Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is Sopelco's levered equity beta? Sopelco was a private company and so had no way to easily discem the beta of its equity. But

What is Sopelco's levered equity beta?

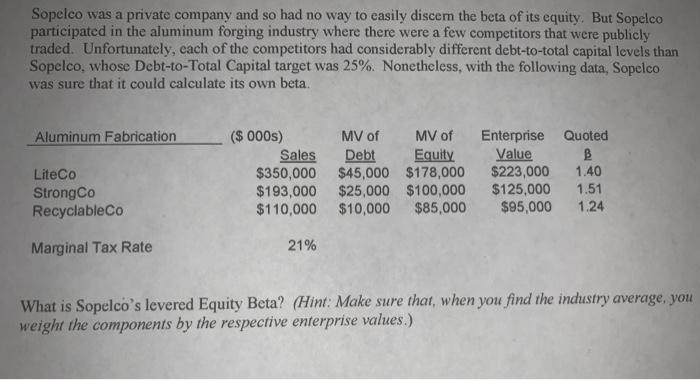

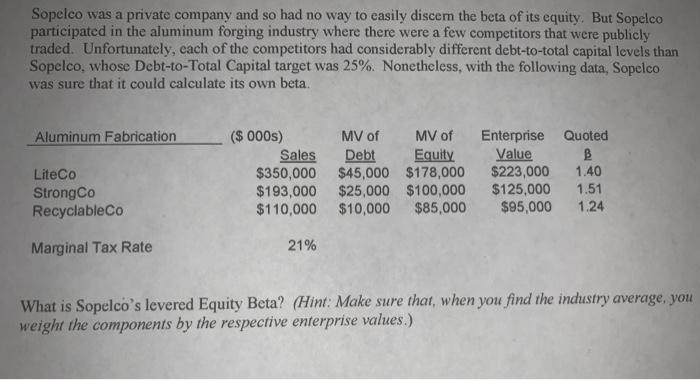

Sopelco was a private company and so had no way to easily discem the beta of its equity. But Sopelco participated in the aluminum forging industry where there were a few competitors that were publicly traded. Unfortunately, each of the competitors had considerably different debt-to-total capital levels than Sopelco, whose Debt-to-Total Capital target was 25%. Nonetheless, with the following data, Sopelco was sure that it could calculate its own beta. Aluminum Fabrication Liteco Strong Co RecyclableCo ($ 000s) Sales $350,000 $193,000 $110,000 MV of MV of Debt Equity $45,000 $178,000 $25,000 $100,000 $10,000 $85,000 Enterprise Quoted Value B $223,000 1.40 $125,000 1.51 $95,000 1.24 Marginal Tax Rate 21% What is Sopelco's levered Equity Beta? (Hint: Make sure that when you find the industry average, you weight the components by the respective enterprise values.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started