Answered step by step

Verified Expert Solution

Question

1 Approved Answer

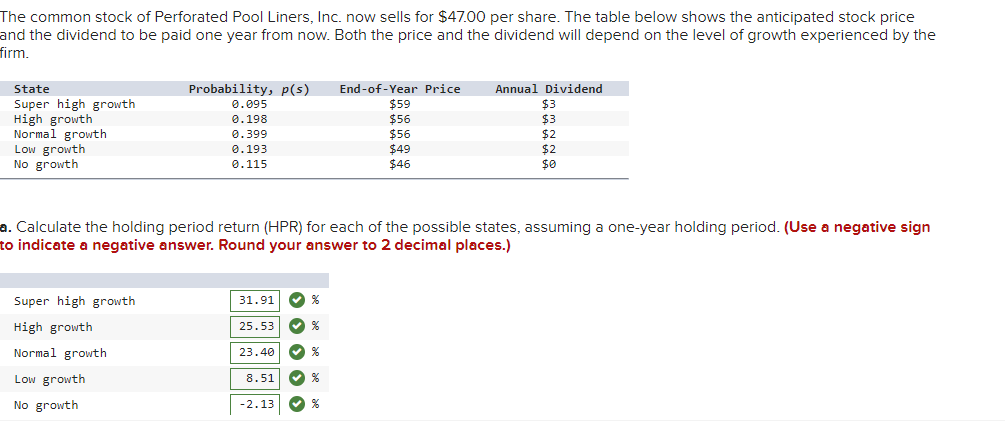

What is the correct answer for part c? The common stock of Perforated Pool Liners, Inc. now sells for $47.00 per share. The table below

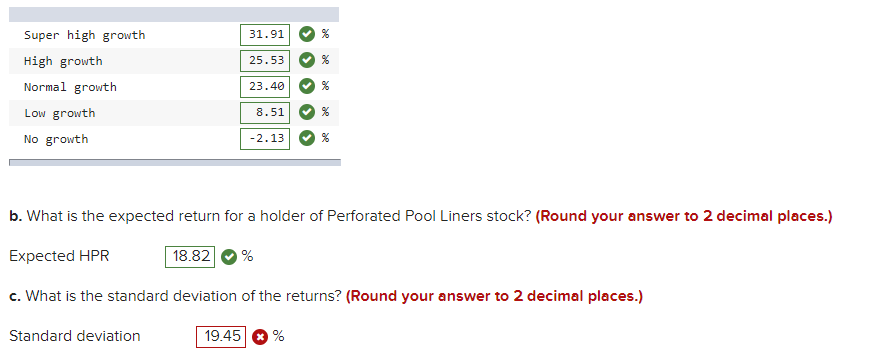

What is the correct answer for part c?

The common stock of Perforated Pool Liners, Inc. now sells for $47.00 per share. The table below shows the anticipated stock price and the dividend to be paid one year from now. Both the price and the dividend will depend on the level of growth experienced by the firm. State Super high growth High growth Normal growth Low growth No growth Probability, p(s) 0.095 0.198 0.399 0.193 0.115 End-of-Year Price $59 $56 $56 $49 $46 Annual Dividend $3 $3 $2. $2 $0 a. Calculate the holding period return (HPR) for each of the possible states, assuming a one-year holding period. (Use a negative sign to indicate a negative answer. Round your answer to 2 decimal places.) 31.91 % Super high growth High growth Normal growth 25.53 >>>> ae de se de 23.40 % Low growth 8.51 % No growth -2.13 % 31.91 % Super high growth High growth Normal growth 25.53 > > > % 23.40 % Low growth 8.51 % No growth -2.13 % b. What is the expected return for a holder of Perforated Pool Liners stock? (Round your answer to 2 decimal places.) Expected HPR 18.82 % c. What is the standard deviation of the returns? (Round your answer to 2 decimal places.) Standard deviation 19.45 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started