Answered step by step

Verified Expert Solution

Question

1 Approved Answer

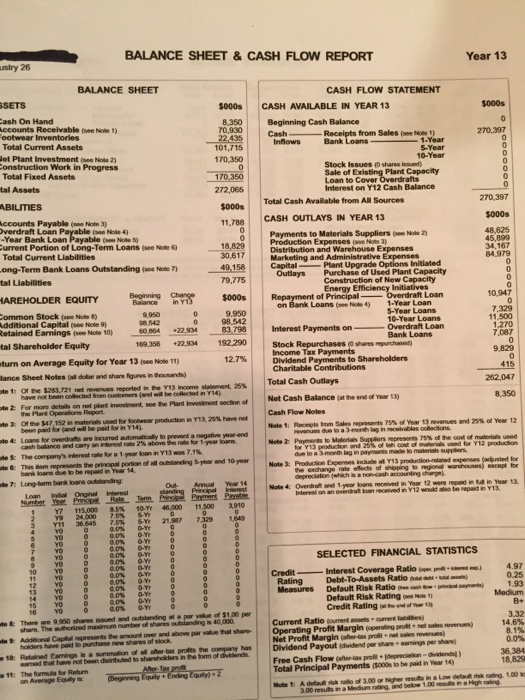

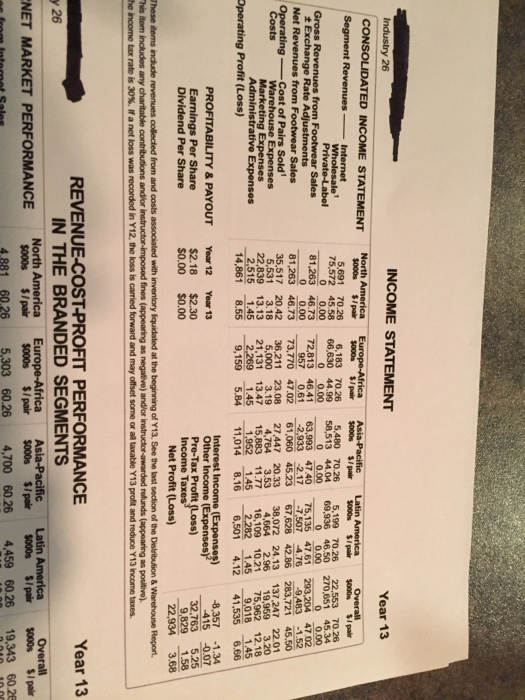

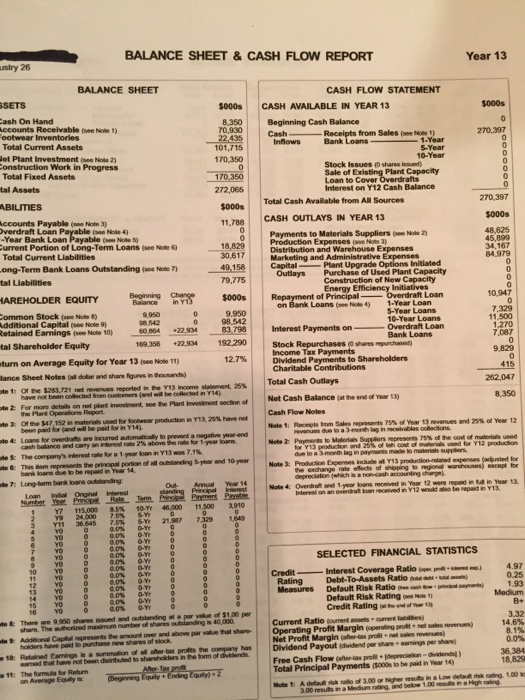

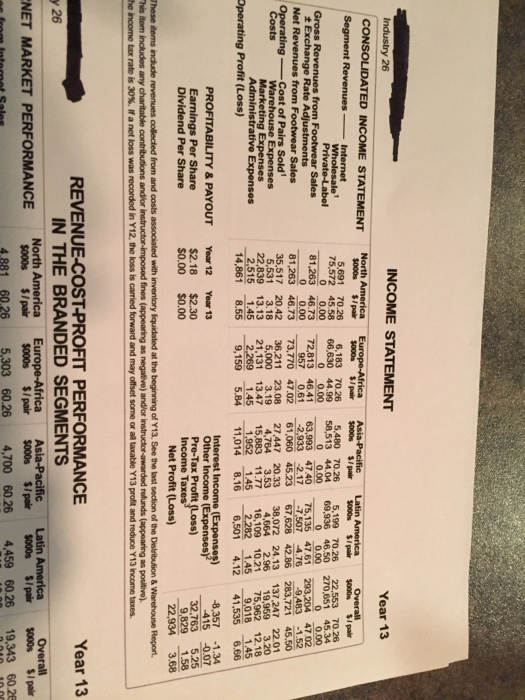

What is my return on shareholder equity? Inventory turnover? Days' cash? BALANCE SHEET&CASH FLOW REPORT Year 13 BALANCE SHEET CASH FLOW STATEMENT SETS $000s CASH

What is my return on shareholder equity?

BALANCE SHEET&CASH FLOW REPORT Year 13 BALANCE SHEET CASH FLOW STATEMENT SETS $000s CASH AVAILABLE IN YEAR 13 $000s 50 ash On Hand ccounts Receivable (see Note 1) Beginning Cash Balance Cash Receipts from Sales tsee N -1) 270,397 Inflows Bank Loans 1-Year Total Current Assets 101,715 10-Year et Plant Investment (see Niole 2) onstruction Work in Progress Total Fixed Assets Stock issues (0 shares icsued) Loan to Cover Interest on Y12 Cash Balance 272,065 Total Cash Available from All Sources 270,397 $000s $000s 11,788 CASH OUTLAYS IN YEAR 13 ccounts Payable (oe Note 3) verdraft Loan Payable (see N1 -Year Bank Loan urrent Portion of Long-Term Loans (see Noke 6) Total Current Liabilities Payments to Materials Suppliers (ee Note 2) Production Expenses isee Note Distribution and Warehouse Expenses Plant Upgrade Options lnitiated ong-Term Bank Loans Outstanding (ace ote 7)49,158Outays Capital Purchase of Used Plant Capacity of PrincipalOverdraft Loan 10-Year Loans Energy Efficiency Initiatives AREHOLDER EQUI000 Loans (one N4) 1-Year Loan 5-Year Loans ommon Stock (see Note 8) dditional Capital (e ole 9 etained Earnings (see Note 10)60864 tal Shareholder Equity Interest Payments on-Overdraft Loan 83798 169356 22,934 192,290 12.7% 22.83 9,829 Income Tax Pa turn on Average Equity for Year 13 (a Not T) lance Sheet Notes (all doliar and share figures in thousands) 8.350 Net Cash Balance (thendofe" |Cash Flow Notes have not been collected trom cauntomers (ond wilt be colleced in Y14) For mortatilson nel plant mmhnt, see ho Pant-mit-of #2 | -$47152 nmatene, used tr bewer been paid for (and will be paid for in Y14) 3: mactcn inl 25% have net Note 1: Roceipis irom Sales represents Note 4 Overdrat and 1- year loans reoeived in Year 12 were repaid in tu in Year 13. eceived in Y12 wouldaso be repaid in Y13 Lean Int Ongnal Interest 17 115,000 8.5% 10-Yr 46,000 11,500 3910 Y11 36.645 7.5% 6-Yr 21,987 7329 1,549 SELECTED FINANCIAL STATISTICS Interest Coverage Ratio--.- 4.97 0.25 Credit Rating Debt-To-Assets Ratio Measures Default Risk Ratio o Default Risk Rating ( Credit Rating on e nd of Year 1 te8; Therarn 9950 shares issed and outstanding at a par vak of$100 per oAdditional Capital represents te amount over and above par vaue that shareOperating Proht Margin (operating prut neet sales revenue) e 10: Retained Eamings is a summation of all wer tax prolits the company hasDividend Payout idvidend per share+ earnings per share) e 11: The formula for Return Current Ratio (oument assets current lablEes) Net Profit Margin(aor-as profit n sales rnvenes Free Cash Flow (afer-dax prolt+10epreciation-avidendl) share. The authorined 0.0% eamed hat have not been Total Principal Payments (5000s to be paikd in Year 14) on Average Equlya Inventory turnover?

Days' cash?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started