What is the answer for question 4 and 5? thank you

Please show steps

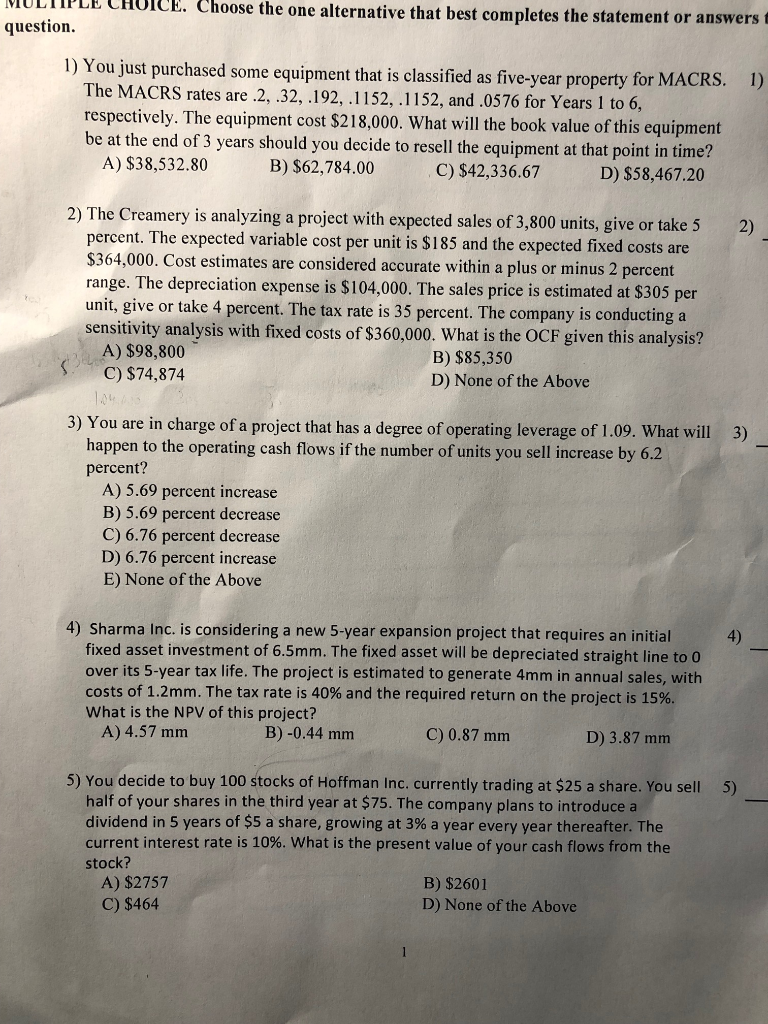

VIULTIPLE CHOICE. Choose the one alternative that best completes the staten question 1) You just purchased some equipment that is classified as five-year property for MACRS. 1) The MACRS rates are .2, .32, 192, 1152,.1152, and.0576 for Years 1 to 6, respectively. The equipment cost $218,000. What will the book value of this equipment be at the end of 3 years should you decide to resell the equipment at that point in time A) $38,532.80 B) $62,784.00 C) $42,336.67 D) $58,467.20 2) The Creamery is analyzing a project with expected sales of 3,800 units, give or take 5 2) percent. The expected variable cost per unit is $185 and the expected fixed costs are range. The depreciation expense is $104,000. The sales price is estimated at $305 per sensitivity analysis with fixed costs of $360,000. What is the OCF given this analysis? $364,000. Cost estimates are considered accurate within a plus or minus 2 percer give or take 4 percent. The tax rate is 35 percent. The company is conducting a A) $98,800 C) $74,874 B) $85,350 D) None of the Above 3) You are in charge of a project that has a degree of operating leverage of 1.09. What will 3) happen to the operating cash flows if the number of units you sell increase by 6.2 percent? A) 5.69 percent increase B) 5.69 percent decrease C) 6.76 percent decrease D) 6.76 percent increase E) None of the Above 4) Sharma Inc. is considering a new 5-year expansion project that requires an initial 4) fixed asset investment of 6.5mm. The fixed asset will be depreciated straight line to O over its 5-year tax life. The project is estimated to generate 4mm in annual sales, with costs of 1.2mm. The tax rate is 40% and the required return on the project is 15% What is the NPV of this project? A) 4.57 mm B) -0.44 mm C) 0.87 mm D) 3.87 mm 5) You decide to buy 100 stocks of Hoffman Inc. currently trading at $25 a share. You sell 5) half of your shares in the third year at $75. The company plans to introduce a dividend in 5 years of $5 a share, growing at 3% a year every year thereafter. The est rate is 10%, what is the present value of your cash flows from the stock? A) $2757 C) $464 B) $2601 D) None of the Above