Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is the answer to this? Summer Corporation's is a USA business but international in scope and is subject to income taxes in a one

what is the answer to this?

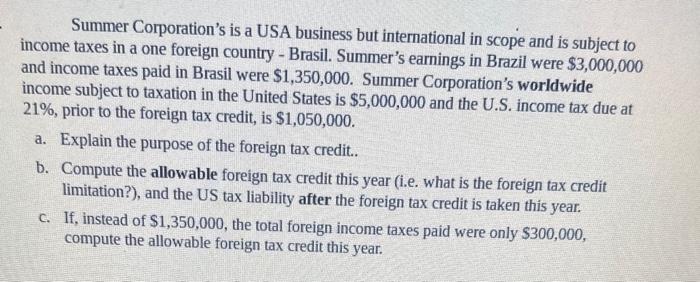

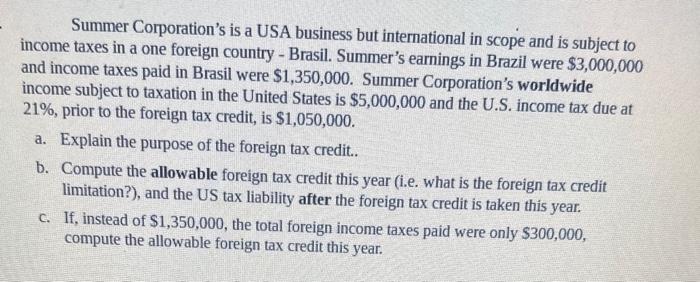

Summer Corporation's is a USA business but international in scope and is subject to income taxes in a one foreign country - Brasil. Summer's earnings in Brazil were $3,000,000 and income taxes paid in Brasil were $1,350,000. Summer Corporation's worldwide income subject to taxation in the United States is $5,000,000 and the U.S. income tax due at 21%, prior to the foreign tax credit, is $1,050,000. a. Explain the purpose of the foreign tax credit.. b. Compute the allowable foreign tax credit this year (i.e. what is the foreign tax credit limitation?), and the US tax liability after the foreign tax credit is taken this year. c. If, instead of $1,350,000, the total foreign income taxes paid were only $300,000, compute the allowable foreign tax credit this year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started