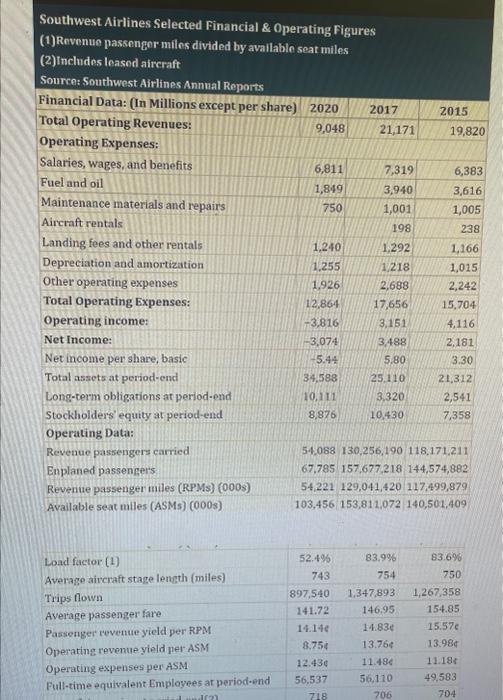

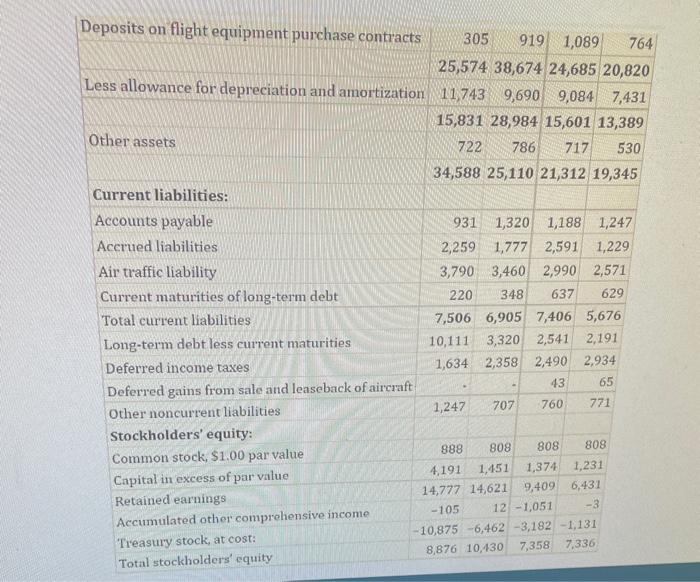

What is Southwest's Current Ratio in 2020? Is that considered a healthy ratio? By what percent did Southwest reduce its Fuel \& Oil costs between 2017 and 2020 ? Edit View Insert Format Tools Table Southwest Airlines Selected Financial \& Operating Figures (1)Rnvenue passengor miles divided by available seat miles (2)Includes leased aireraft Source: Southwest Airlines Annual Reports \begin{tabular}{|l|r|r|c|} \hline Financial Data: (In Millions except per share) & 2020 & 2017 & 2015 \\ \hline Total Operating Revenues: & 9,048 & 21,171 & 19,820 \\ \hline \end{tabular} Operating Expenses: Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs Aircraft rentals Landing fees and other rentals Depreciation and amortization Other operating expenses Total operating Expenses: Operating income: Net Income: Net income per share, basic Total assets at period-end Long-term obligations at period-end Stockholders' equity at period-end Operating Data: Enplaned passengers 67,785157,677,218144,574,882 \begin{tabular}{|lr|r|r|} Revenue passenger miles (RPMs) (000s) & 54,221 & 129,041,420 & 117,499,879 \\ \hline Available seat milles (ASMs) (000s) & 103,456 & 153,811,072 & 140,501,409 \end{tabular} Load factor [1] Average aircraft stage length (miles) Trips flown Average passenger fare Passenger revenue yield per RPM Operating revenue yield ner ASM \begin{tabular}{l|rrr|} \hline Operating expenses per ASM & 12.436 & 11.486 & 11.18t \\ \hline Full-time equivalent Employees ar period-end & 56,537 & 56,110 & 49,583 \\ \hline \end{tabular} \begin{tabular}{|l|rrr|r|} \hline Deposits on flight equipment purchase contracts & 305 & 919 & 1,089 & 764 \\ \hline \begin{tabular}{lrrrr|} & 25,574 & 38,674 & 24,685 & 20,820 \\ \hline Less allowance for depreciation and amortization & 11,743 & 9,690 & 9,084 & 7,431 \\ \hline Other assets & 15,831 & 28,984 & 15,601 & 13,389 \\ \hline & 722 & 786 & 717 & 530 \\ \hline \end{tabular} \end{tabular} Current liabilities: Accounts payable Accrued liabilities Air traffic liability Current maturities of long-term debt Total current liabilities Long-term debt less current maturities Deferred income taxes Deferred gains from sale and leaseback of aircraft Other noncurrent liabilities Stockholders' equity: Common stock, $1.00 par value Capital in excess of par value Retained earnings Accumulated other comprehensive income Treasury stock, at cost: Total stockholders' equity \begin{tabular}{|r|r|r|r|} \hline 931 & 1,320 & 1,188 & 1,247 \\ \hline 2,259 & 1,777 & 2,591 & 1,229 \\ \hline 3,790 & 3,460 & 2,990 & 2,571 \\ \hline 220 & 348 & 637 & 629 \\ \hline 7,506 & 6,905 & 7,406 & 5,676 \\ \hline 10,111 & 3,320 & 2,541 & 2,191 \\ \hline 1,634 & 2,358 & 2,490 & 2,934 \\ \hline & & 43 & 65 \\ \hline 1,247 & 707 & 760 & 771 \\ \hline & & & \\ \hline 888 & 808 & 808 & 808 \\ \hline 4,191 & 1,451 & 1,374 & 1,231 \\ \hline 14,777 & 14,621 & 9,409 & 6,431 \\ -105 & 12 & 1,051 & -3 \\ 10,875 & 6,462 & 3,182 & 1,131 \\ \hline 8,876 & 10,430 & 7,358 & 7,336 \\ \hline \end{tabular}