Answered step by step

Verified Expert Solution

Question

1 Approved Answer

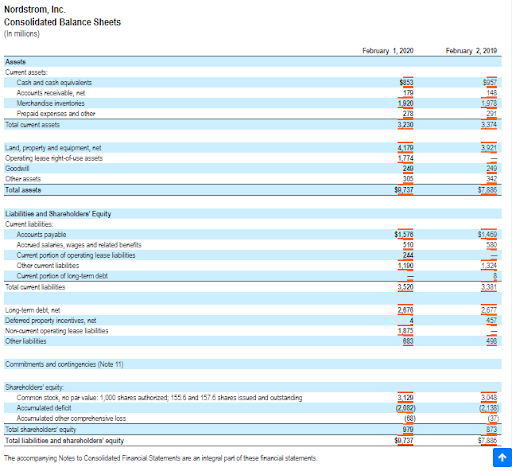

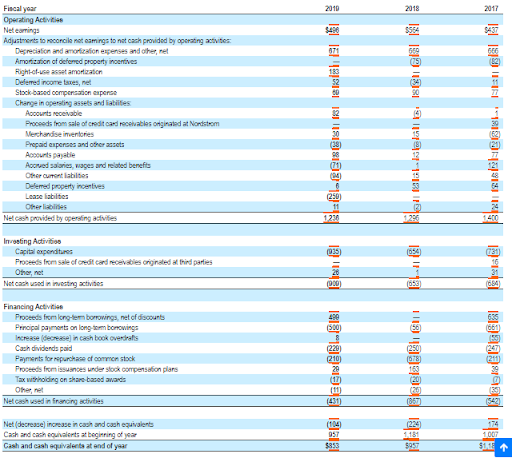

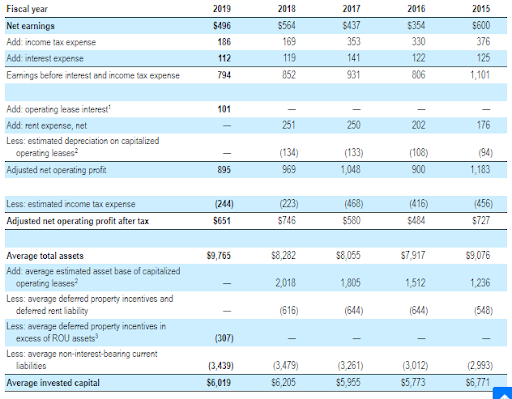

what is nordstroms abnormal earnings for 2018-2020? Nordstrom, Inc. Consolidated Balance Sheets February 1 2020 February 2, 2010 Contact Cash and co lors Merchandienones Prepaid

what is nordstroms abnormal earnings for 2018-2020?

Nordstrom, Inc. Consolidated Balance Sheets February 1 2020 February 2, 2010 Contact Cash and co lors Merchandienones Prepaid expenses and other Land property and mentre Operating wee s Goodwil 300 $9.737 Total $1,576 Lalities and shareholders' Equity Cunnt abilities Accounts payable And sales wages and related benefits Current portion of operating lease labilities Other current sites Cum portion of long-term det ables T LOR- det Deferred property incentives, not Non-cumorong lease labies Other listes Commitments and contingencies Note 11) 1556 and 1576 sharescued and outstanding Shareholders Common S 000 A ddict Accut r onsvelas To Shar Tots and shareholders The coronjing Notes to Consolidated Francial Statements are an integral part of the financial statements Operating Activ Net Adjustments to r e mings to not cach provided by posting activities D inamo esses and other el Anton of food property Inves Rig a s amation Delad income taxes, et Stock-based compenso espere 1912 1 19TEI 191912 191118138133-19 19 1910 1919 19201212 913 Aceable Proceeds from sale of credit card receivables orginated at Nordstrom Merchandise inventores Prepad experts and her assets Accounts payable Apoved ones, apes and related benefits Deemed property incentives Lease bites Others Netcash provided by opening advies 0 3 1 Inventing Active Capital expenditures Proceeds from sale of credit card receivables originated at third parties Ohornet Notes d esting activities Financing Activities Proceeds from long to borrowings, net of discounts Proclamation longo bonowings A n cash book overs Cash dividend paid Payment for purchase of common stock Proceeds from w est compensation plans Tax withholding on share based awards ON Netched infancing activities 1819193 1982 19818 18 23922 1912 19999999 Net decrease increase in cash and cache vient Cach i ng of Cash and cash quvaleta at and a year Fiscal year Net earnings Add income tax expense Add interest expense Earings before interest and income tax expense 2019 $496 186 112 794 2018 5564 169 119 852 2017 $437 353 141 931 2016 354 330 122 806 2015 $600 376 125 1,101 101 - 251 250 Add operating lease interest Add: rent expense, net Loos: estimated depreciation on capitalized operating leases Adjusted net operating profit - 895 (134) 969 (133) 1,048 (108) (94) 9001,183 Less: estimated income tax expense Adjusted net operating profit after tax (244) $651 (223) $746 (468) $580 (416) 484 (456) 727 5 $9,765 $8,282 $8,055 $7,917 $9,076 2018 1236 1,805 (544) - 1 Average total assets Add average estimated asset base of capitalized operating leases Loos: average deferred property incentives and deferred rent liability Less: average deferred property incentives in excess of ROU assets Loos: average non-interest bearing current labilities Average invested capital 1,512 (644) - (568) (307) 3,439 $6,019 (616) - 3.479) $6.205 3261) 55,965 (3,012) 55,773 2993) 56,771 Nordstrom, Inc. Consolidated Balance Sheets February 1 2020 February 2, 2010 Contact Cash and co lors Merchandienones Prepaid expenses and other Land property and mentre Operating wee s Goodwil 300 $9.737 Total $1,576 Lalities and shareholders' Equity Cunnt abilities Accounts payable And sales wages and related benefits Current portion of operating lease labilities Other current sites Cum portion of long-term det ables T LOR- det Deferred property incentives, not Non-cumorong lease labies Other listes Commitments and contingencies Note 11) 1556 and 1576 sharescued and outstanding Shareholders Common S 000 A ddict Accut r onsvelas To Shar Tots and shareholders The coronjing Notes to Consolidated Francial Statements are an integral part of the financial statements Operating Activ Net Adjustments to r e mings to not cach provided by posting activities D inamo esses and other el Anton of food property Inves Rig a s amation Delad income taxes, et Stock-based compenso espere 1912 1 19TEI 191912 191118138133-19 19 1910 1919 19201212 913 Aceable Proceeds from sale of credit card receivables orginated at Nordstrom Merchandise inventores Prepad experts and her assets Accounts payable Apoved ones, apes and related benefits Deemed property incentives Lease bites Others Netcash provided by opening advies 0 3 1 Inventing Active Capital expenditures Proceeds from sale of credit card receivables originated at third parties Ohornet Notes d esting activities Financing Activities Proceeds from long to borrowings, net of discounts Proclamation longo bonowings A n cash book overs Cash dividend paid Payment for purchase of common stock Proceeds from w est compensation plans Tax withholding on share based awards ON Netched infancing activities 1819193 1982 19818 18 23922 1912 19999999 Net decrease increase in cash and cache vient Cach i ng of Cash and cash quvaleta at and a year Fiscal year Net earnings Add income tax expense Add interest expense Earings before interest and income tax expense 2019 $496 186 112 794 2018 5564 169 119 852 2017 $437 353 141 931 2016 354 330 122 806 2015 $600 376 125 1,101 101 - 251 250 Add operating lease interest Add: rent expense, net Loos: estimated depreciation on capitalized operating leases Adjusted net operating profit - 895 (134) 969 (133) 1,048 (108) (94) 9001,183 Less: estimated income tax expense Adjusted net operating profit after tax (244) $651 (223) $746 (468) $580 (416) 484 (456) 727 5 $9,765 $8,282 $8,055 $7,917 $9,076 2018 1236 1,805 (544) - 1 Average total assets Add average estimated asset base of capitalized operating leases Loos: average deferred property incentives and deferred rent liability Less: average deferred property incentives in excess of ROU assets Loos: average non-interest bearing current labilities Average invested capital 1,512 (644) - (568) (307) 3,439 $6,019 (616) - 3.479) $6.205 3261) 55,965 (3,012) 55,773 2993) 56,771

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started