What is the accumulated depreciation?

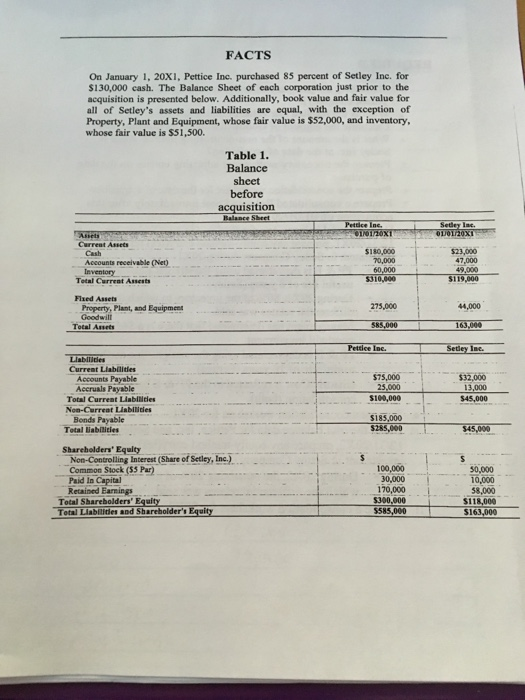

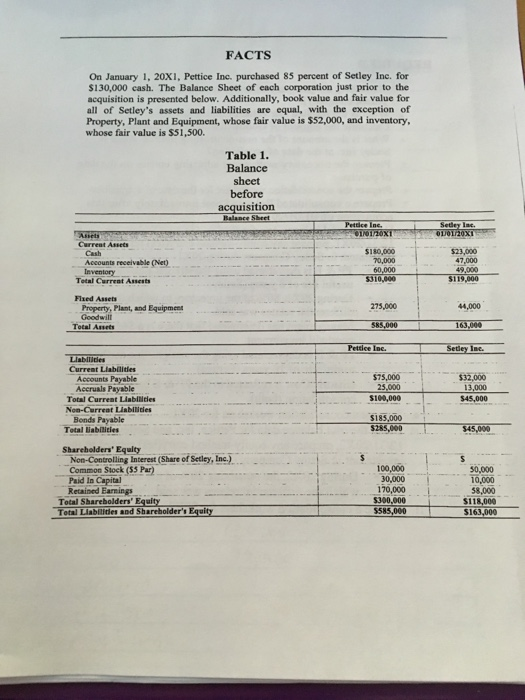

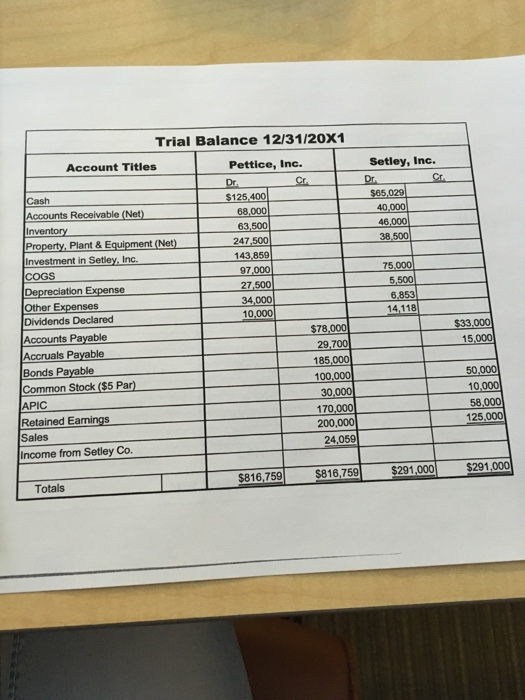

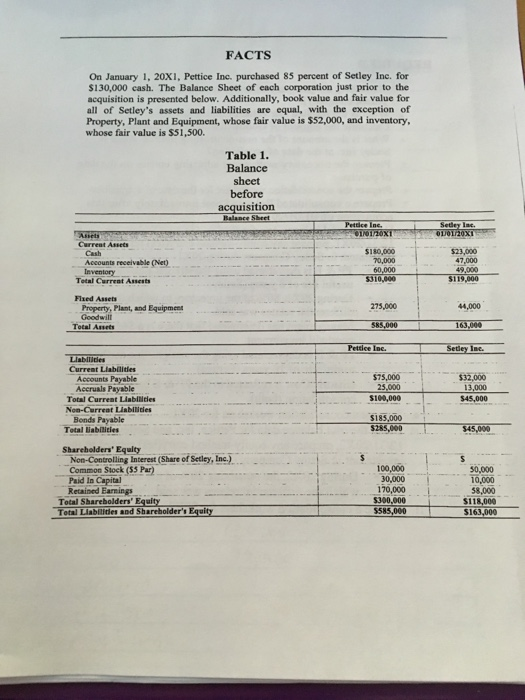

FACTS On January 1, 20X1, Pettice Inc, purchased 85 percent of Setley Inc. for $130,000 cash. The Balance Sheet of each corporation just prior to the acquisition is presented below. Additionally, book value and fair value for all of Setley's assets and liabilities are equal, with the exception of Property, Plant and Equipment, whose fair value is $52,000, and inventory whose fair value is $51,500. Table 1. Balance sheet before acquisition Currest Assets $180,000 70,000 60,000 Cash 47,000 Total Current Asests Flxed Asets 44,000 585,000163,00 Setley Ine. 275,000 Property, Plant, and Equipmens Goodwill Total Anets Pettice Ine. Liabilitdes Current Liabilitles $75,000 $100,000 185,000 $32,000 13,000 45,000 Accounts Payable Accruals Payable Total Current Liabilities Noa-Curreat Liabilides Bonds Payable Total iabilities $285,000 $45,000 Shareholders' Equity Non-Controlling Interest (Share of Setley, Inc.) Common Stock (S3 Par). Paid In Capital Retained Earnings 100,000 30,000 170,000 $300,000 5585,000 0,000 10,000 8,000 $118,000 Total Sharebolders' Equity Total Llablides and Sharebolder's Equity $16 Trial Balance 12/31/20X1 Account Titles Pettice, Inc. Setley, Inc. Dr Cash $125.400 68,000 63,500 247,500 $65,029 Accounts Receivable (Net) 46,000 38 Property, Plant & Equipment (Net) Investment in Setley. Inc COGS Depreciation Expense Other Expenses Dividends Declared Accounts Payable Accruals Payable Bonds Payable Common Stock ($5 Par) 97.000 27,500 34,000 10,000 75,000 5,500 6,853 14,118 78 29,700 185,000 100,000 30,000 15,000 50,000 APIC 58 125,000 Retained Eamings 200,000 24.059 Sales Income from Setley Co $816,759 $816,759 $291,000 $291,000 Totals FACTS On January 1, 20X1, Pettice Inc, purchased 85 percent of Setley Inc. for $130,000 cash. The Balance Sheet of each corporation just prior to the acquisition is presented below. Additionally, book value and fair value for all of Setley's assets and liabilities are equal, with the exception of Property, Plant and Equipment, whose fair value is $52,000, and inventory whose fair value is $51,500. Table 1. Balance sheet before acquisition Currest Assets $180,000 70,000 60,000 Cash 47,000 Total Current Asests Flxed Asets 44,000 585,000163,00 Setley Ine. 275,000 Property, Plant, and Equipmens Goodwill Total Anets Pettice Ine. Liabilitdes Current Liabilitles $75,000 $100,000 185,000 $32,000 13,000 45,000 Accounts Payable Accruals Payable Total Current Liabilities Noa-Curreat Liabilides Bonds Payable Total iabilities $285,000 $45,000 Shareholders' Equity Non-Controlling Interest (Share of Setley, Inc.) Common Stock (S3 Par). Paid In Capital Retained Earnings 100,000 30,000 170,000 $300,000 5585,000 0,000 10,000 8,000 $118,000 Total Sharebolders' Equity Total Llablides and Sharebolder's Equity $16 Trial Balance 12/31/20X1 Account Titles Pettice, Inc. Setley, Inc. Dr Cash $125.400 68,000 63,500 247,500 $65,029 Accounts Receivable (Net) 46,000 38 Property, Plant & Equipment (Net) Investment in Setley. Inc COGS Depreciation Expense Other Expenses Dividends Declared Accounts Payable Accruals Payable Bonds Payable Common Stock ($5 Par) 97.000 27,500 34,000 10,000 75,000 5,500 6,853 14,118 78 29,700 185,000 100,000 30,000 15,000 50,000 APIC 58 125,000 Retained Eamings 200,000 24.059 Sales Income from Setley Co $816,759 $816,759 $291,000 $291,000 Totals