Answered step by step

Verified Expert Solution

Question

1 Approved Answer

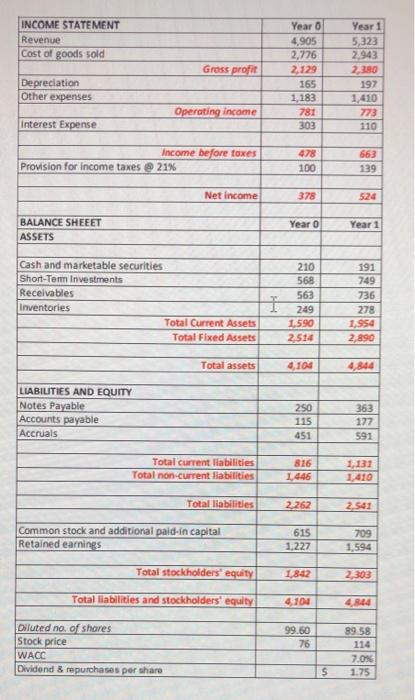

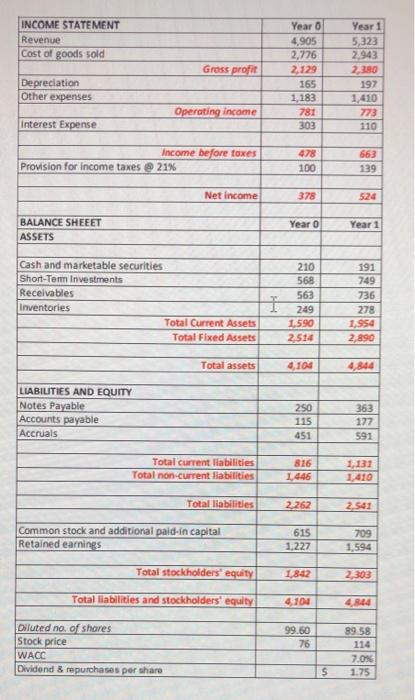

What is the basic earnings power (BEP) ratio of Lowell Inc for Year 1. INCOME STATEMENT Revenue Cost of goods sold Gross profit Year o

What is the basic earnings power (BEP) ratio of Lowell Inc for Year 1.

INCOME STATEMENT Revenue Cost of goods sold Gross profit Year o 4,905 2,776 2.129 165 1 183 781 303 Depreciation Other expenses Year 1 5,323 2.943 2,380 197 1,410 773 110 Operating income Interest Expense Income before foxes Provision for income taxes 21% 478 100 663 139 Net Income 378 Year o BALANCE SHEEET ASSETS Year 1 Cash and marketable securities Short-Term Investments Receivables Inventories Total Current Assets Total Fixed Assets HR 210 568 563 249 1.590 2514 191 749 736 278 1.954 2,890 Total assets 4,100 4,844 LIABILITIES AND EQUITY Notes Payable Accounts payable Accruals 250 115 451 363 177 591 Total current liabilities Total non-current liabilities 816 1.446 1.131 1.410 Total liabilities 2,262 2.541 Common stock and additional paid-in capital Retained earnings 615 1,227 709 1,594 Total stockholders' equity 1842 2,303 Total liabilities and stockholders' equity 4,104 Diluted no. of shares Stock price WACC Dividend & repurchases per share 99.50 76 89 58 114 7.0% 1.75 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started