What is the company's Basic EPS for the recent year?

Can you recompute this amount using the weighted average shares disclosed?

Show the calculation using the provided weighted average shares outstanding.

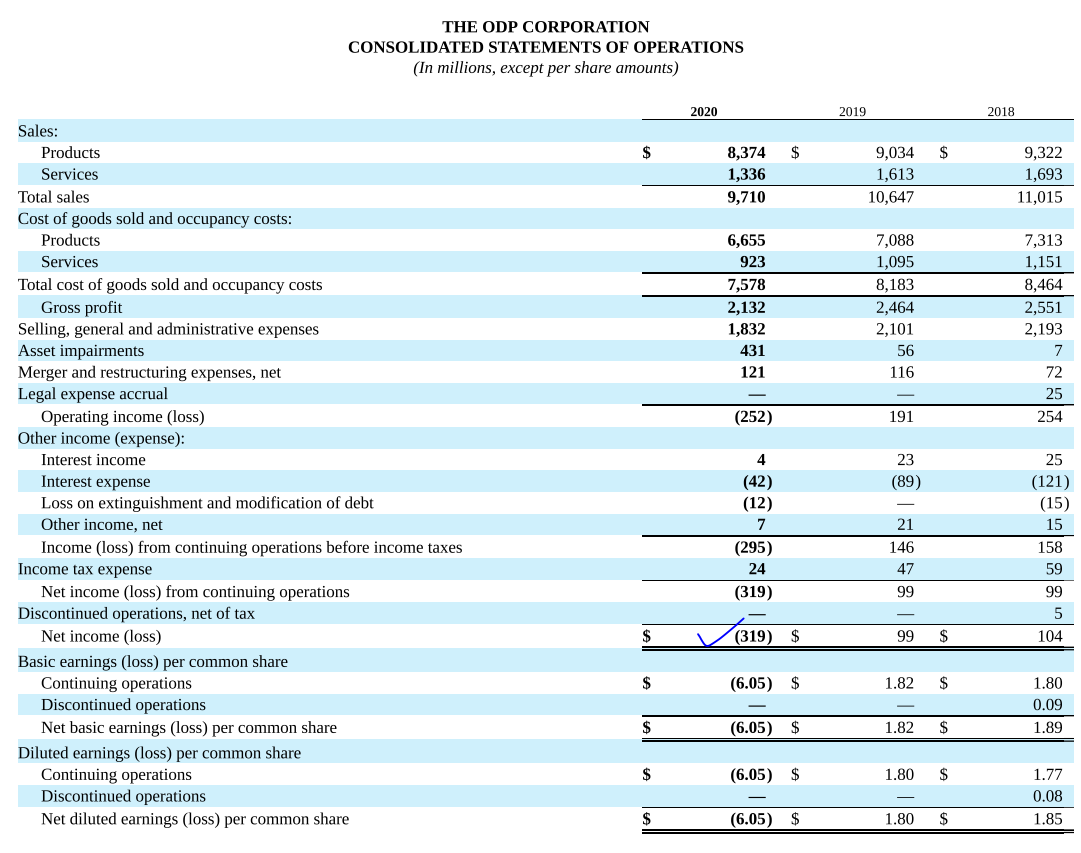

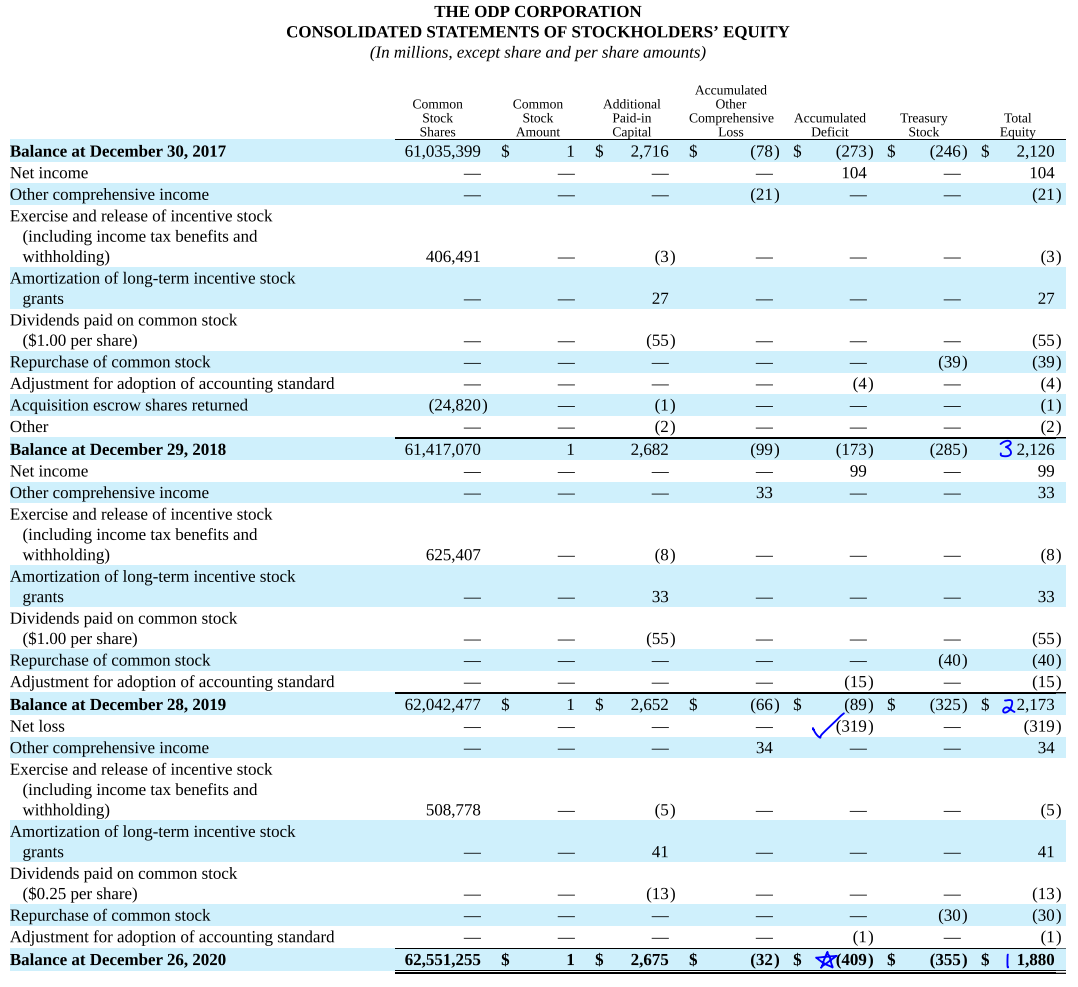

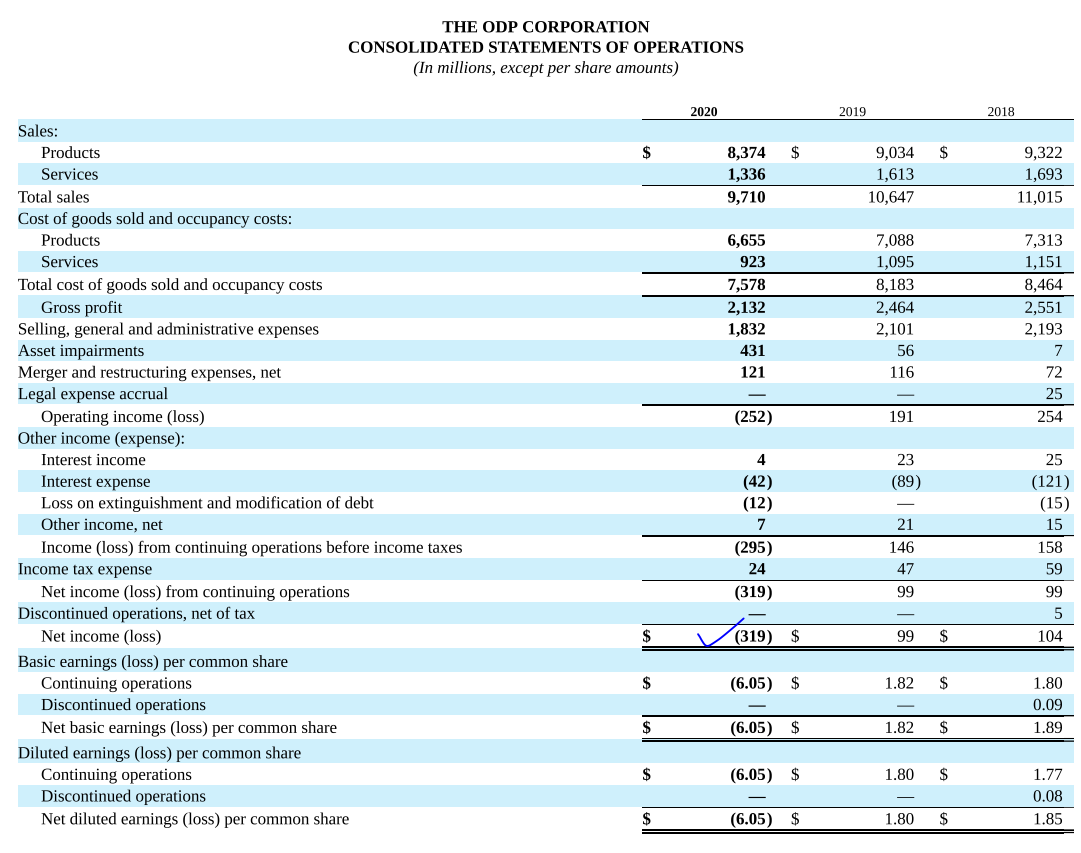

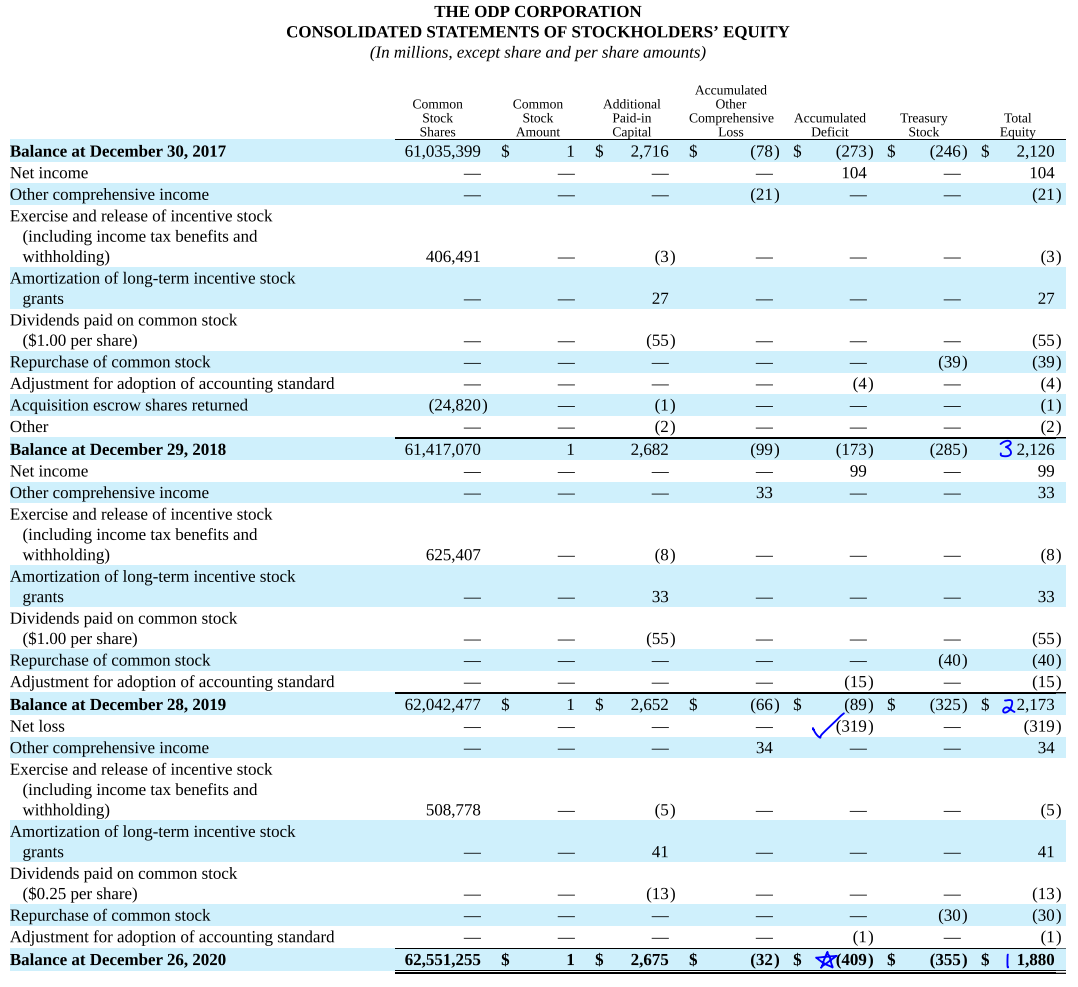

THE ODP CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except per share amounts) 2020 2019 2018 $ $ 8,374 1,336 9,710 9,034 1,613 10,647 9,322 1,693 11,015 6,655 923 7,578 2,132 1,832 431 121 7,088 1,095 8,183 2,464 2,101 56 116 7,313 1,151 8,464 2,551 2,193 7 72 (252) 25 254 191 Sales: Products Services Total sales Cost of goods sold and occupancy costs: Products Services Total cost of goods sold and occupancy costs Gross profit Selling, general and administrative expenses Asset impairments Merger and restructuring expenses, net Legal expense accrual Operating income (loss) Other income (expense): Interest income Interest expense Loss on extinguishment and modification of debt Other income, net Income (loss) from continuing operations before income taxes Income tax expense Net income (loss) from continuing operations Discontinued operations, net of tax Net income (loss) Basic earnings (loss) per common share Continuing operations Discontinued operations Net basic earnings (loss) per common share Diluted earnings (loss) per common share Continuing operations Discontinued operations Net diluted earnings (loss) per common share 23 (89) 4 (42) (12) 7 (295) 24 (319) 21 146 47 25 (121) (15) 15 158 59 99 5 104 99 $ (319) $ 99 $ $ (6.05) $ 1.82 $ 1.80 0.09 1.89 S (6.05) $ 1.82 $ $ (6.05) $ 1.80 $ 1.77 0.08 1.85 $ (6.05) $ 1.80 $ THE ODP CORPORATION CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (In millions, except share and per share amounts) Common Stock Shares 61,035,399 Common Stock Amount $ Additional Paid-in Capital $ 2,716 Accumulated Other Comprehensive Accumulated Treasury Loss Deficit Stock $ (78) $ (273) $ (246) $ 104 (21) Total Equity 2,120 104 (21) 406,491 (3) (3) II 27 27 on -- (55) (39) IIIIIIII (4) (24,820) (1) (2) 2,682 (55) (39) (4) (1) (2) 32,126 99 33 61,417,070 (99) (285) (173) 99 33 Balance at December 30, 2017 Net income Other comprehensive income Exercise and release of incentive stock (including income tax benefits and withholding) Amortization of long-term incentive stock grants Dividends paid on common stock ($1.00 per share) Repurchase of common stock Adjustment for adoption of accounting standard Acquisition escrow shares returned Other Balance at December 29, 2018 Net income Other comprehensive income Exercise and release of incentive stock (including income tax benefits and withholding) Amortization of long-term incentive stock grants Dividends paid on common stock ($1.00 per share) Repurchase of common stock Adjustment for adoption of accounting standard Balance at December 28, 2019 Net loss Other comprehensive income Exercise and release of incentive stock (including income tax benefits and withholding) Amortization of long-term incentive stock grants Dividends paid on common stock ($0.25 per share) Repurchase of common stock Adjustment for adoption of accounting standard Balance at December 26, 2020 625,407 (8) - (8) 33 - 33 (55) (15) (89) $ (55) (40) (40) (15) (325) $ 22,173 (319) 34 62,042,477 $ 1 $ 2,652 $ (66) $ (319 ) 34 508,778 (5) (5) / 1 41 41 (13) 11 (13) (30) (30) (1) (355) $ ( 1,880 62,551,255 (1) (32) $ (409) $ $ 1 $ 2,675 $