Answered step by step

Verified Expert Solution

Question

1 Approved Answer

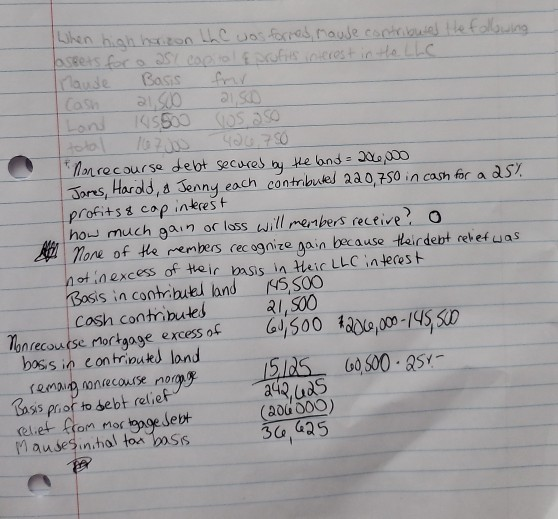

what is maudes cash basis in her llc interest? tried to solve but it not correct wht tax basis do James, harold and Jenny have

what is maudes cash basis in her llc interest? tried to solve but it not correct

wht tax basis do James, harold and Jenny have in their llc interests

When high horizon the was formed house contributed the following laseets for a as1 coetol & rufits interest in the LLC Mause Basis for Casual SD SD Land 145500 Gos 250 total 1670 406, 750 Nonrecourse debt secured by the land = 206,000 James, Harold, a Jenny each contributed 220,750 in cash for a 25% profits & cap interest how much gain or loss will members receive o None of the members recognize gain because their debt relet was hot in excess of their basis in their LLC interest Basis in contributed land 145,500 cash contributed 21,500 Nonrecourse Mortgage excess of 6,500 $20,000-145,500 basis in contributed land 15,125 remaing onrecourse poropre 60,500 251 Basis prior to debt relief 242, 425 relief from mortgage Jebt (200000) Maudes initial tox basis 36,625 When high horizon the was formed house contributed the following laseets for a as1 coetol & rufits interest in the LLC Mause Basis for Casual SD SD Land 145500 Gos 250 total 1670 406, 750 Nonrecourse debt secured by the land = 206,000 James, Harold, a Jenny each contributed 220,750 in cash for a 25% profits & cap interest how much gain or loss will members receive o None of the members recognize gain because their debt relet was hot in excess of their basis in their LLC interest Basis in contributed land 145,500 cash contributed 21,500 Nonrecourse Mortgage excess of 6,500 $20,000-145,500 basis in contributed land 15,125 remaing onrecourse poropre 60,500 251 Basis prior to debt relief 242, 425 relief from mortgage Jebt (200000) Maudes initial tox basis 36,625Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started