Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the amount of non controlling interest in net income for 20x2? What is the amount of consolidated net income for 20x2? Peter acquired

What is the amount of non controlling interest in net income for 20x2?

What is the amount of consolidated net income for 20x2?

What is the amount of consolidated net income for 20x2?

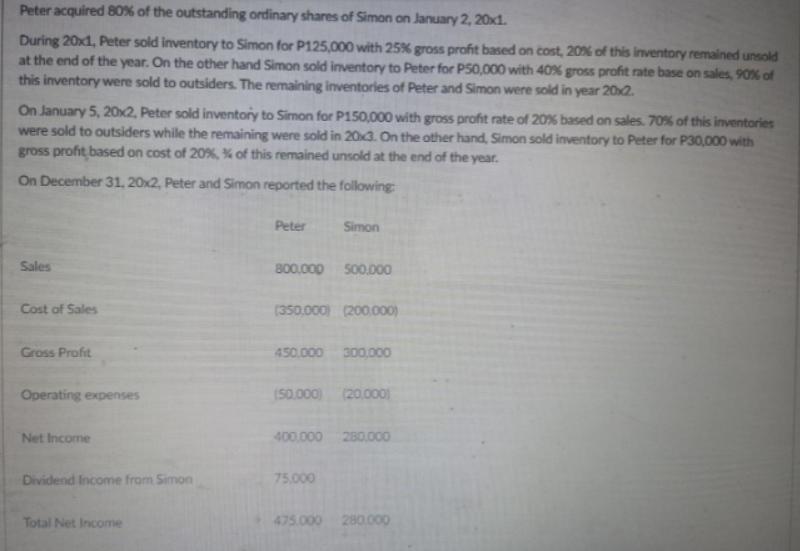

Peter acquired 80% of the outstanding ordinary shares of Simon on January 2, 20x1. During 20x1, Peter sold inventory to Simon for P125,000 with 25% gross profit based on cost, 20% of this inventory remained unsold at the end of the year. On the other hand Simon sold inventory to Peter for P50,000 with 40% gross profit rate base on sales, 90% of this inventory were sold to outsiders. The remaining inventories of Peter and Simon were sold in year 20x2. On January 5, 20x2, Peter sold inventory to Simon for P150,000 with gross profit rate of 20% based on sales. 70% of this inventories were sold to outsiders while the remaining were sold in 20x3. On the other hand, Simon sold inventory to Peter for P30,000 with gross profit based on cost of 20%, % of this remained unsold at the end of the year. On December 31, 20x2, Peter and Simon reported the following: Sales Cost of Sales Gross Profit Operating expenses Net Income Dividend Income from Simon Total Net Income Peter 800,000 500.000 Simon (350,000) (200,000) 450.000 300,000 (50,000) 75,000 (20,0001 400.000 280,000 475.000 280.000

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a What is the amount of non controlling interest in net income for 20x2 The amount of non controllin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started