Answered step by step

Verified Expert Solution

Question

1 Approved Answer

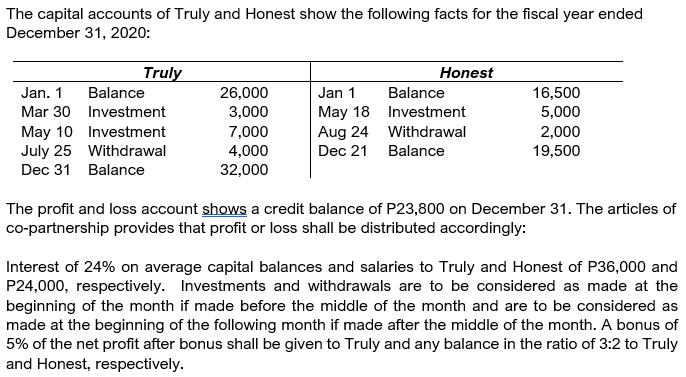

What is the capital balance of Truly on December 31, 2020? The capital accounts of Truly and Honest show the following facts for the fiscal

What is the capital balance of Truly on December 31, 2020?

The capital accounts of Truly and Honest show the following facts for the fiscal year ended December 31, 2020: Jan. 1 Mar 30 May 10 July 25 Dec 31 Truly Balance Investment Investment Withdrawal Balance 26,000 3,000 7,000 4,000 32,000 Jan 1 May 18 Aug 24 Dec 21 Honest Balance Investment Withdrawal Balance 16,500 5,000 2,000 19,500 The profit and loss account shows a credit balance of P23,800 on December 31. The articles of co-partnership provides that profit or loss shall be distributed accordingly: Interest of 24% on average capital balances and salaries to Truly and Honest of P36,000 and P24,000, respectively. Investments and withdrawals are to be considered as made at the beginning of the month if made before the middle of the month and are to be considered as made at the beginning of the following month if made after the middle of the month. A bonus of 5% of the net profit after bonus shall be given to Truly and any balance in the ratio of 3:2 to Truly and Honest, respectively.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the profit distribution for Truly and Honest we can follow these steps 1 Calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started