What is the best option for each one of these?

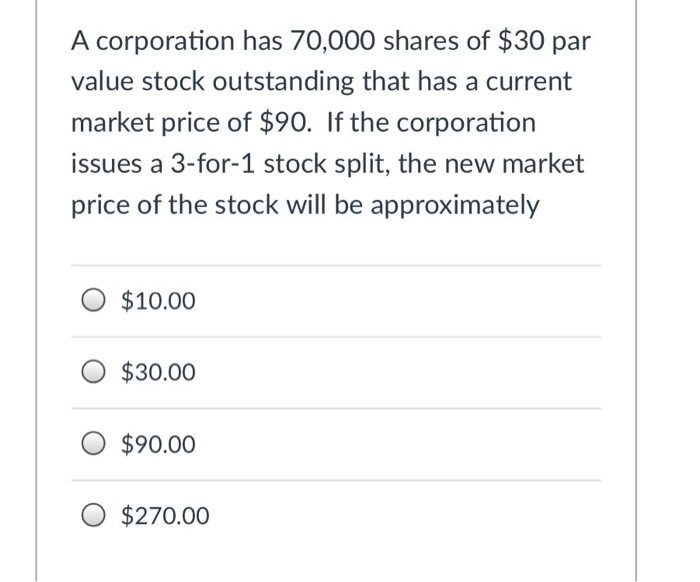

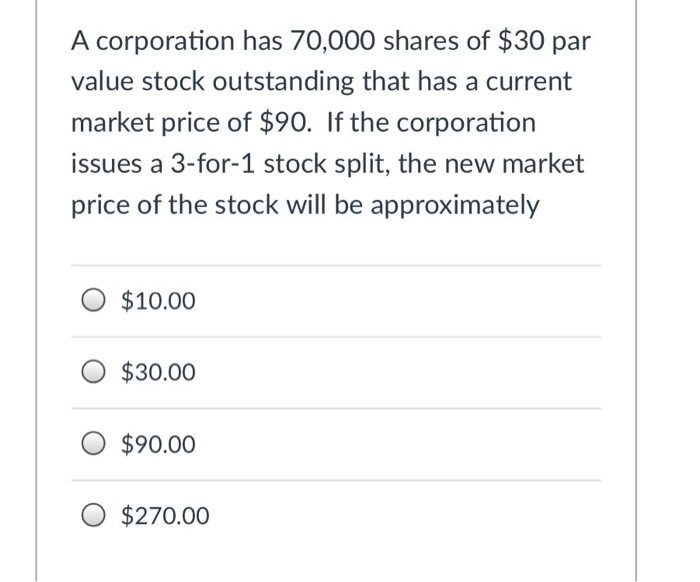

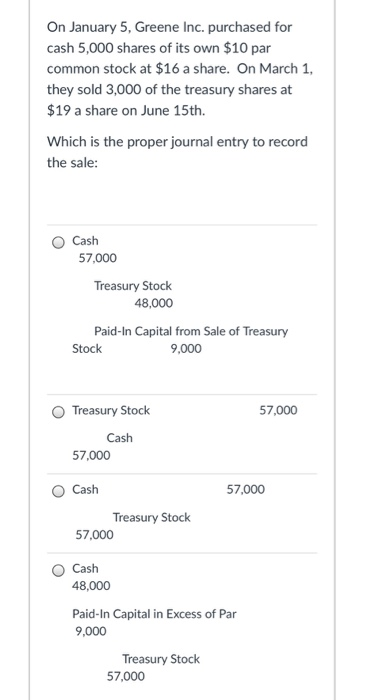

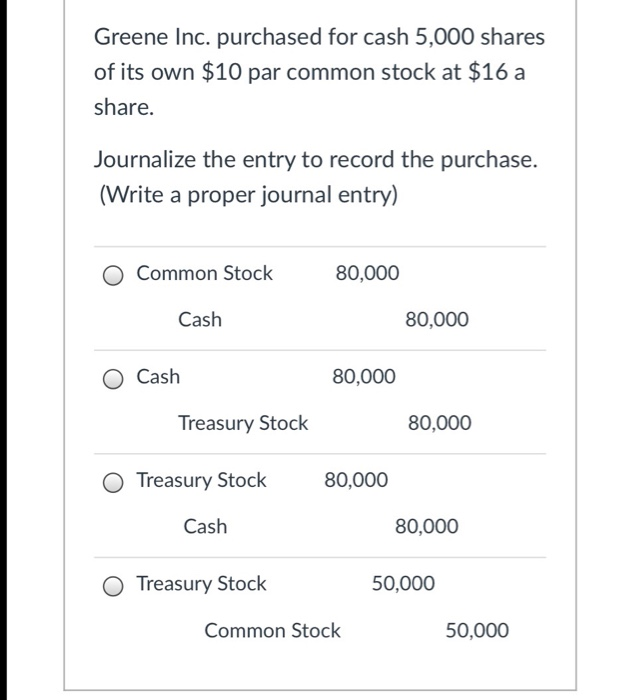

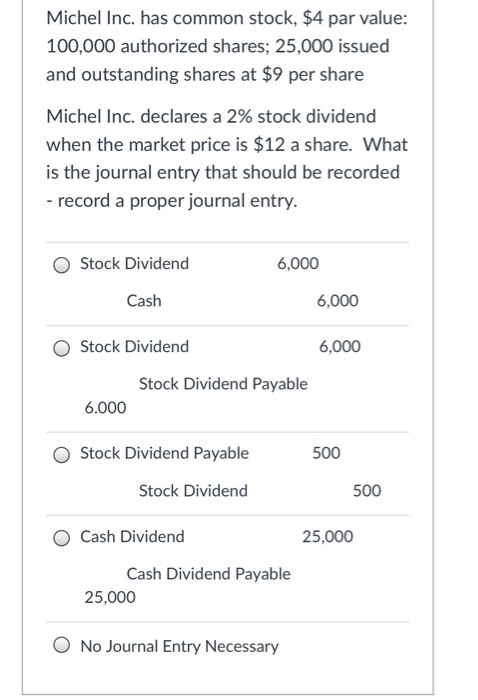

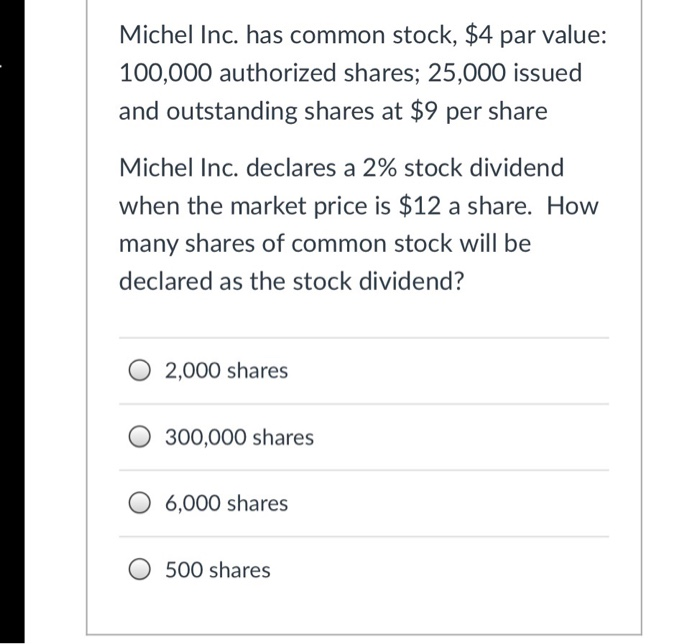

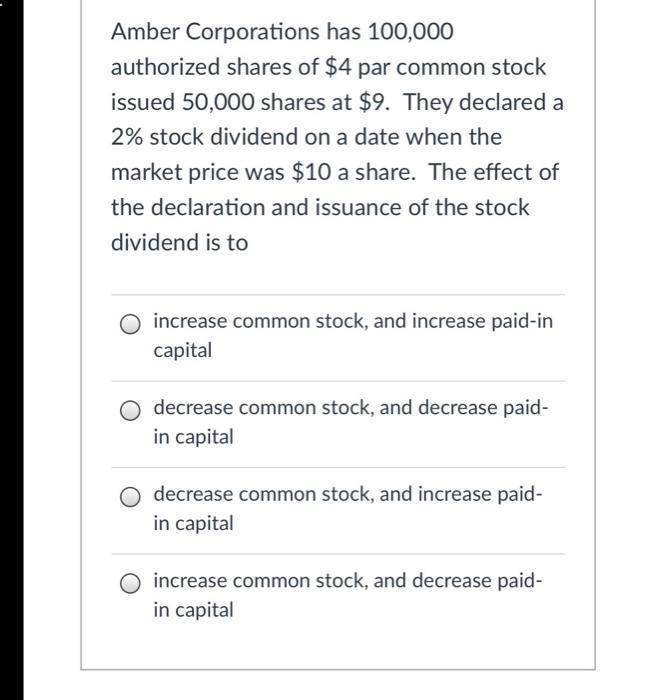

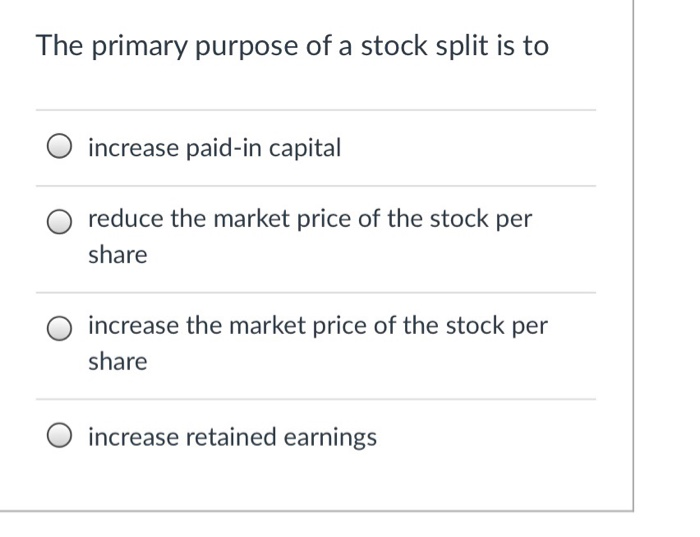

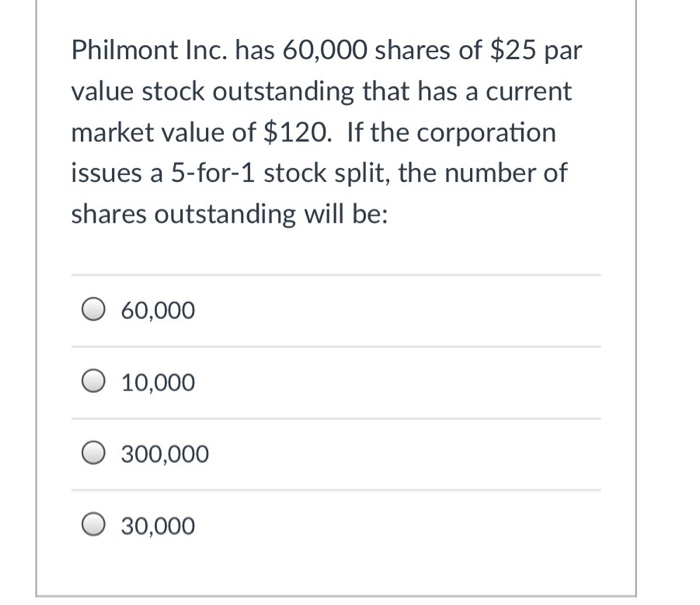

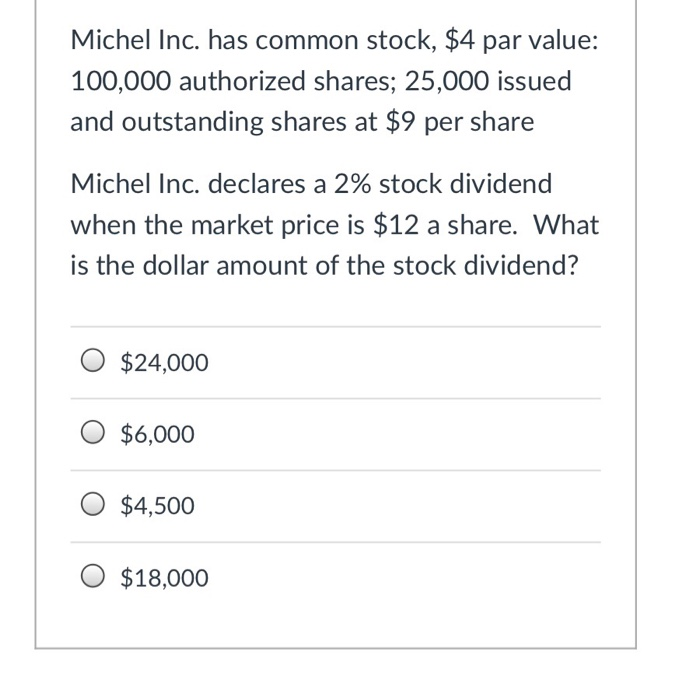

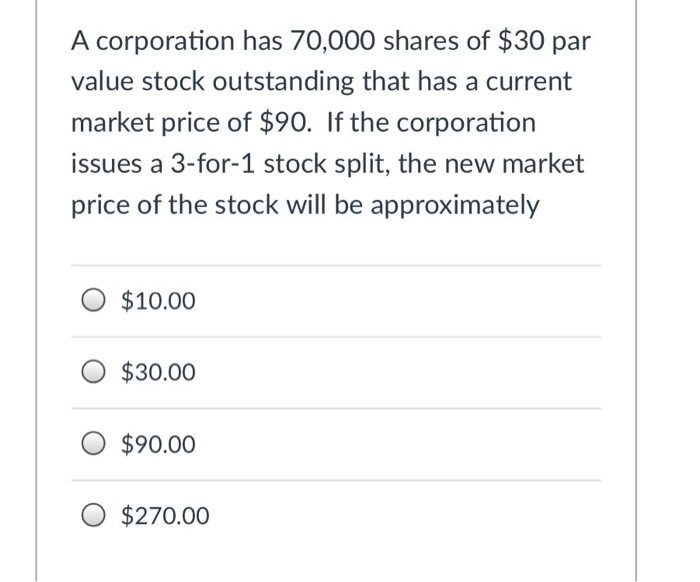

A corporation has 70,000 shares of $30 par value stock outstanding that has a current market price of $90. If the corporation issues a 3-for-1 stock split, the new market price of the stock will be approximately O $10.00 O $30.00 O $90.00 O $270.00 On January 5, Greene Inc. purchased for cash 5,000 shares of its own $10 par common stock at $16 a share. On March 1, they sold 3,000 of the treasury shares at $19 a share on June 15th. Which is the proper journal entry to record the sale O Cash 57,000 Treasury Stock 48,000 Paid-In Capital from Sale of Treasury Stock 9,000 O Treasury Stock 57,000 Cash 57,000 O Cash 57,000 Treasury Stock 57,000 O Cash 48,000 Paid-In Capital in Excess of Par 9,000 Treasury Stock 57,000 Farmers Corporation has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends: Year$30,000 1: Year 45,000 2: Year 70,000 3: What is the total dollar amount that will be paid out to the Common Stock shareholders in year 3? O $45,000 O $25,000 O $40,000 O $70,000 Greene Inc. purchased for cash 5,000 shares of its own $10 par common stock at $16 a share. Journalize the entry to record the purchase. (Write a proper journal entry) Common Stock 80,000 Cash 80,000 O Cash 80,000 Treasury Stock 80,000 Treasury Stock 80,000 Cash 80,000 O Treasury Stock 50,000 Common Stock 50,000 Michel Inc. has common stock, $4 par value: 100,000 authorized shares; 25,000 issued and outstanding shares at $9 per share Michel Inc. declares a 2% stock dividend when the market price is $12 a share. What is the journal entry that should be recorded record a proper journal entry. O Stock Dividend 6,000 Cash 6,000 O Stock Dividend 6,000 Stock Dividend Payable 6.000 O Stock Dividend Payable 500 Stock Dividend 500 O Cash Dividend 25,000 Cash Dividend Payable 25,000 O No Journal Entry Necssary Michel Inc. has common stock, $4 par value: 100,000 authorized shares; 25,000 issued and outstanding shares at $9 per share Michel Inc. declares a 2% stock dividend when the market price is $12 a share. How many shares of common stock will be declared as the stock dividend? O 2,000 shares O 300,000 shares O 6,000 shares O 500 shares Amber Corporations has 100,000 authorized shares of $4 par common stock issued 50,000 shares at $9. They declared a 2% stock dividend on a date when the market price was $10 a share. The effect of the declaration and issuance of the stock dividend is to O increase common stock, and increase paid-in capital O decrease common stock, and decrease paid- in capital O decrease common stock, and increase paid- in capital O increase common stock, and decrease paid- in capital The primary purpose of a stock split is to O increase paid-in capital O reduce the market price of the stock per share O increase the market price of the stock per share O increase retained earnings Philmont Inc. has 60,000 shares of $25 par value stock outstanding that has a current market value of $120. If the corporation issues a 5-for-1 stock split, the number of shares outstanding will be: O 60,000 O 10,000 O 300,000 O 30,000 Michel Inc. has common stock, $4 par value: 100,000 authorized shares; 25,000 issued and outstanding shares at $9 per share Michel Inc. declares a 2% stock dividend when the market price is $12 a share. What is the dollar amount of the stock dividend? O $24,000 O $6,000 O $4,500 O $18,000