Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the annual percentage rate of interest on terms: 3/7, net 27? WHAT WOULD BE THE EASIEST WAY TO CALCULATE THIS ON A CALCULATOR?

What is the annual percentage rate of interest on terms: 3/7, net 27?

WHAT WOULD BE THE EASIEST WAY TO CALCULATE THIS ON A CALCULATOR?

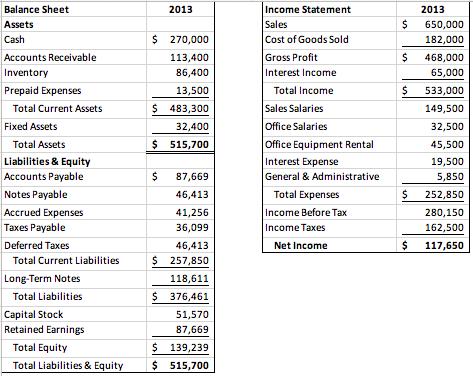

Balance Sheet Assets Cash 2013 Income Statement 2013 Sales $ 650,000 $ 270,000 Cost of Goods Sold 182,000 Accounts Receivable 113,400 Gross Profit $ 468,000 Inventory Prepaid Expenses Total Current Assets Fixed Assets 86,400 Interest Income 65,000 13,500 Total Income $ 533,000 $ 483,300 Sales Salaries 149,500 32,400 Office Salaries 32,500 Total Assets $ 515,700 Office Equipment Rental 45,500 Liabilities & Equity Interest Expense 19,500 Accounts Payable $ 87,669 General & Administrative 5,850 Notes Payable Accrued Expenses Taxes Payable 46,413 Total Expenses $ 252,850 41,256 Income Before Tax 280,150 36,099 Income Taxes 162,500 Deferred Taxes 46,413 Net Income $ 117,650 Total Current Liabilities $ 257,850 Long-Term Notes 118,611 Total Liabilities Capital Stock Retained Earnings Total Equity Total Liabilities & Equity $ 376,461 51,570 87,669 $ 139,239 $ 515,700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the annual percentage rate APR of interest on terms such as 37 net 27 you need to know the discount period the discount percentage and th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started