Answered step by step

Verified Expert Solution

Question

1 Approved Answer

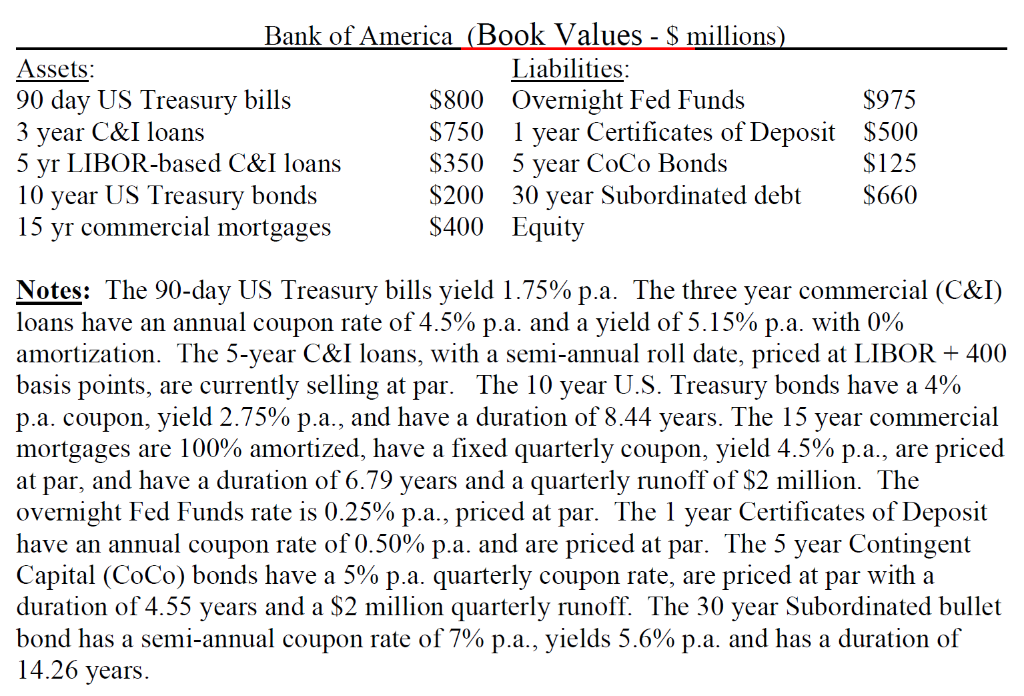

What is the 91 day cumulative repricing gap? -$178.5 million +$300 million +$171.5 million -$2.6 million +$925 million Bank of America (Book Values - $

- What is the 91 day cumulative repricing gap?

- -$178.5 million

- +$300 million

- +$171.5 million

- -$2.6 million

- +$925 million

Bank of America (Book Values - $ millions) Assets: Liabilities: 90 day US Treasury bills $800 Overnight Fed Funds $975 3 year C&I loans $750 1 year Certificates of Deposit $500 5 yr LIBOR-based C&I loans $350 5 5 year CoCo Bonds $125 10 year US Treasury bonds $200 30 year Subordinated debt $660 15 yr commercial mortgages $400 Equity Notes: The 90-day US Treasury bills yield 1.75% p.a. The three year commercial (C&I) loans have an annual coupon rate of 4.5% p.a. and a yield of 5.15% p.a. with 0% amortization. The 5-year C&I loans, with a semi-annual roll date, priced at LIBOR + 400 basis points, are currently selling at par. The 10 year U.S. Treasury bonds have a 4% p.a. coupon, yield 2.75% p.a., and have a duration of 8.44 years. The 15 year commercial mortgages are 100% amortized, have a fixed quarterly coupon, yield 4.5% p.a., are priced at par, and have a duration of 6.79 years and a quarterly runoff of $2 million. The overnight Fed Funds rate is 0.25% p.a., priced at par. The 1 year Certificates of Deposit have an annual coupon rate of 0.50% p.a. and are priced at par. The 5 year Contingent Capital (CoCo) bonds have a 5% p.a. quarterly coupon rate, are priced at par with a duration of 4.55 years and a $2 million quarterly runoff. The 30 year Subordinated bullet bond has a semi-annual coupon rate of 7% p.a., yields 5.6% p.a. and has a duration of 14.26 years. Bank of America (Book Values - $ millions) Assets: Liabilities: 90 day US Treasury bills $800 Overnight Fed Funds $975 3 year C&I loans $750 1 year Certificates of Deposit $500 5 yr LIBOR-based C&I loans $350 5 5 year CoCo Bonds $125 10 year US Treasury bonds $200 30 year Subordinated debt $660 15 yr commercial mortgages $400 Equity Notes: The 90-day US Treasury bills yield 1.75% p.a. The three year commercial (C&I) loans have an annual coupon rate of 4.5% p.a. and a yield of 5.15% p.a. with 0% amortization. The 5-year C&I loans, with a semi-annual roll date, priced at LIBOR + 400 basis points, are currently selling at par. The 10 year U.S. Treasury bonds have a 4% p.a. coupon, yield 2.75% p.a., and have a duration of 8.44 years. The 15 year commercial mortgages are 100% amortized, have a fixed quarterly coupon, yield 4.5% p.a., are priced at par, and have a duration of 6.79 years and a quarterly runoff of $2 million. The overnight Fed Funds rate is 0.25% p.a., priced at par. The 1 year Certificates of Deposit have an annual coupon rate of 0.50% p.a. and are priced at par. The 5 year Contingent Capital (CoCo) bonds have a 5% p.a. quarterly coupon rate, are priced at par with a duration of 4.55 years and a $2 million quarterly runoff. The 30 year Subordinated bullet bond has a semi-annual coupon rate of 7% p.a., yields 5.6% p.a. and has a duration of 14.26 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started