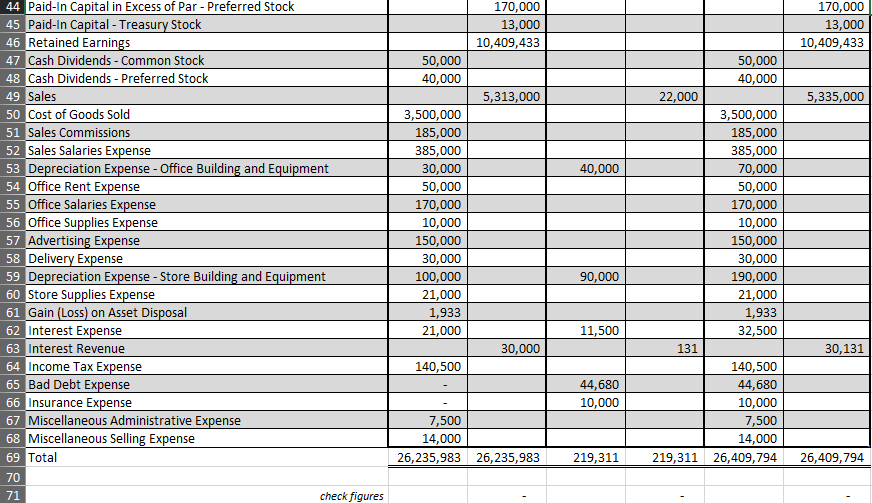

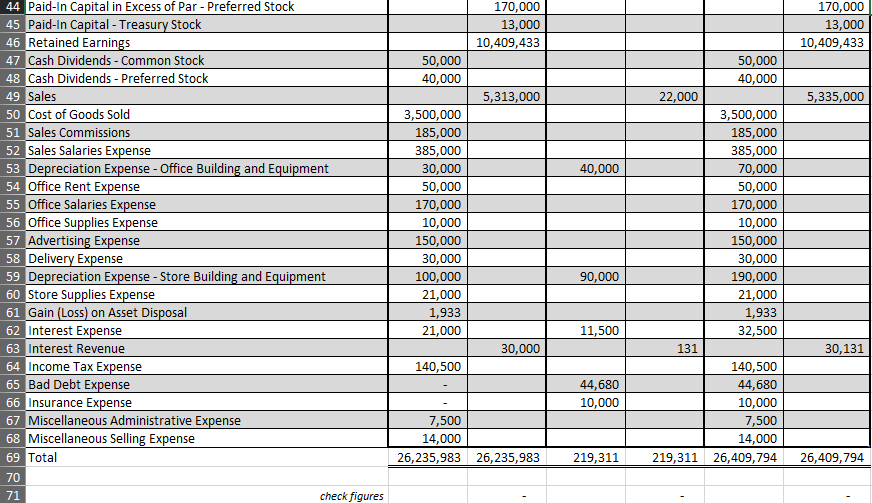

What is the amount of earnings per share for common stock (after tax)?

What was the P/E ratio on the date of the last Treasury Stock Transaction?

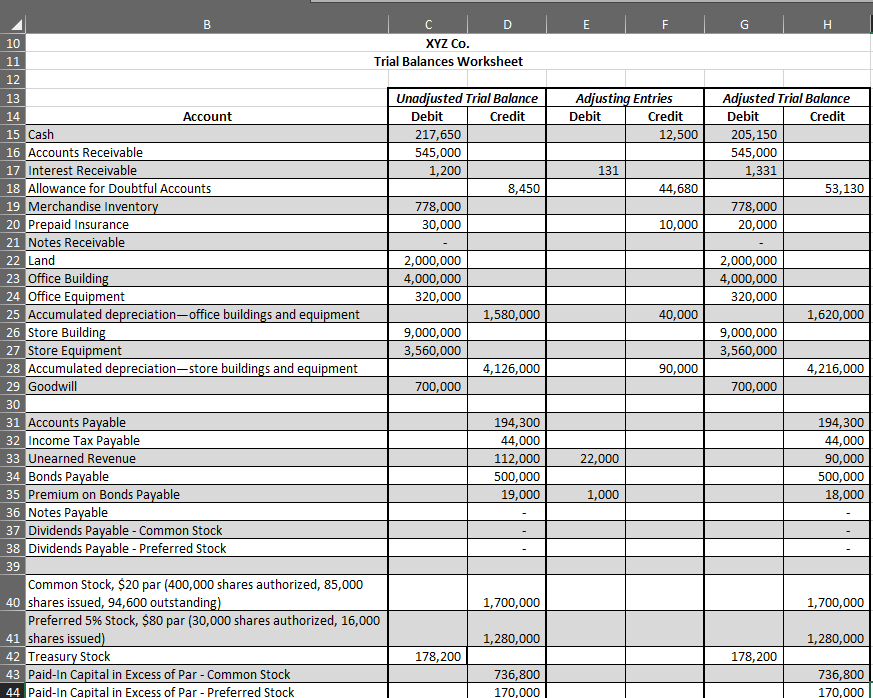

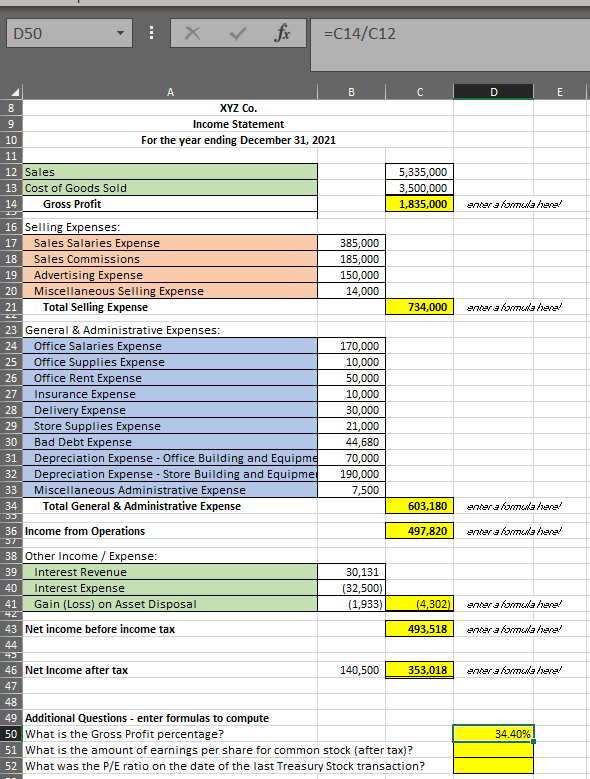

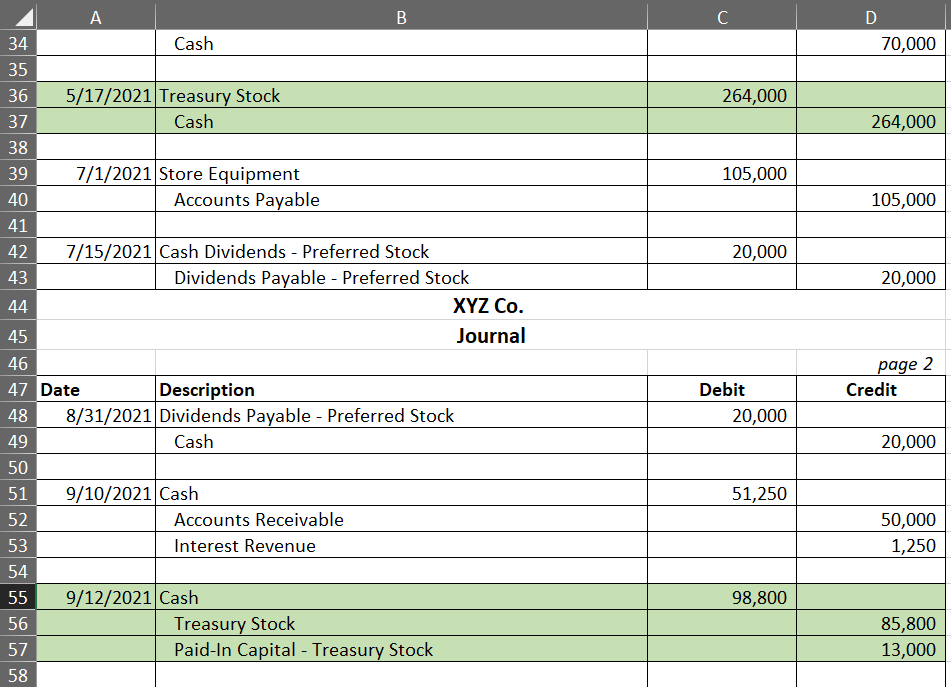

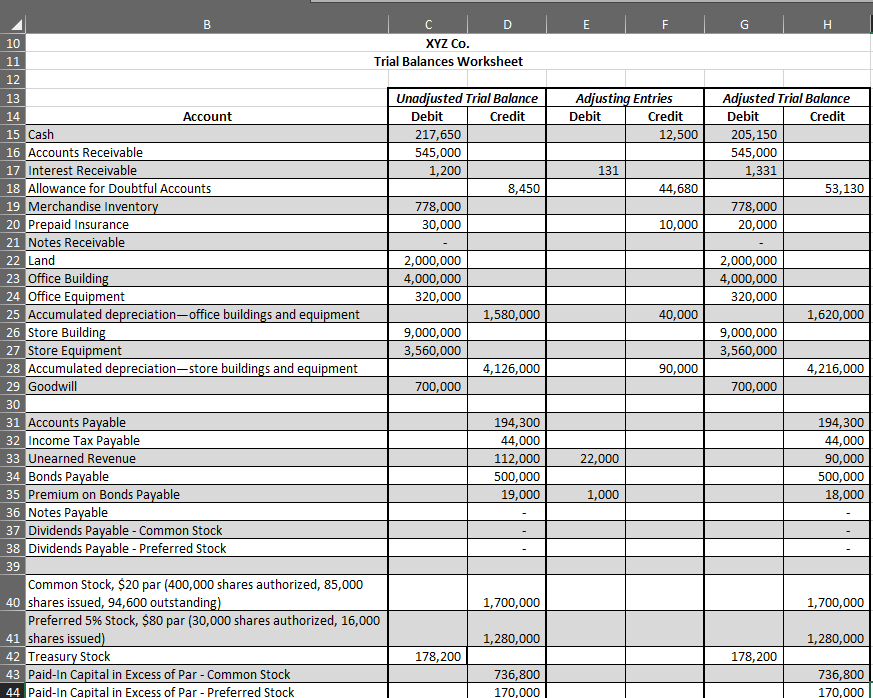

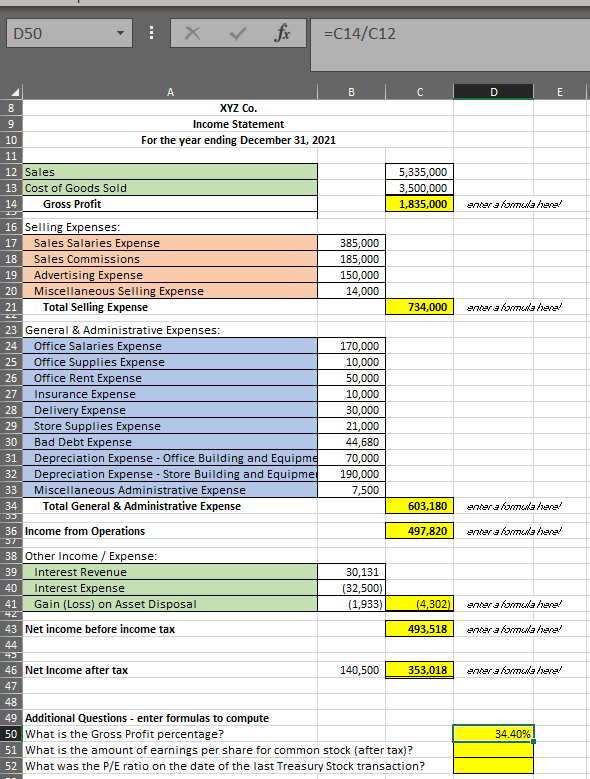

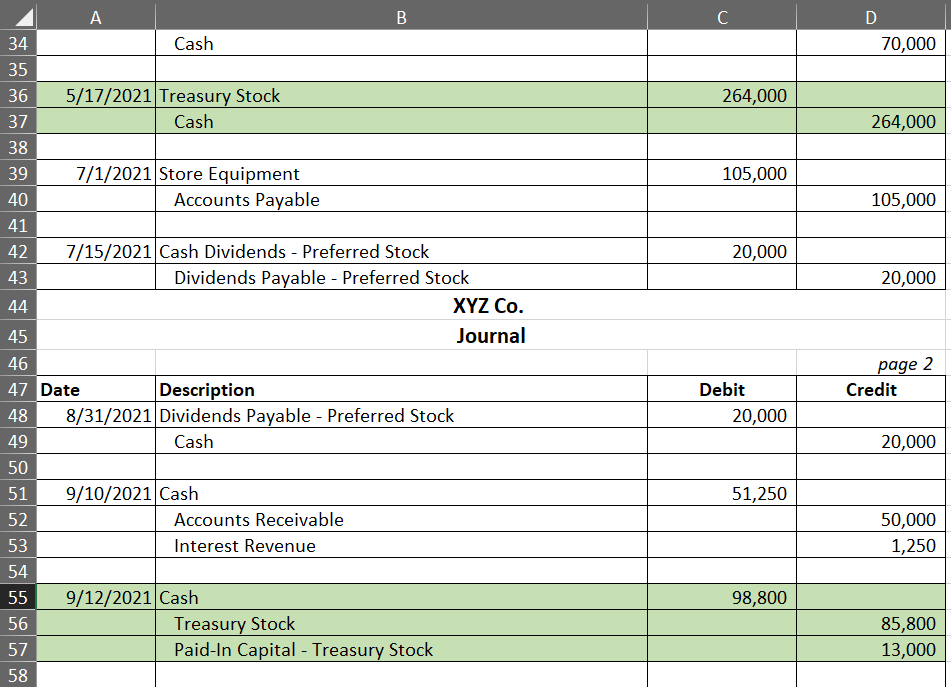

E F G H 14 Adjusting Entries Debit Credit 12,500 Adjusted Trial Balance Debit Credit 205,150 545,000 1,331 53,130 778,000 20,000 131 44,680 10,000 2,000,000 4,000,000 320,000 40,000 1,620,000 B 10 XYZ Co. 11 Trial Balances Worksheet 12 13 Unadjusted Trial Balance Account Debit Credit 15 Cash 217,650 16 Accounts Receivable 545,000 17 Interest Receivable 1,200 18 Allowance for Doubtful Accounts 8,450 19 Merchandise Inventory 778,000 20 Prepaid Insurance 30,000 21 Notes Receivable 22 Land 2,000,000 23 Office Building 4,000,000 24 Office Equipment 320,000 25 Accumulated depreciation-office buildings and equipment 1,580,000 26 Store Building 9,000,000 27 Store Equipment 3,560,000 28 Accumulated depreciation-store buildings and equipment 4,126,000 29 Goodwill 700,000 30 31 Accounts Payable 194,300 32 Income Tax Payable 44,000 33 Unearned Revenue 112,000 34 Bonds Payable 500,000 35 Premium on Bonds Payable 19,000 36 Notes Payable 37 Dividends Payable - Common Stock 38 Dividends Payable - Preferred Stock 39 Common Stock, $20 par (400,000 shares authorized, 85,000 40 shares issued, 94,600 outstanding) 1,700,000 Preferred 5% Stock, $80 par (30,000 shares authorized, 16,000 41 shares issued) 1,280,000 42 Treasury Stock 178,200 43 Paid-In Capital in Excess of Par - Common Stock 736,800 44 Paid-In Capital in Excess of Par - Preferred Stock 170,000 9,000,000 3,560,000 90,000 4,216,000 700,000 22,000 194,300 44,000 90,000 500,000 18,000 1,000 1,700,000 1,280,000 178,200 736,800 170,000 - 170,000 13,000 10,409,433 170,000 13,000 10,409,433 50,000 40,000 5,313,000 5,335,000 40,000 44 Paid-In Capital in Excess of Par - Preferred Stock 45 Paid-In Capital - Treasury Stock 46 Retained Earnings 47 Cash Dividends - Common Stock 48 Cash Dividends - Preferred Stock 49 Sales 50 Cost of Goods Sold 51 Sales Commissions 52 Sales Salaries Expense 53 Depreciation Expense - Office Building and Equipment 54 Office Rent Expense 55 Office Salaries Expense 56 Office Supplies Expense 57 Advertising Expense 58 Delivery Expense 59 Depreciation Expense - Store Building and Equipment 60 Store Supplies Expense 61 Gain (Loss) on Asset Disposal 62 Interest Expense 63 Interest Revenue 64 Income Tax Expense 65 Bad Debt Expense 66 Insurance Expense 67 Miscellaneous Administrative Expense 68 Miscellaneous Selling Expense 69 Total 70 71 check figures 3,500,000 185,000 385,000 30,000 50,000 170,000 10,000 150,000 30,000 100,000 21,000 1,933 21,000 50,000 40,000 22,000 3,500,000 185,000 385,000 70,000 50,000 170,000 10,000 150,000 30,000 190,000 21,000 1,933 32,500 131 140,500 44,680 10,000 7,500 14,000 219,311 26,409,794 90,000 11,500 30,000 30,131 140,500 44,680 10,000 7,500 14,000 26,235,983 26,235,983 219,311 26,409,794 D50 fx =C14/C12 B D E 8 XYZ Co. Income Statement For the year ending December 31, 2021 9 10 11 12 Sales 13 Cost of Goods Sold 14 Gross Profit 5,335,000 3,500,000 1,835,000 antara kwa here hanel 22 16 Selling Expenses: 17 Sales Salaries Expense 385,000 18 Sales Commissions 185,000 19 Advertising Expense 150,000 20 Miscellaneous Selling Expense 14,000 21 Total Selling Expense 734,000 23 General & Administrative Expenses: 24 Office Salaries Expense 170,000 25 Office Supplies Expense 10,000 26 Office Rent Expense 50,000 27 Insurance Expense 10,000 28 Delivery Expense 30,000 29 Store Supplies Expense 21,000 30 Bad Debt Expense 44,680 31 Depreciation Expense - Office Building and Equipme 70,000 32 Depreciation Expense - Store Building and Equipme 190,000 33 Miscellaneous Administrative Expense 7,500 34 Total General & Administrative Expense 603,180 33 36 Income from Operations 497,820 ST 38 Other Income / Expense: 39 Interest Revenue 30,131 40 Interest Expense (32,500) 41 Gain (Loss) on Asset Disposal (1,933) 14,302) 42 43 Net income before income tax 493,518 44 43 46 Net Income after tax 140,500 353,018 47 48 49 Additional Questions - enter formulas to compute 50 What is the Gross Profit percentage? 51 What is the amount of earnings per share for common stock (after tax)? 52 What was the P/E ratio on the date of the last Treasury Stock transaction? mahanel eharat mathema/ ener a wide hera/ hanal 34.40% C D 70,000 264,000 264,000 105,000 105,000 20,000 20,000 A B 34 Cash 35 36 5/17/2021 Treasury Stock 37 Cash 38 39 7/1/2021 Store Equipment 40 Accounts Payable 41 42 7/15/2021 Cash Dividends - Preferred Stock 43 Dividends Payable - Preferred Stock 44 XYZ Co. 45 Journal 46 47 Date Description 48 8/31/2021 Dividends Payable - Preferred Stock 49 Cash 50 51 9/10/2021 Cash 52 Accounts Receivable 53 Interest Revenue 54 55 9/12/2021 Cash 56 Treasury Stock 57 Paid-In Capital - Treasury Stock 58 page 2 Credit Debit 20,000 20,000 51,250 50,000 1,250 98,800 85,800 13,000