Answered step by step

Verified Expert Solution

Question

1 Approved Answer

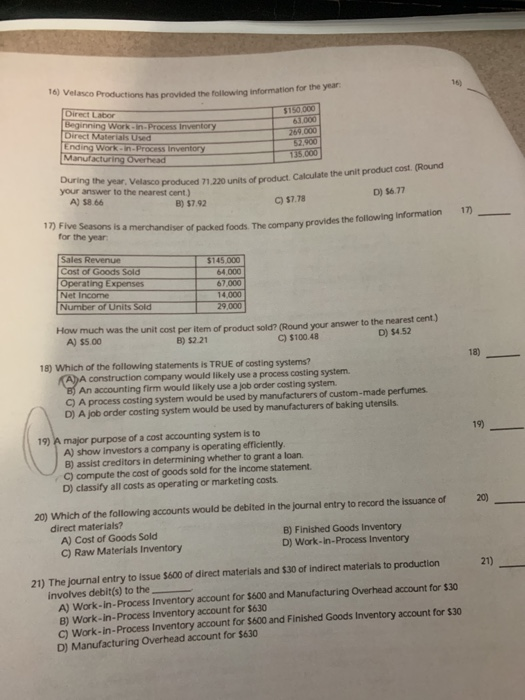

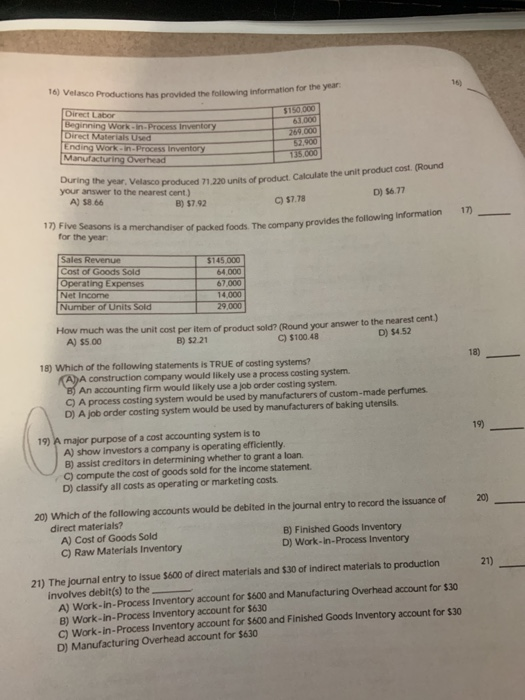

what is the answer from 16 to 21 please 16 16) Velasco Productions has provided the following information for the year $150 000 61.000 269.000

what is the answer from 16 to 21 please

16 16) Velasco Productions has provided the following information for the year $150 000 61.000 269.000 SP00 Direct Labor Beginning Work-in-Process Inventory Direct Materials Used Ending Work-in-Process Inventory Manufacturing Overhead 18S 000 During the year, Velasco produced 71,220 units of product. Calculate the unit product cost. (Round your answer to the nearest cent.) D) $6.77 A) $8.66 ) $7.78 B) $7.92 17) 17) Five Seasons is a merchandiser of packed foods. The company provides the following information for the year Sales Revenue Cost of Goods Sold $145.000 64.000 Operating Expenses Net Income Number of Units Sold 67,000 14.000 29,000 How much was the unit cost per item of product sold? (Round your answer to the nearest cent) A) $5.00 D) $4.52 C) $100.48 B) $2.21 18) 18) Which of the following statements is TRUE of costing systems? KADA construction company would likely use a process costing system. B An accounting firm would likely use a job order costing system. C) A process costing system would be used by manufacturers of custom-made perfumes D) A job order costing system would be used by manufacturers of baking utensils 19) 19) A major purpose of a cost accounting system is to A) show investors a company is operating efficiently. B) assist creditors in determining whether to grant a loan. C) compute the cost of goods sold for the income statement. D) classify all costs as operating or marketing costs 20) 20) Which of the following accounts would be debited in the journal entry to record the issuance of direct materials? A) Cost of Goods Sold C) Raw Materials Inventory B) Finished Goods Inventory D) Work-in-Process Inventory 21) The journal entry to issue $600 of direct materials and $30 of indirect materials to production involves debit(s) to the A) Work-in-Process Inventory account for $600 and Manufacturing Overhead account for $30 B) Work-in-Process Inventory account for $630 C) Work-in-Process Inventory account for $600 and Finished Goods Inventory account for $30 21) D) Manufacturing Overhead account for $630

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started