Answered step by step

Verified Expert Solution

Question

1 Approved Answer

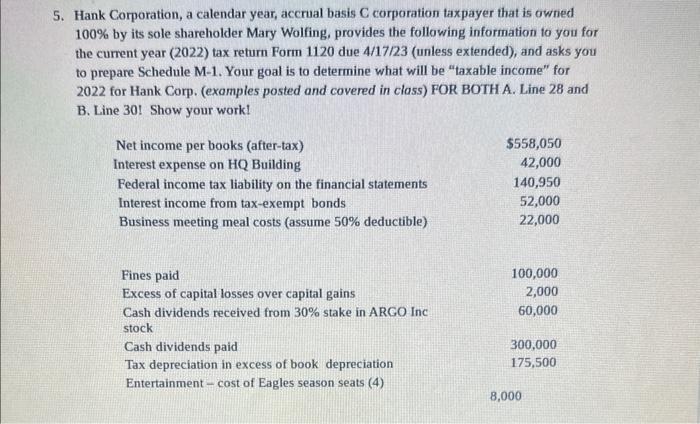

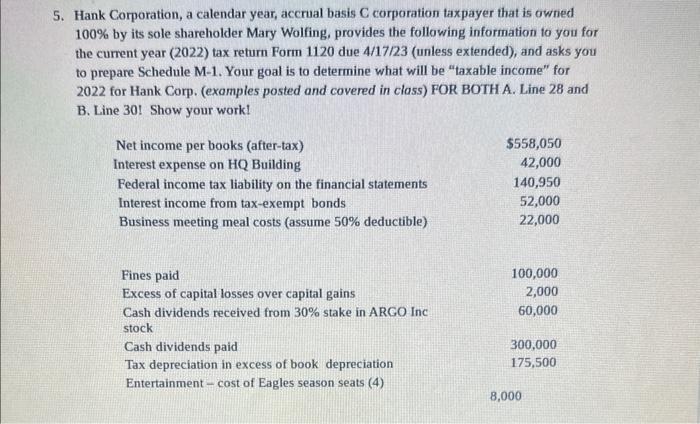

what is the answer to this? 5. Hank Corporation, a calendar year, accrual basis C corporation taxpayer that is owned 100% by its sole shareholder

what is the answer to this?

5. Hank Corporation, a calendar year, accrual basis C corporation taxpayer that is owned 100% by its sole shareholder Mary Wolfing, provides the following information to you for the current year (2022) tax return Form 1120 due 4/17/23 (unless extended), and asks you to prepare Schedule M-1. Your goal is to determine what will be "taxable income" for 2022 for Hank Corp. (examples posted and covered in class) FOR BOTH A. Line 28 and B. Line 30! Show your work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started