What is the amount that AF reports in its income statement for its stock options for the year ended December 31, 2013? [ Hint: See Note 30: Share-Based Compensation.] Are AFs share options cliff vesting or graded vesting? How does accounting differ between U.S. GAAP and IFRS for graded-vesting plans?

What is the amount that AF reports in its income statement for its stock options for the year ended December 31, 2013? [ Hint: See Note 30: Share-Based Compensation.] Are AFs share options cliff vesting or graded vesting? How does accounting differ between U.S. GAAP and IFRS for graded-vesting plans?

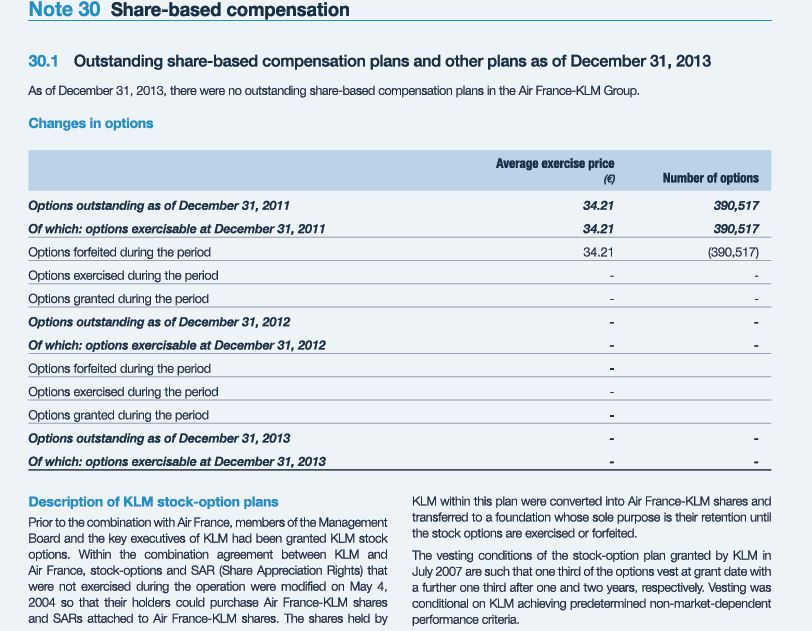

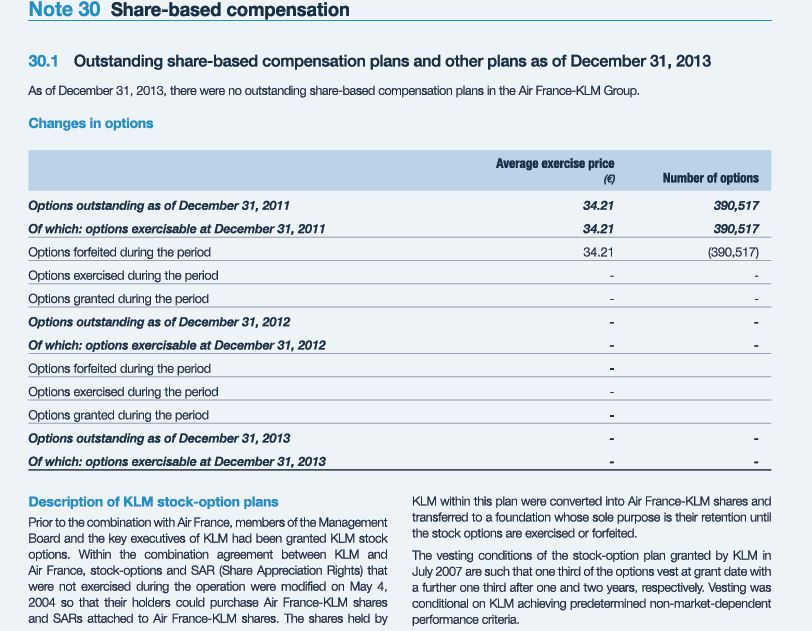

Note 30 Share-based compensation Outstanding share-based compensation plans and other plans as of December 31, 2013 30.1 As of December 31, 2013, there were no outstanding share-based compensation plans in the Air France-KLM Group. Changes in options Average exercise price Number of options Options outstanding as of December 31, 2011 34.21 390,517 Of which: options exercisable at December 31, 2011 34.21 390,517 Options forfeited during the period 34.21 (390,517) Options exercised during the period Options granted during the period Options outstanding as of December 31, 2012 Of which: options exercisable at December 31, 2012 Options forfeited during the period Options exercised cluring the period Options granted during the period Options outstanding as of December 31, 2013 Of which: options exercisable at December 31, 2013 Description of KLM stock-option plans KLM within this plan were converted into Air France-KLM shares and transferred to a foundation whose sole purpose is their retention unti the stock options are exercised or forfeited. Prior to the combination with Air France, members of the Management Board and the key executives of KLM had been granted KLM stock options. Within the combination agreement between KLM and Air France, stock-options and SAR (Share Appreciation Rights) that were not exercised during the operation were modified on May 4, 2004 so that their holders could purchase Air France-KLM shares and SARS attached to Air France-KLM shares. The shares held by The vesting conditions of the stock-option plan granted by KLM in July 2007 are such that one third of the options vest at grant date with a further one third after one and two years, respectively. Vesting was conditional on KLM achieving predetermined non-market-dependent performance criteria Note 30 Share-based compensation Outstanding share-based compensation plans and other plans as of December 31, 2013 30.1 As of December 31, 2013, there were no outstanding share-based compensation plans in the Air France-KLM Group. Changes in options Average exercise price Number of options Options outstanding as of December 31, 2011 34.21 390,517 Of which: options exercisable at December 31, 2011 34.21 390,517 Options forfeited during the period 34.21 (390,517) Options exercised during the period Options granted during the period Options outstanding as of December 31, 2012 Of which: options exercisable at December 31, 2012 Options forfeited during the period Options exercised cluring the period Options granted during the period Options outstanding as of December 31, 2013 Of which: options exercisable at December 31, 2013 Description of KLM stock-option plans KLM within this plan were converted into Air France-KLM shares and transferred to a foundation whose sole purpose is their retention unti the stock options are exercised or forfeited. Prior to the combination with Air France, members of the Management Board and the key executives of KLM had been granted KLM stock options. Within the combination agreement between KLM and Air France, stock-options and SAR (Share Appreciation Rights) that were not exercised during the operation were modified on May 4, 2004 so that their holders could purchase Air France-KLM shares and SARS attached to Air France-KLM shares. The shares held by The vesting conditions of the stock-option plan granted by KLM in July 2007 are such that one third of the options vest at grant date with a further one third after one and two years, respectively. Vesting was conditional on KLM achieving predetermined non-market-dependent performance criteria

What is the amount that AF reports in its income statement for its stock options for the year ended December 31, 2013? [ Hint: See Note 30: Share-Based Compensation.] Are AFs share options cliff vesting or graded vesting? How does accounting differ between U.S. GAAP and IFRS for graded-vesting plans?

What is the amount that AF reports in its income statement for its stock options for the year ended December 31, 2013? [ Hint: See Note 30: Share-Based Compensation.] Are AFs share options cliff vesting or graded vesting? How does accounting differ between U.S. GAAP and IFRS for graded-vesting plans?