Question

What is the carrying amount of the Old Furniture on VMR Corporation's Balance Sheet before this non-monetary exchange? What is the journal entry to recognize

What is the carrying amount of the Old Furniture on VMR Corporation's Balance Sheet before this non-monetary exchange?

What is the journal entry to recognize this non-monetary exchange?

Debit New Furniture for $37,000, Debit Accumulated Depreciation - Old Furniture for $12,000, Credit Old Furniture for $28,000, Credit Cash for $14,000, and Credit Gain on Exchange of Assets for $7,000

Debit New Furniture for $37,000, Debit Accumulated Depreciation - Old Furniture for $12,000, Credit Old Furniture for $35,000, and Credit Cash for $14,000

Debit New Furniture for $42,000, Credit Old Furniture for $28,000, and Credit Cash for $14,000

Debit New Furniture for $42,000, Debit Accumulated Depreciation - Old Furniture for $12,000, Credit Old Furniture for $35,000, Credit Cash for $14,000, and Credit Gain on Exchange of Assets for $5,000

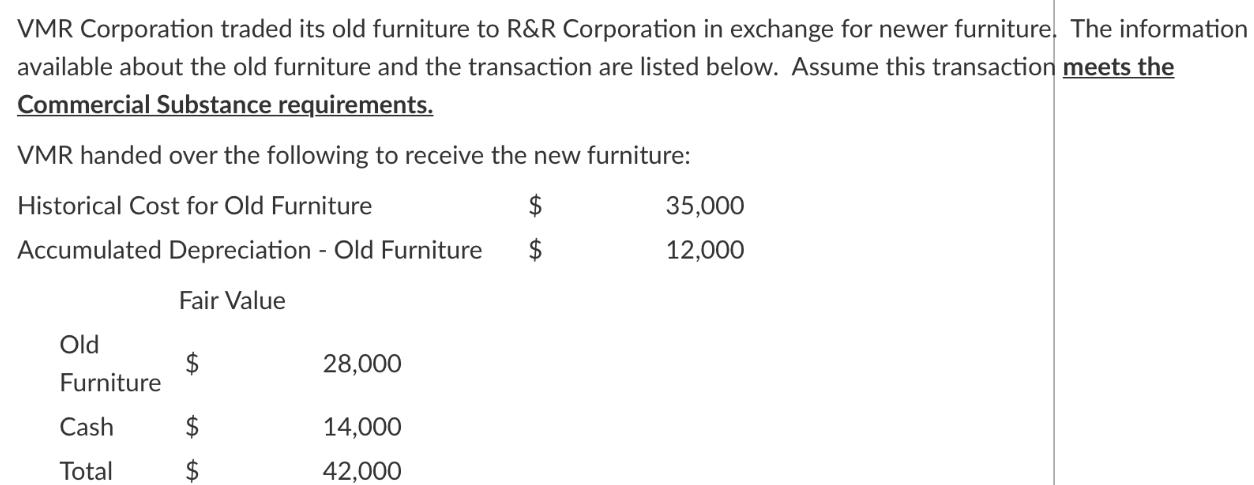

VMR Corporation traded its old furniture to R&R Corporation in exchange for newer furniture. The information available about the old furniture and the transaction are listed below. Assume this transaction meets the Commercial Substance requirements. VMR handed over the following to receive the new furniture: Historical Cost for Old Furniture $ Accumulated Depreciation - Old Furniture $ Fair Value Old Furniture Cash Total $ 28,000 14,000 42,000 35,000 12,000

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The carrying amount of an asset on the balance sheet is determined by subtracting the accumulated depreciation from the historical cost of the asset B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started