What is the capital structure of respected organization in most recent and pervious reporting period?

What is the capital structure of respected organization in most recent and pervious reporting period?

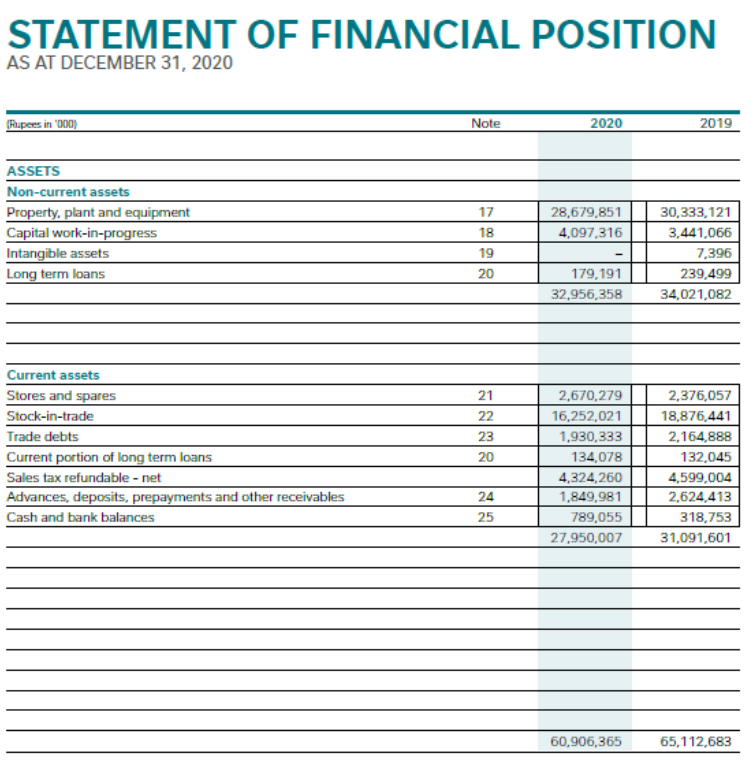

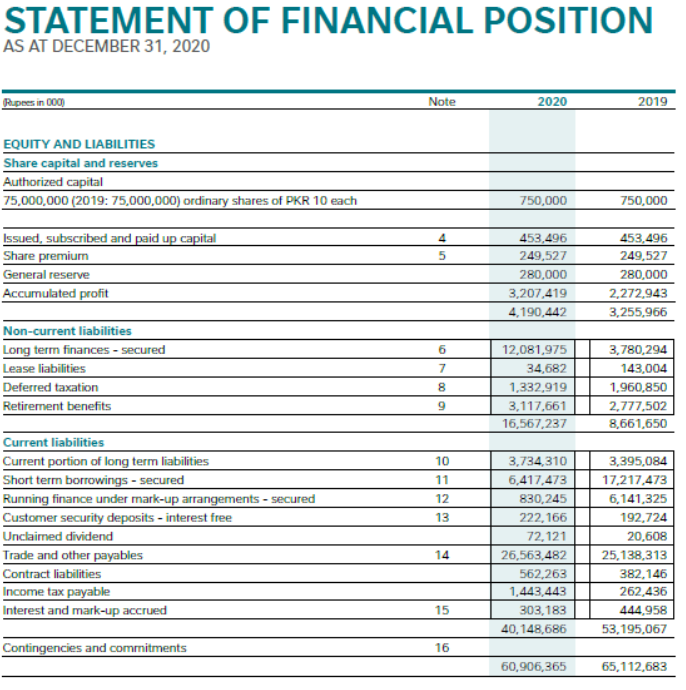

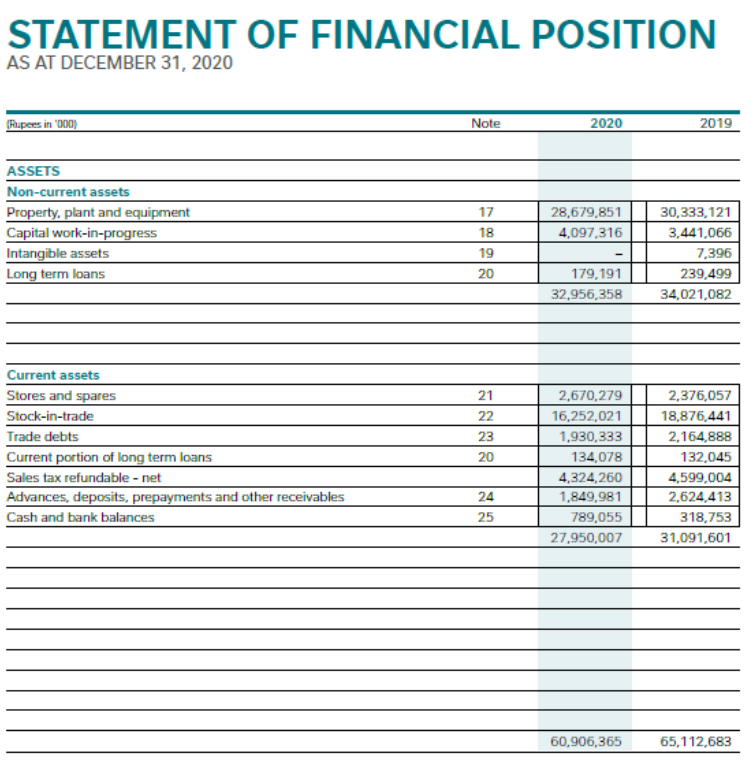

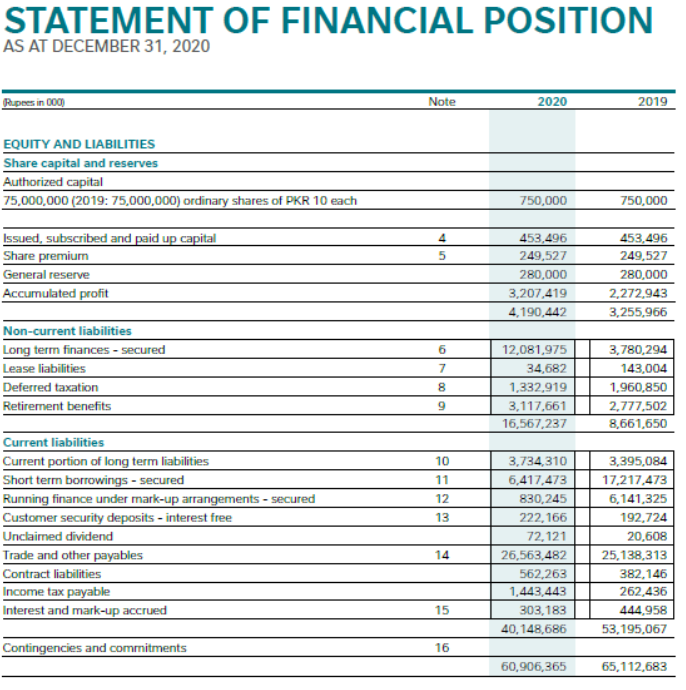

STATEMENT OF FINANCIAL POSITION AS AT DECEMBER 31, 2020 (Rupees in '000 Note 2020 2019 ASSETS Non-current assets Property, plant and equipment Capital work-in-progress Intangible assets Long term loans 28,679,851 4,097,316 17 18 19 20 30,333,121 3,441,066 7,396 239,499 34,02 1,082 179,191 32,956,358 Current assets Stores and spares Stock-in-trade Trade debts Current portion of long term loans Sales tax refundable - net Advances, deposits, prepayments and other receivables Cash and bank balances 21 22 23 20 2,670,279 16,252,021 1.930,333 134,078 4,324,260 1,849,981 789,055 27,950,007 2,376,057 18,876,441 2,164,888 132,045 4,599,004 2,624,413 318,753 31,091,601 24 25 60,906,365 65,112,683 STATEMENT OF FINANCIAL POSITION AS AT DECEMBER 31, 2020 Rupees in 000 Note 2020 2019 EQUITY AND LIABILITIES Share capital and reserves Authorized capital 75,000,000 (2019: 75,000,000) ordinary shares of PKR 10 each 750,000 750,000 4 5 Issued, subscribed and paid up capital Share premium General reserve Accumulated profit 453,496 249,527 280,000 3,207,419 4,190,442 453,496 249,527 280,000 2,272,943 3,255,966 6 Non-current liabilities Long term finances - secured Lease liabilities Deferred taxation Retirement benefits 7 8 12,081,975 34,682 1,332,919 3,117,661 16,567,237 3,780,294 143,004 1,960,850 2,777,502 8,661,650 9 10 11 12 13 Current liabilities Current portion of long term liabilities Short term borrowings - Secured Running finance under mark-up arrangements - Secured Customer security deposits - interest free Unclaimed dividend Trade and other payables Contract liabilities Income tax payable Interest and mark-up accrued 3,734,310 6,417,473 830,245 222,166 72,121 26,563,482 562,263 1,443,443 303,183 40,148,686 3,395,084 17,217,473 6,141,325 192,724 20,608 25,138,313 382,146 262,436 444,958 53,195,067 14 15 Contingencies and commitments 16 60,906,365 65,112,683 STATEMENT OF FINANCIAL POSITION AS AT DECEMBER 31, 2020 (Rupees in '000 Note 2020 2019 ASSETS Non-current assets Property, plant and equipment Capital work-in-progress Intangible assets Long term loans 28,679,851 4,097,316 17 18 19 20 30,333,121 3,441,066 7,396 239,499 34,02 1,082 179,191 32,956,358 Current assets Stores and spares Stock-in-trade Trade debts Current portion of long term loans Sales tax refundable - net Advances, deposits, prepayments and other receivables Cash and bank balances 21 22 23 20 2,670,279 16,252,021 1.930,333 134,078 4,324,260 1,849,981 789,055 27,950,007 2,376,057 18,876,441 2,164,888 132,045 4,599,004 2,624,413 318,753 31,091,601 24 25 60,906,365 65,112,683 STATEMENT OF FINANCIAL POSITION AS AT DECEMBER 31, 2020 Rupees in 000 Note 2020 2019 EQUITY AND LIABILITIES Share capital and reserves Authorized capital 75,000,000 (2019: 75,000,000) ordinary shares of PKR 10 each 750,000 750,000 4 5 Issued, subscribed and paid up capital Share premium General reserve Accumulated profit 453,496 249,527 280,000 3,207,419 4,190,442 453,496 249,527 280,000 2,272,943 3,255,966 6 Non-current liabilities Long term finances - secured Lease liabilities Deferred taxation Retirement benefits 7 8 12,081,975 34,682 1,332,919 3,117,661 16,567,237 3,780,294 143,004 1,960,850 2,777,502 8,661,650 9 10 11 12 13 Current liabilities Current portion of long term liabilities Short term borrowings - Secured Running finance under mark-up arrangements - Secured Customer security deposits - interest free Unclaimed dividend Trade and other payables Contract liabilities Income tax payable Interest and mark-up accrued 3,734,310 6,417,473 830,245 222,166 72,121 26,563,482 562,263 1,443,443 303,183 40,148,686 3,395,084 17,217,473 6,141,325 192,724 20,608 25,138,313 382,146 262,436 444,958 53,195,067 14 15 Contingencies and commitments 16 60,906,365 65,112,683

What is the capital structure of respected organization in most recent and pervious reporting period?

What is the capital structure of respected organization in most recent and pervious reporting period?