Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the answer of 2(b)? Questions for Bed Bath & Beyond case Deliverable: Please submit your case writeup on Canvas in the form of

What is the answer of 2(b)?

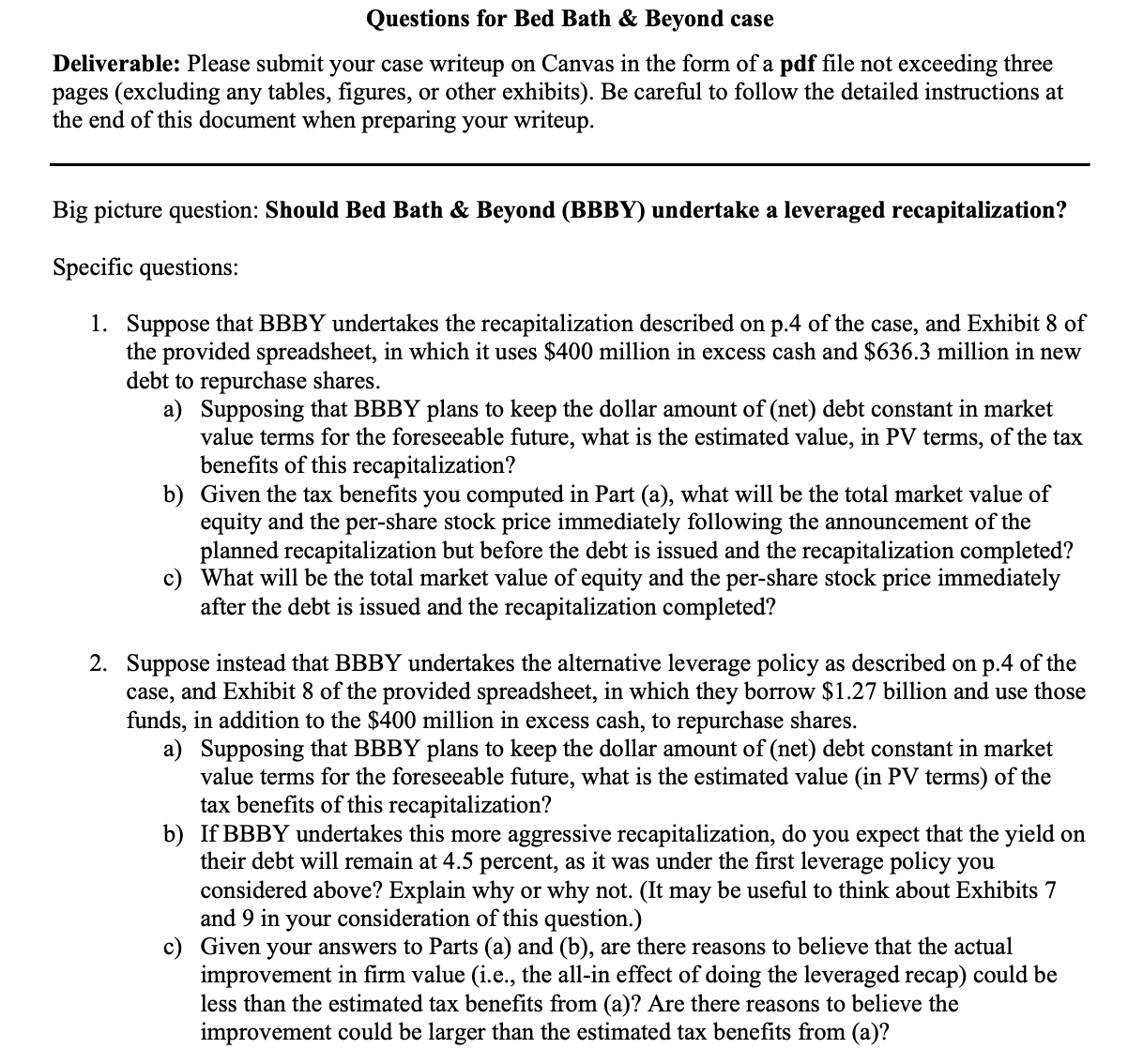

Questions for Bed Bath & Beyond case Deliverable: Please submit your case writeup on Canvas in the form of a pdf file not exceeding three pages (excluding any tables, figures, or other exhibits). Be careful to follow the detailed instructions at the end of this document when preparing your writeup. Big picture question: Should Bed Bath & Beyond (BBBY) undertake a leveraged recapitalization? Specific questions: 1. Suppose that BBBY undertakes the recapitalization described on p.4 of the case, and Exhibit 8 of the provided spreadsheet, in which it uses $400 million in excess cash and $636.3 million in new debt to repurchase shares. a) Supposing that BBBY plans to keep the dollar amount of (net) debt constant in market value terms for the foreseeable future, what is the estimated value, in PV terms, of the tax benefits of this recapitalization? b) Given the tax benefits you computed in Part (a), what will be the total market value of equity and the per-share stock price immediately following the announcement of the planned recapitalization but before the debt is issued and the recapitalization completed? c) What will be the total market value of equity and the per-share stock price immediately after the debt is issued and the recapitalization completed? 2. Suppose instead that BBBY undertakes the alternative leverage policy as described on p.4 of the case, and Exhibit 8 of the provided spreadsheet, in which they borrow $1.27 billion and use those funds, in addition to the $400 million in excess cash, to repurchase shares. a) Supposing that BBBY plans to keep the dollar amount of (net) debt constant in market value terms for the foreseeable future, what is the estimated value (in PV terms) of the tax benefits of this recapitalization? b) If BBBY undertakes this more aggressive recapitalization, do you expect that the yield on their debt will remain at 4.5 percent, as it was under the first leverage policy you considered above? Explain why or why not. (It may be useful to think about Exhibits 7 and 9 in your consideration of this question.) Given your answers to Parts (a) and (b), are there reasons to believe that the actual improvement in firm value (i.e., the all-in effect of doing the leveraged recap) could be less than the estimated tax benefits from (a)? Are there reasons to believe the improvement could be larger than the estimated tax benefits from (a)?

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started