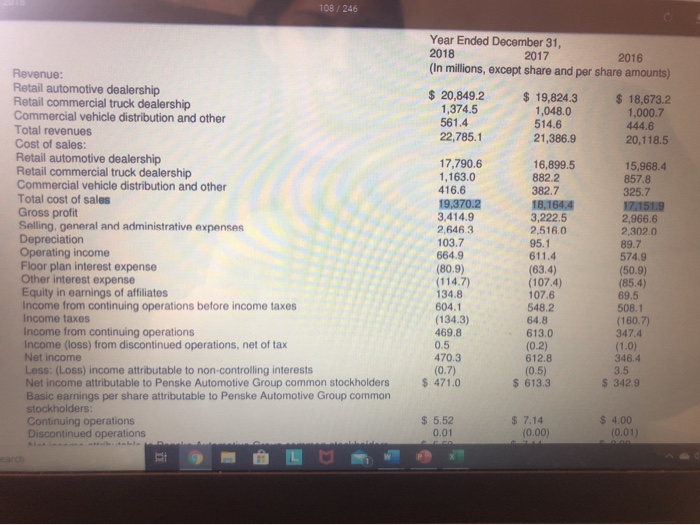

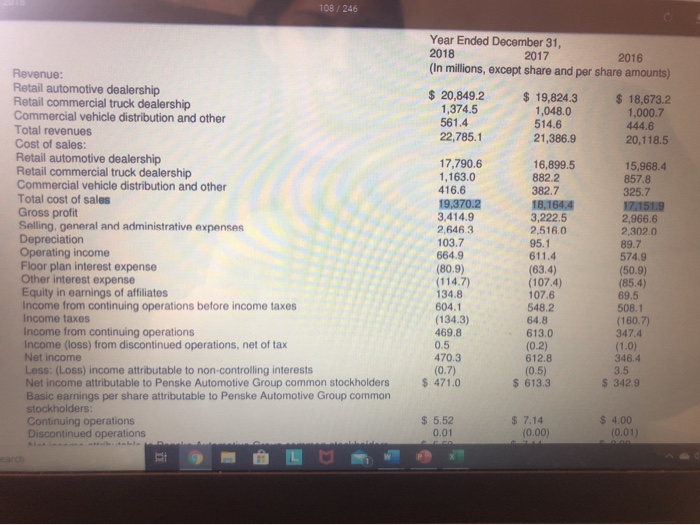

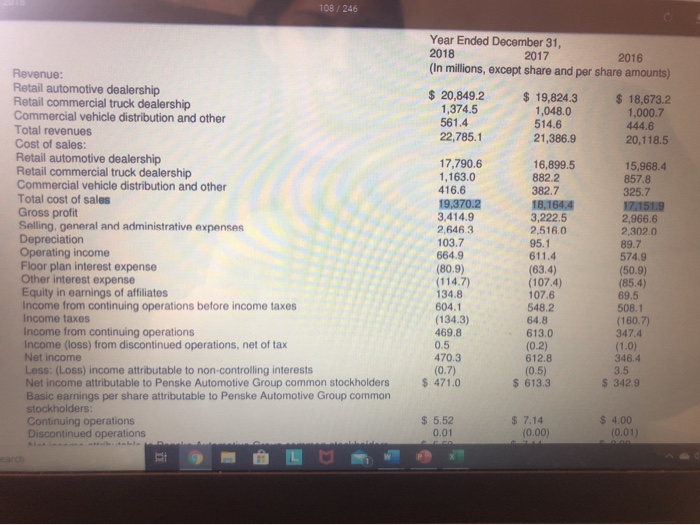

what is the amount of operating,selling, and G&A expenses? And %? is it improving?

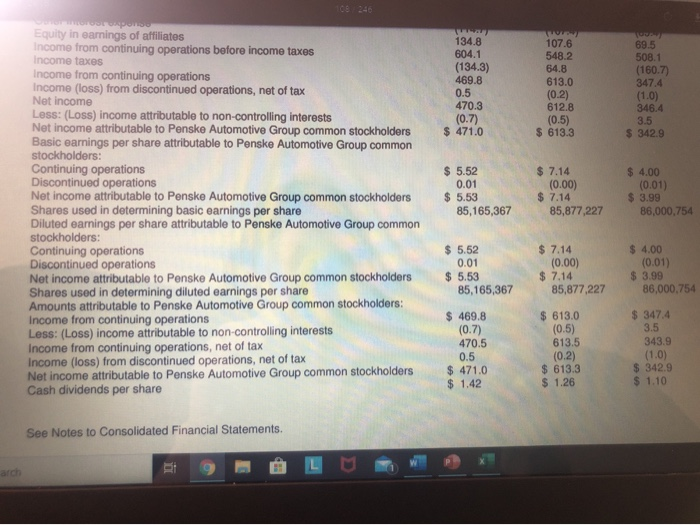

108/246 Year Ended December 31, 2018 2017 2016 (In millions, except share and per share amounts) $ 20,849.2 1,374.5 561.4 22,785.1 $ 19,824.3 1,048.0 514.6 21,386.9 $ 18,673.2 1,000.7 444.6 20.118.5 Revenue: Retail automotive dealership Retail commercial truck dealership Commercial vehicle distribution and other Total revenues Cost of sales: Retail automotive dealership Retail commercial truck dealership Commercial vehicle distribution and other Total cost of sales Gross profit Selling, general and administrative expenses Depreciation Operating income Floor plan interest expense Other interest expense Equity in earnings of affiliates Income from continuing operations before income taxes Income taxes Income from continuing operations Income (loss) from discontinued operations, net of tax Net income Less: (Loss) income attributable to non-controlling interests Net income attributable to Penske Automotive Group common stockholders Basic earnings per share attributable to Penske Automotive Group common stockholders: Continuing operations Discontinued operations 17,790.6 1,163.0 416.6 19,370.2 3,414.9 2,646.3 103.7 664.9 (80.9) (114.7) 134.8 604.1 (134.3) 469.8 0.5 470.3 (0.7) $ 471.0 16,899.5 8822 382.7 18,164.4 3,222.5 2,516.0 95.1 611.4 (63.4) (107.4) 107.6 548.2 64.8 613.0 (0.2) 612.8 (0.5) $ 613.3 15,968.4 857.8 325.7 17.151.9 2,966.6 2,302.0 89.7 574.9 (50.9) (85.4) 69.5 508.1 (160.7) 347.4 (1.0) 346.4 3.5 $ 342.9 $ 5.52 0.01 $ 7.14 (0.00) $ 4.00 (0.01) 134.8 604.1 (134.3) 469.8 0.5 470.3 (0.7) $ 471.0 107.6 548.2 64.8 613.0 (0.2) 612.8 (0.5) $ 613.3 69.5 508.1 (160.7) 347.4 (1.0) 346.4 3.5 $ 342.9 $ 5.52 0.01 BONDO Equity in earnings of affiliates Income from continuing operations before income taxes Income taxes Income from continuing operations Income (loss) from discontinued operations, net of tax Net income Less: (Loss) income attributable to non-controlling interests Net income attributable to Penske Automotive Group common stockholders Basic earnings per share attributable to Penske Automotive Group common stockholders: Continuing operations Discontinued operations Net income attributable to Penske Automotive Group common stockholders Shares used in determining basic earnings per share Diluted earnings per share attributable to Penske Automotive Group common stockholders: Continuing operations Discontinued operations Net income attributable to Penske Automotive Group common stockholders Shares used in determining diluted earnings per share Amounts attributable to Penske Automotive Group common stockholders: Income from continuing operations Less: (Loss) income attributable to non-controlling interests Income from continuing operations, net of tax Income (loss) from discontinued operations, net of tax Net income attributable to Penske Automotive Group common stockholders Cash dividends per share $ 5.53 85,165,367 $ 7.14 (0.00) $ 7.14 85,877,227 $ 4.00 (0.01) $ 3.99 86,000,754 $ 5.52 0.01 $ 5.53 85,165,367 $ 7.14 (0.00) $ 7.14 85,877,227 $ 4.00 (0.01) $ 3.99 86,000,754 $ 469.8 (0.7) 470.5 $ 613.0 (0.5) 613.5 $ 347.4 3.5 343.9 (1.0) $ 342.9 $ 1.10 0.5 $ 471.0 $ 1.42 (0.2) $ 613.3 $ 1.26 See Notes to Consolidated Financial Statements