What is the analysis for these reports? Please explain if the results for the company is good or bad thanks!

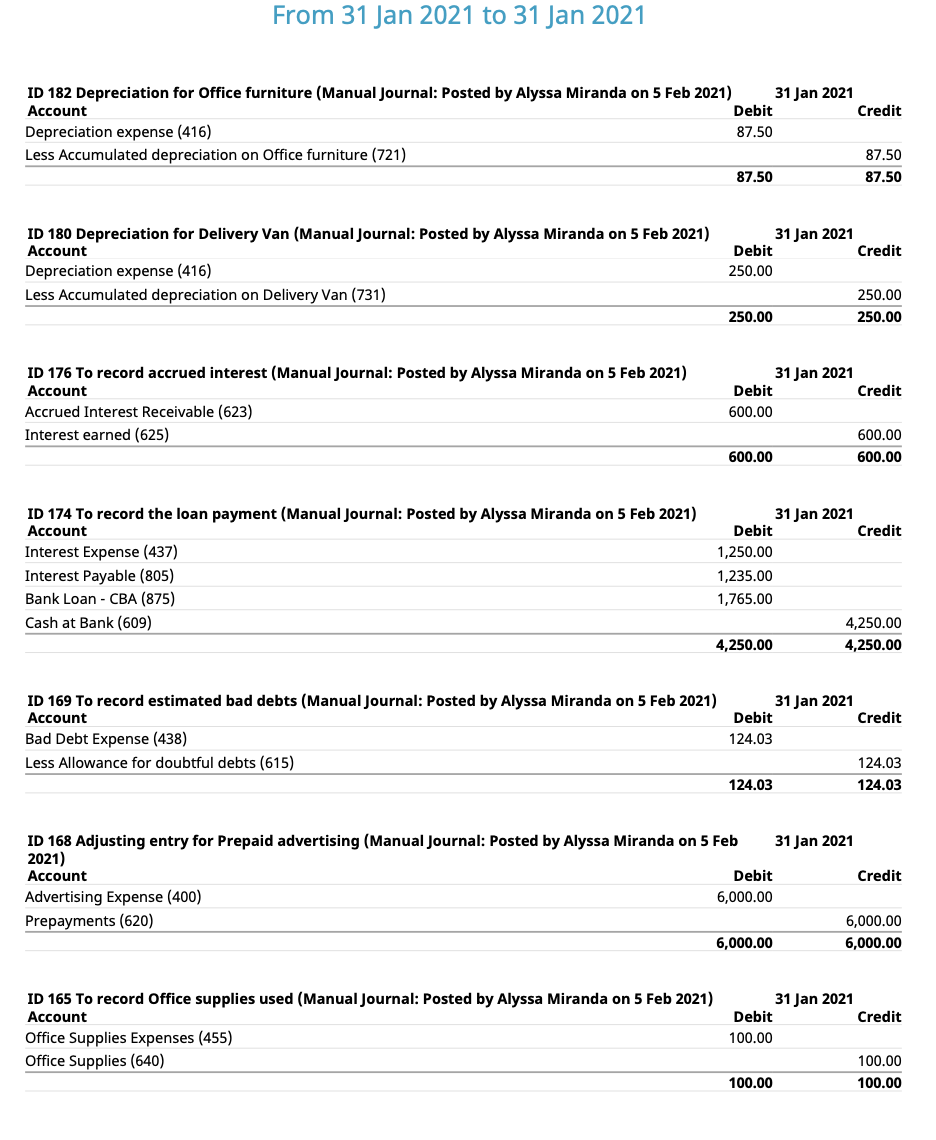

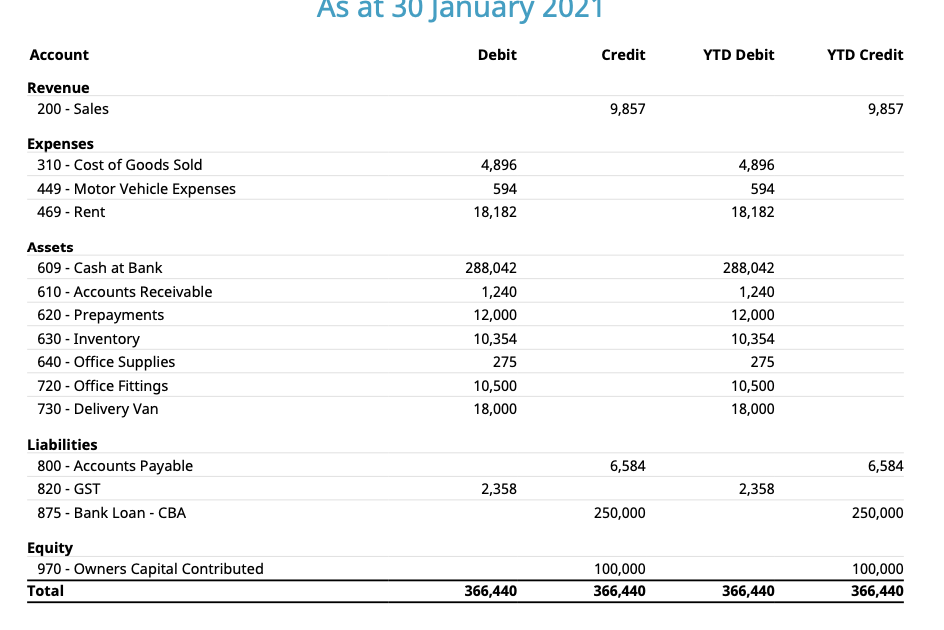

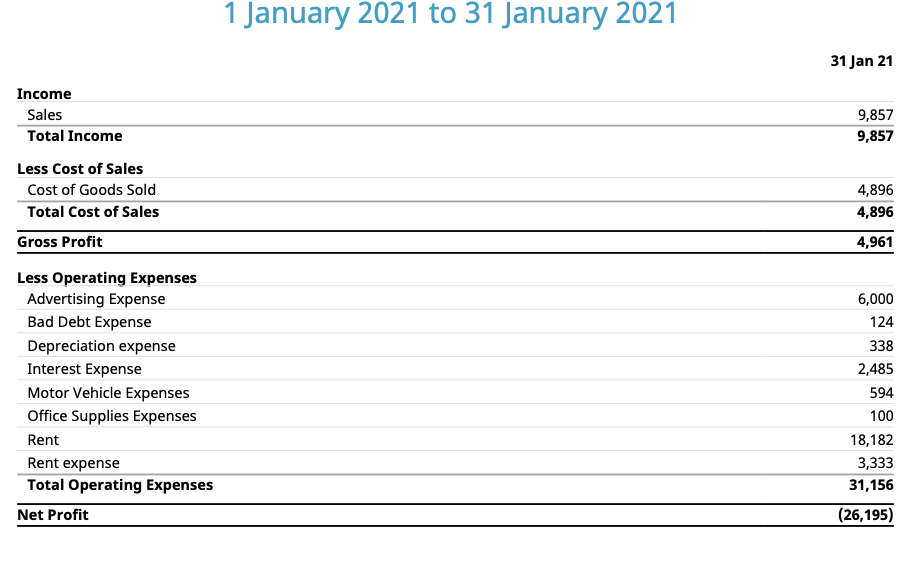

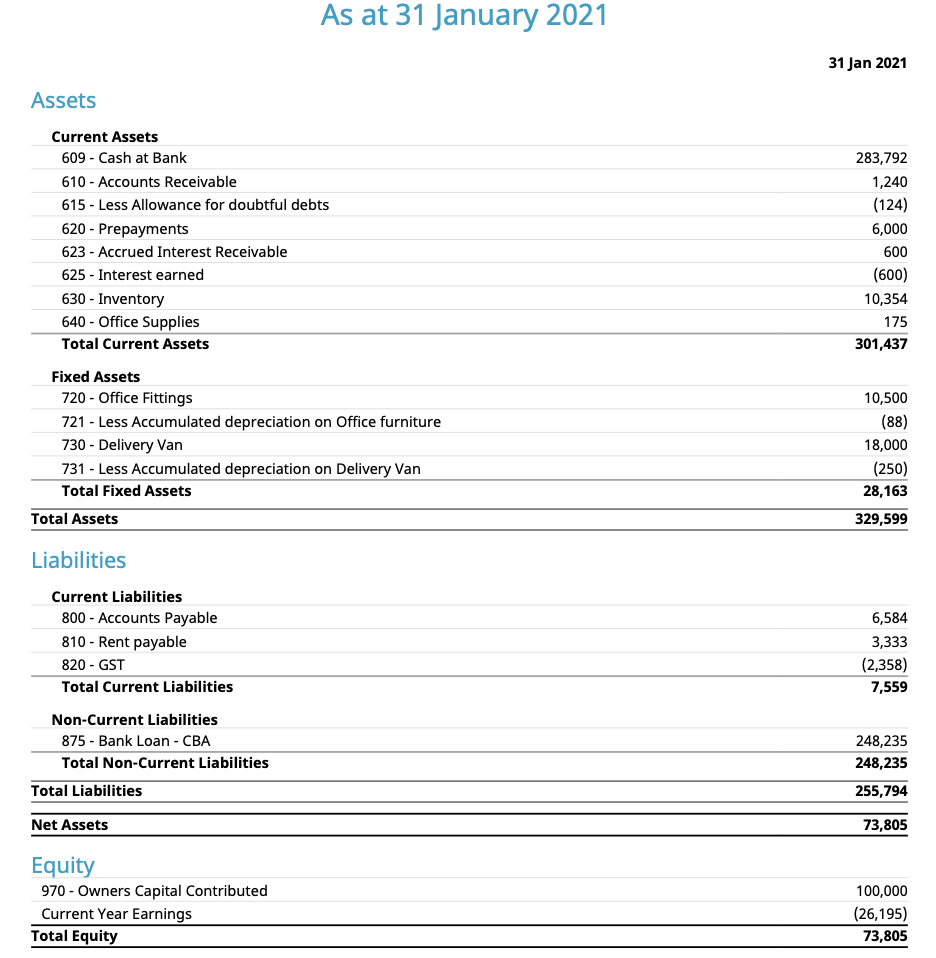

Trial balance, Journal report, Balance sheet, Profit and loss report

BALANCE SHEET

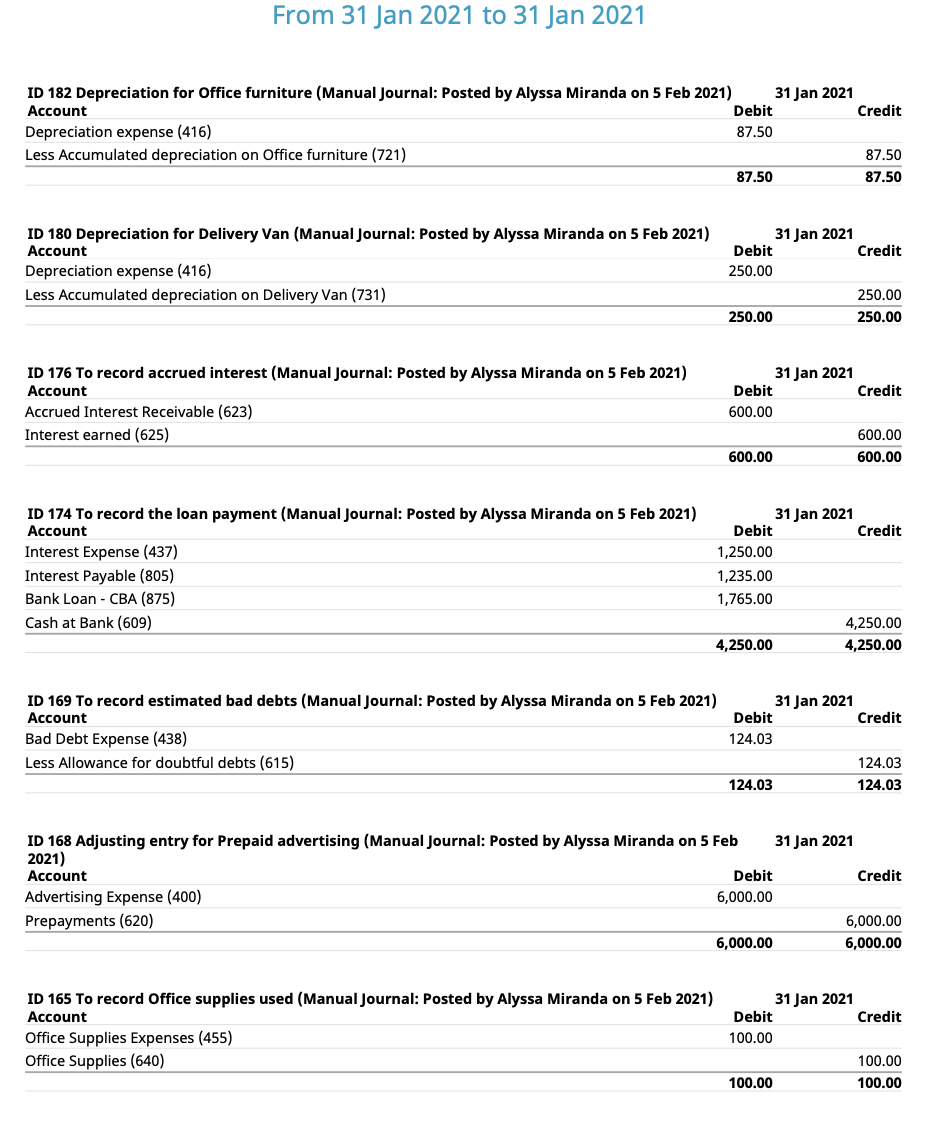

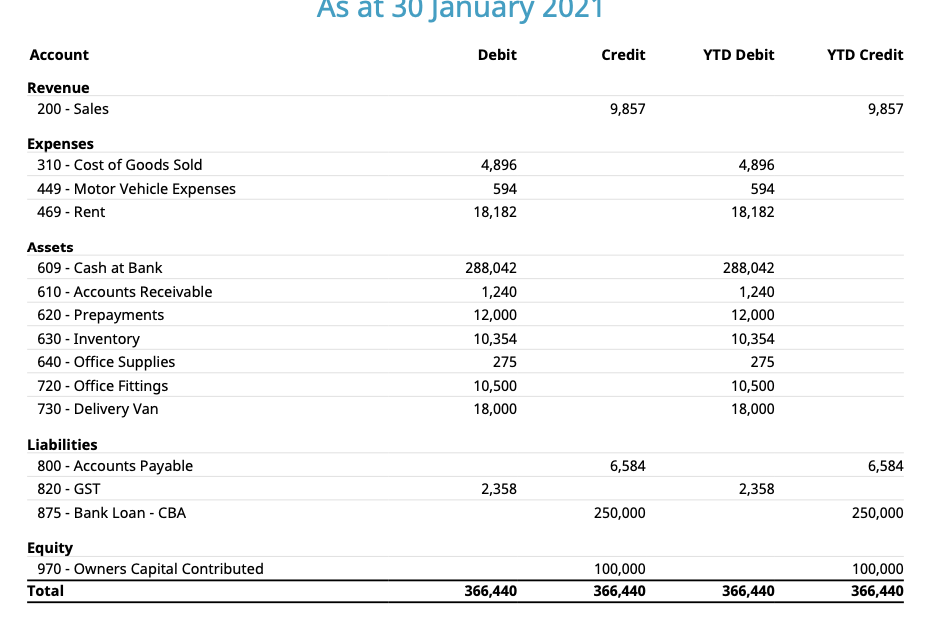

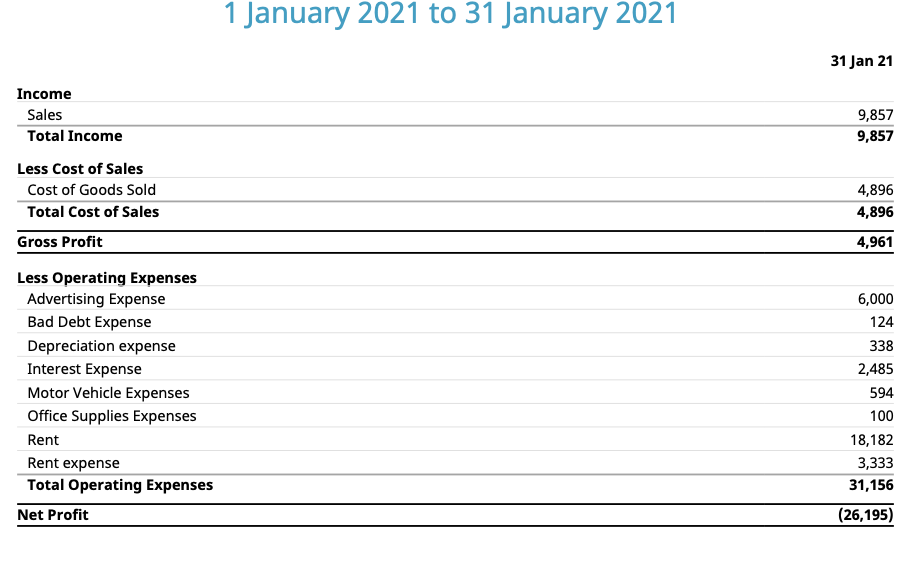

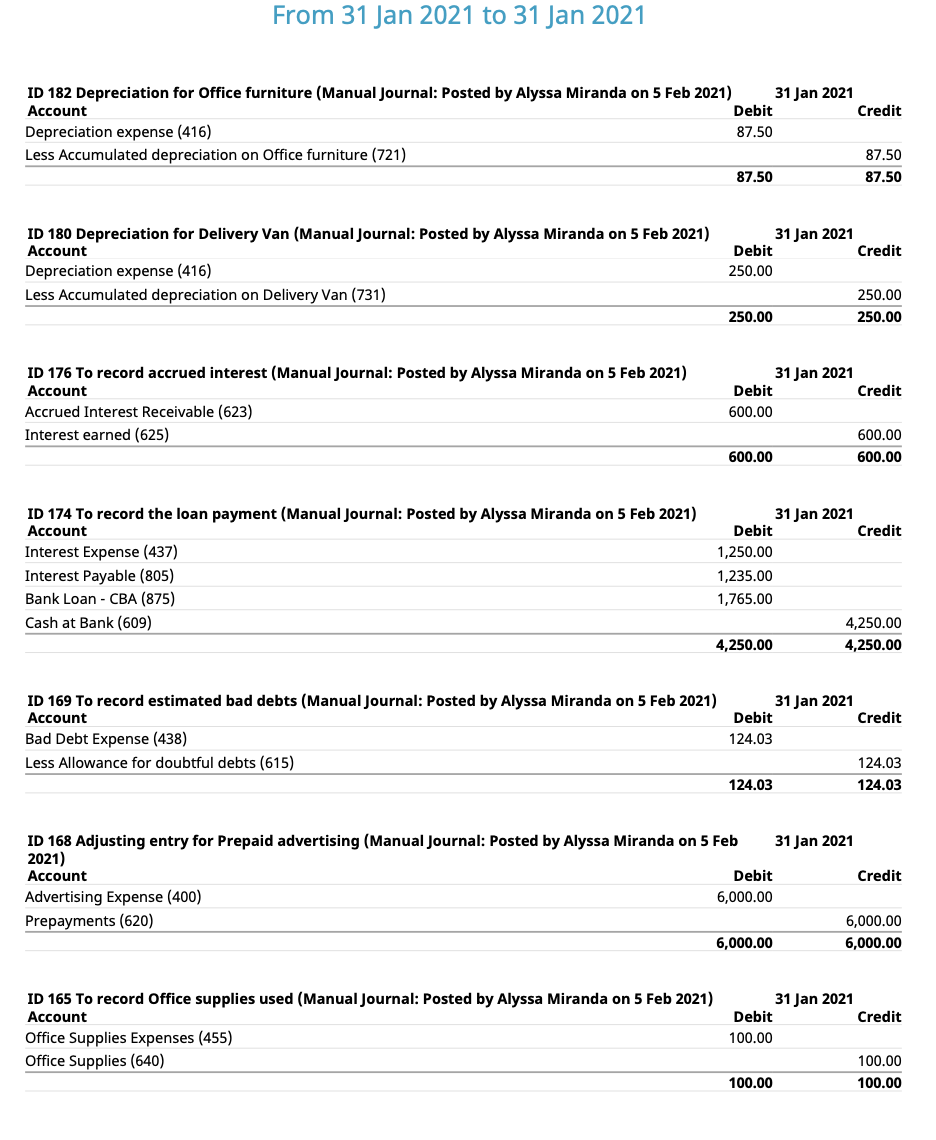

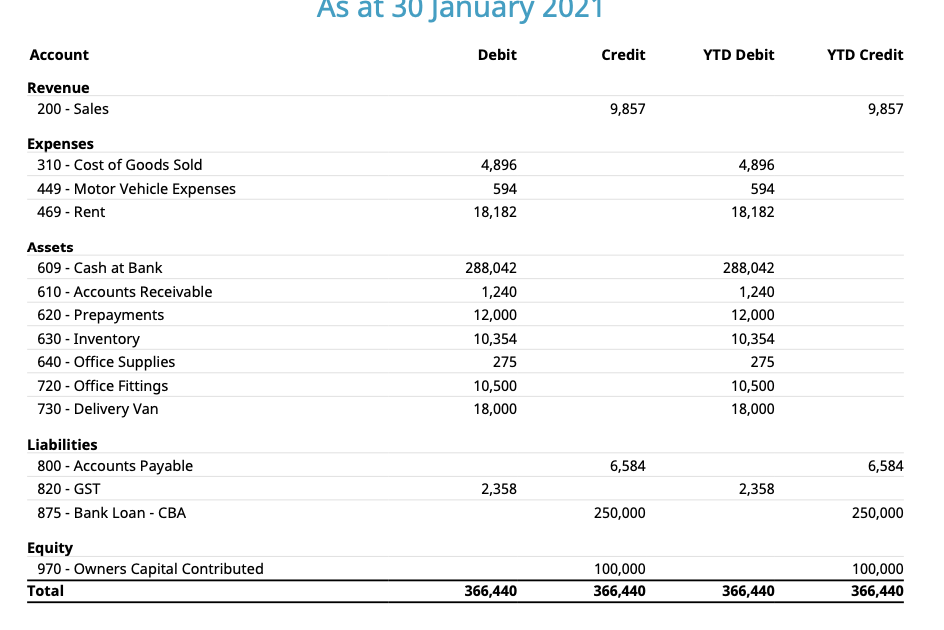

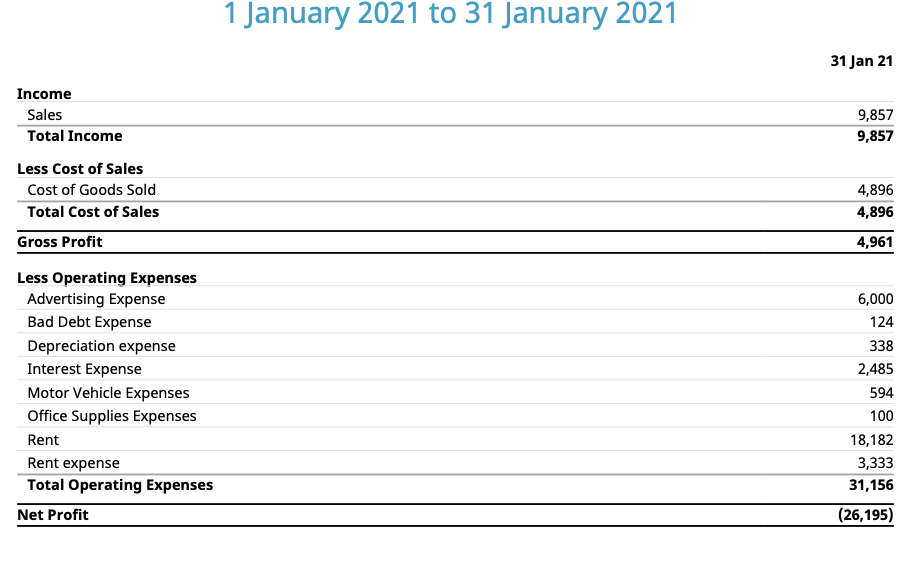

As at 31 January 2021 31 Jan 2021 Assets Current Assets 609 - Cash at Bank 283,792 610 - Accounts Receivable 1,240 615 - Less Allowance for doubtful debts (124) 620 - Prepayments 6,000 623 - Accrued Interest Receivable 600 625 - Interest earned (600) 630 - Inventory 10,354 640 - Office Supplies 175 Total Current Assets 301,437 Fixed Assets 720 - Office Fittings 10,500 721 - Less Accumulated depreciation on Office furniture (88) 730 - Delivery Van 18,000 731 - Less Accumulated depreciation on Delivery Van (250) Total Fixed Assets 28,163 Total Assets 329,599 Liabilities Current Liabilities 800 - Accounts Payable 6,584 810 - Rent payable 3,333 820 - GST (2,358) Total Current Liabilities 7,559 Non-Current Liabilities 875 - Bank Loan - CBA 248,235 Total Non-Current Liabilities 248,235 Total Liabilities 255,794 Net Assets 73,805 Equity 970 - Owners Capital Contributed 100,000 Current Year Earnings (26, 195) Total Equity 73,805From 31 Jan 2021 to 31 Jan 2021 ID 182 Depreciation for Office furniture (Manual Journal: Posted by Alyssa Miranda on 5 Feb 2021) 31 Jan 2021 Account Debit Credit Depreciation expense (416) 87.50 Less Accumulated depreciation on Office furniture (721) 87.50 87.50 87.50 ID 180 Depreciation for Delivery Van (Manual Journal: Posted by Alyssa Miranda on 5 Feb 2021) 31 Jan 2021 Account Debit Credit Depreciation expense (416) 250.00 Less Accumulated depreciation on Delivery Van (731) 250.00 250.00 250.00 ID 176 To record accrued interest (Manual Journal: Posted by Alyssa Miranda on 5 Feb 2021) 31 Jan 2021 Account Debit Credit Accrued Interest Receivable (623) 600.00 Interest earned (625) 600.00 600.00 600.00 ID 174 To record the loan payment (Manual Journal: Posted by Alyssa Miranda on 5 Feb 2021) 31 Jan 2021 Account Debit Credit Interest Expense (437) 1,250.00 Interest Payable (805) 1,235.00 Bank Loan - CBA (875) 1,765.00 Cash at Bank (609) 4,250.00 4,250.00 4,250.00 ID 169 To record estimated bad debts (Manual Journal: Posted by Alyssa Miranda on 5 Feb 2021) 31 Jan 2021 Account Debit Credit Bad Debt Expense (438) 124.03 Less Allowance for doubtful debts (615) 124.03 124.03 124.03 ID 168 Adjusting entry for Prepaid advertising (Manual Journal: Posted by Alyssa Miranda on 5 Feb 31 Jan 2021 2021) Account Debit Credit Advertising Expense (400) 6,000.00 Prepayments (620) 6,000.00 6,000.00 6,000.00 ID 165 To record Office supplies used (Manual Journal: Posted by Alyssa Miranda on 5 Feb 2021) 31 Jan 2021 Account Debit Credit Office Supplies Expenses (455) 100.00 Office Supplies (640) 100.00 100.00 100.00As at 30 January 2021 Account Debit Credit YTD Debit YTD Credit Revenue 200 - Sales 9,857 9,857 Expenses 310 - Cost of Goods Sold 4,896 4,896 449 - Motor Vehicle Expenses 594 594 469 - Rent 18,182 18,182 Assets 609 - Cash at Bank 288,042 288,042 610 - Accounts Receivable 1,240 1,240 620 - Prepayments 12,000 12,000 630 - Inventory 10,354 10,354 640 - Office Supplies 275 275 720 - Office Fittings 10,500 10,500 730 - Delivery Van 18,000 18,000 Liabilities 800 - Accounts Payable 6,584 6,584 820 - GST 2,358 2,358 875 - Bank Loan - CBA 250,000 250,000 Equity 970 - Owners Capital Contributed 100,000 100,000 Total 366,440 366,440 366,440 366,4401 January 2021 to 31 January 2021 31 Jan 21 Income Sales 9,85}ll Total Income 9,85? Less Cost of Sales Cost of Goods Sold 4,896 Total Cost of Sales 4,896 Gross Profit 4,961 Less Operating Expenses Advertising Expense 6,000 Bad Debt Expense 124 Depreciation expense 338 Interest Expense 2,485 Motor Vehicle Expenses 594 Ofce Supplies Expenses 100 Rent 18,182 Rent expense 3,333 Total Operating Expenses 31,156 Net Prot (25,195)