Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is quantity 7? Valuing an Entity with Buy-Manage-Sell Model Introduction Urstadt Biddle Properties Inc. (UBA) is a profitable, debt-free REIT that invests in grocery-store,

What is quantity 7?

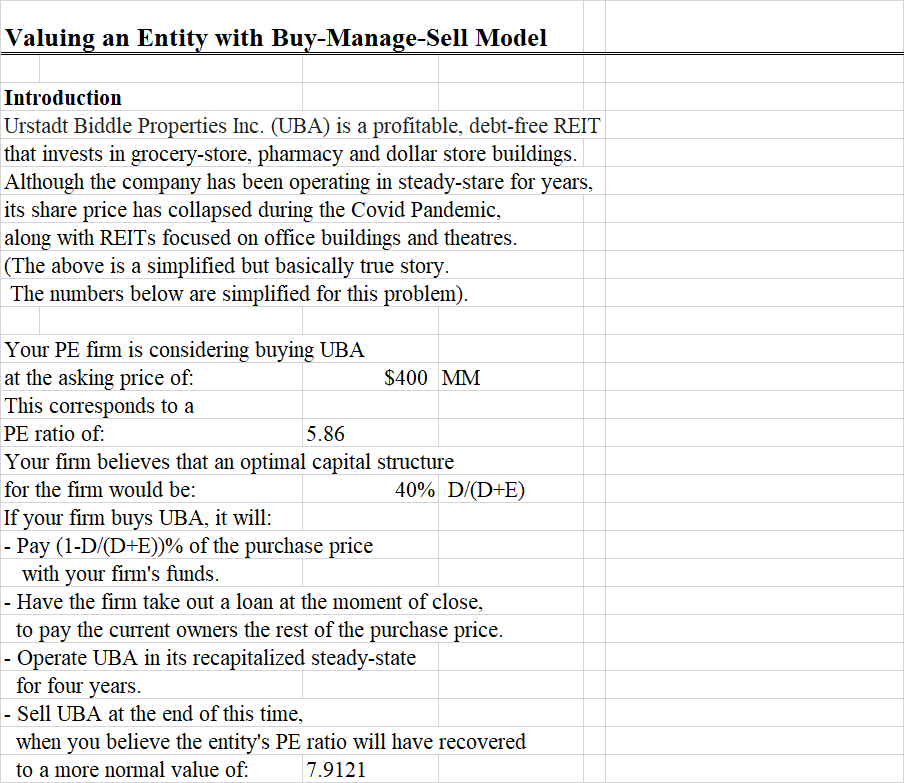

Valuing an Entity with Buy-Manage-Sell Model Introduction Urstadt Biddle Properties Inc. (UBA) is a profitable, debt-free REIT that invests in grocery-store, pharmacy and dollar store buildings. Although the company has been operating in steady-stare for years, its share price has collapsed during the Covid Pandemic, along with REITs focused on office buildings and theatres. (The above is a simplified but basically true story. The numbers below are simplified for this problem). Your PE firm is considering buying UBA at the asking price of: $400 MM This corresponds to a PE ratio of: 5.86 Your firm believes that an optimal capital structure for the firm would be: 40% D/(D+E) If your firm buys UBA, it will: - Pay (1-D/D+E))% of the purchase price with your firm's funds. - Have the firm take out a loan at the moment of close, to pay the current owners the rest of the purchase price. - Operate UBA in its recapitalized steady-state for four years. - Sell UBA at the end of this time, when you believe the entity's PE ratio will have recovered to a more normal value of: 7.9121 Valuing an Entity with Buy-Manage-Sell Model Introduction Urstadt Biddle Properties Inc. (UBA) is a profitable, debt-free REIT that invests in grocery-store, pharmacy and dollar store buildings. Although the company has been operating in steady-stare for years, its share price has collapsed during the Covid Pandemic, along with REITs focused on office buildings and theatres. (The above is a simplified but basically true story. The numbers below are simplified for this problem). Your PE firm is considering buying UBA at the asking price of: $400 MM This corresponds to a PE ratio of: 5.86 Your firm believes that an optimal capital structure for the firm would be: 40% D/(D+E) If your firm buys UBA, it will: - Pay (1-D/D+E))% of the purchase price with your firm's funds. - Have the firm take out a loan at the moment of close, to pay the current owners the rest of the purchase price. - Operate UBA in its recapitalized steady-state for four years. - Sell UBA at the end of this time, when you believe the entity's PE ratio will have recovered to a more normal value of: 7.9121Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started