Question

What is the amount of Tesla's Accounts Receivable? Before Subtracting the allowance for doubtful accounts ( Gross accounts receivables): This year_________ Last Year________ AFTER Subtracting

What is the amount of Tesla's Accounts Receivable?

Before Subtracting the allowance for doubtful accounts ( Gross accounts receivables): This year_________ Last Year________

AFTER Subtracting the allowance for doubtful accounts ( Net accounts receivables): This year_________ Last Year________

What is the amount of the allowance for doubtful accounts? This year_________ Last Year________

What percentage of the gross accounts receivables are considered bad debts? ( See below)

The credit risk ratio; Allowance for doubtful accounts/Gross accounts receivable This year_________ Last Year________

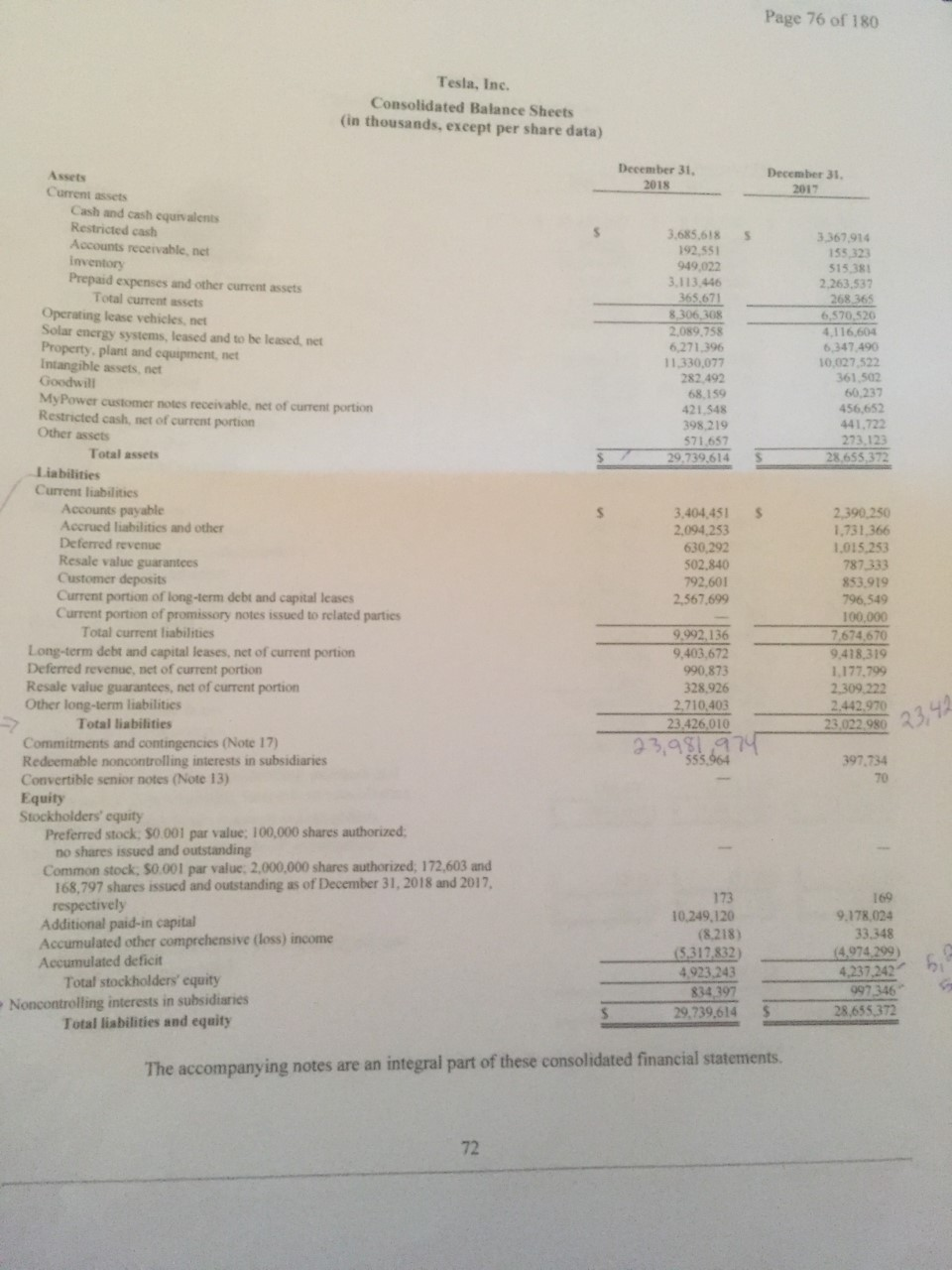

Page 76 of 180 Tesla, Inc. Consolidated Balance Sheets (in thousands, except per share data) December 31, 2018 December 31 2017 3,685,618 192,551 949,022 3.113.446 365.671 8,306,308 2,089,758 6,271,396 11.330,077 282.492 68.159 421,548 398,219 571,657 29,739,614 3.367.914 155323 515 381 2.263.537 268 365 6,570,520 4,116,604 6,347490 10.027 522 361,502 60,237 456,652 441.722 273,123 28.655,372 Assets Current assets Cash and cash equivalents Restricted cash Accounts receivable, net Inventory Prepaid expenses and other current assets Total current assets Operating lease vehicles, net Solar energy systems, leased and to be leased, net Property, plant and equipment, net Intangible assets, net Goodwill My Power customer notes receivable, net of current portion Restricted cash, set of current portion Other assets Total assets Liabilities Current liabilities Accounts payable Accrued liabilities and other Deferred revenue Resale value guarantees Customer deposits Current portion of long-term debt and capital leases Current portion of promissory notes issued to related parties Total current liabilities Long-term debt and capital leases, net of current portion Deferred revenue, net of current portion Resale value guarantees, net of current portion Other long-term liabilities - Total liabilities Commitments and contingencies (Note 17) Redeemable noncontrolling interests in subsidiaries Convertible senior notes (Note 13) Equity Stockholders' equity Preferred stock, S0.001 par value: 100,000 shares authorized: no shares issued and outstanding Common stock, 50.001 par value: 2,000,000 shares authorized: 172,603 and 168,797 shares issued and outstanding as of December 31, 2018 and 2017 respectively Additional paid-in capital Accumulated other comprehensive (loss) income Accumulated deficit Total stockholders' equity Noncontrolling interests in subsidiaries Total liabilities and equity 3.404,451 2,094.253 630,292 502.840 792,601 2,567,699 2,390, 250 1,731,366 1,015.253 787333 853.919 796,549 100,000 7.674670 9,418,319 1.177.799 2,309.222 2.442.970 23.022 980 9.992,136 9,403,672 990,873 328.926 2.710,403 23.426,010 3,951974 555.964 23,42 397.734 70 173 10.249,120 (8,218) (5,317 832) 4.923.243 834 397 29,739,614 169 9.178,024 33,348 (4,974 299) 4,237,242 997 346 28,655,372 The accompanying notes are an integral part of these consolidated financial statements. Page 76 of 180 Tesla, Inc. Consolidated Balance Sheets (in thousands, except per share data) December 31, 2018 December 31 2017 3,685,618 192,551 949,022 3.113.446 365.671 8,306,308 2,089,758 6,271,396 11.330,077 282.492 68.159 421,548 398,219 571,657 29,739,614 3.367.914 155323 515 381 2.263.537 268 365 6,570,520 4,116,604 6,347490 10.027 522 361,502 60,237 456,652 441.722 273,123 28.655,372 Assets Current assets Cash and cash equivalents Restricted cash Accounts receivable, net Inventory Prepaid expenses and other current assets Total current assets Operating lease vehicles, net Solar energy systems, leased and to be leased, net Property, plant and equipment, net Intangible assets, net Goodwill My Power customer notes receivable, net of current portion Restricted cash, set of current portion Other assets Total assets Liabilities Current liabilities Accounts payable Accrued liabilities and other Deferred revenue Resale value guarantees Customer deposits Current portion of long-term debt and capital leases Current portion of promissory notes issued to related parties Total current liabilities Long-term debt and capital leases, net of current portion Deferred revenue, net of current portion Resale value guarantees, net of current portion Other long-term liabilities - Total liabilities Commitments and contingencies (Note 17) Redeemable noncontrolling interests in subsidiaries Convertible senior notes (Note 13) Equity Stockholders' equity Preferred stock, S0.001 par value: 100,000 shares authorized: no shares issued and outstanding Common stock, 50.001 par value: 2,000,000 shares authorized: 172,603 and 168,797 shares issued and outstanding as of December 31, 2018 and 2017 respectively Additional paid-in capital Accumulated other comprehensive (loss) income Accumulated deficit Total stockholders' equity Noncontrolling interests in subsidiaries Total liabilities and equity 3.404,451 2,094.253 630,292 502.840 792,601 2,567,699 2,390, 250 1,731,366 1,015.253 787333 853.919 796,549 100,000 7.674670 9,418,319 1.177.799 2,309.222 2.442.970 23.022 980 9.992,136 9,403,672 990,873 328.926 2.710,403 23.426,010 3,951974 555.964 23,42 397.734 70 173 10.249,120 (8,218) (5,317 832) 4.923.243 834 397 29,739,614 169 9.178,024 33,348 (4,974 299) 4,237,242 997 346 28,655,372 The accompanying notes are an integral part of these consolidated financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started