August 3, at request of Kiwi Insurance. Inc., made repairs on boat of Michael Fay. Sent bill for $5,620 for services rendered to Kiwi Insurance. Inc. (Crcdit Repair Service Revenue.) 3. On August 9, made repairs to hoat of Dennis Conner and collected in full the charge of $2,830. 4. On August 14. placed advertisement in Yachting World to be published in issue of August 20 at cost of $165, payment to be made within 30 days 5On August 25, received a check for $5,620 from Kiwi Insurance, Inc., representing collection of the receivable of August 3. 6. On August 26, made repairs halanice duc within 30 days. 7. On August 30, sent check to Yachting World in payment of the liability incurred on 8. On August 31. Barbara Garwood. owner of Garwood Marine, withdrew $7,600 for personal 4 sactions and nal Entries s, 7, 8, 12 on the vessel Independent totaling $1,890. Collected $400 cash; August 14 use. Instructions a. Write an analysis of each transaction. An cxample of the type of analysis desired is as follows 1. a. Rent is an operating expense. Expenses are recorded by debits. Debit Rent Expense, $4.400. b. The asset Cash was decreased. Decreases in assets are b. Prepare a joural entry (including explanation) for each of the above transactions. c. Transactions 1,7, and 8 all involve cash payments, yet only o recorded by credits Credit Cash, $4,400 as an expense. Describe three situations in which a cash payment would not involve recogni- one of these transactions is recorded tion of an expenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started