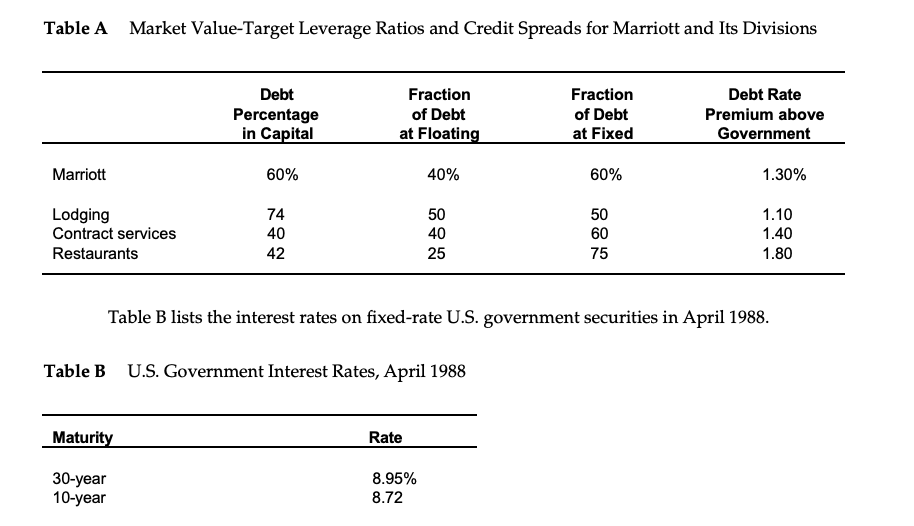

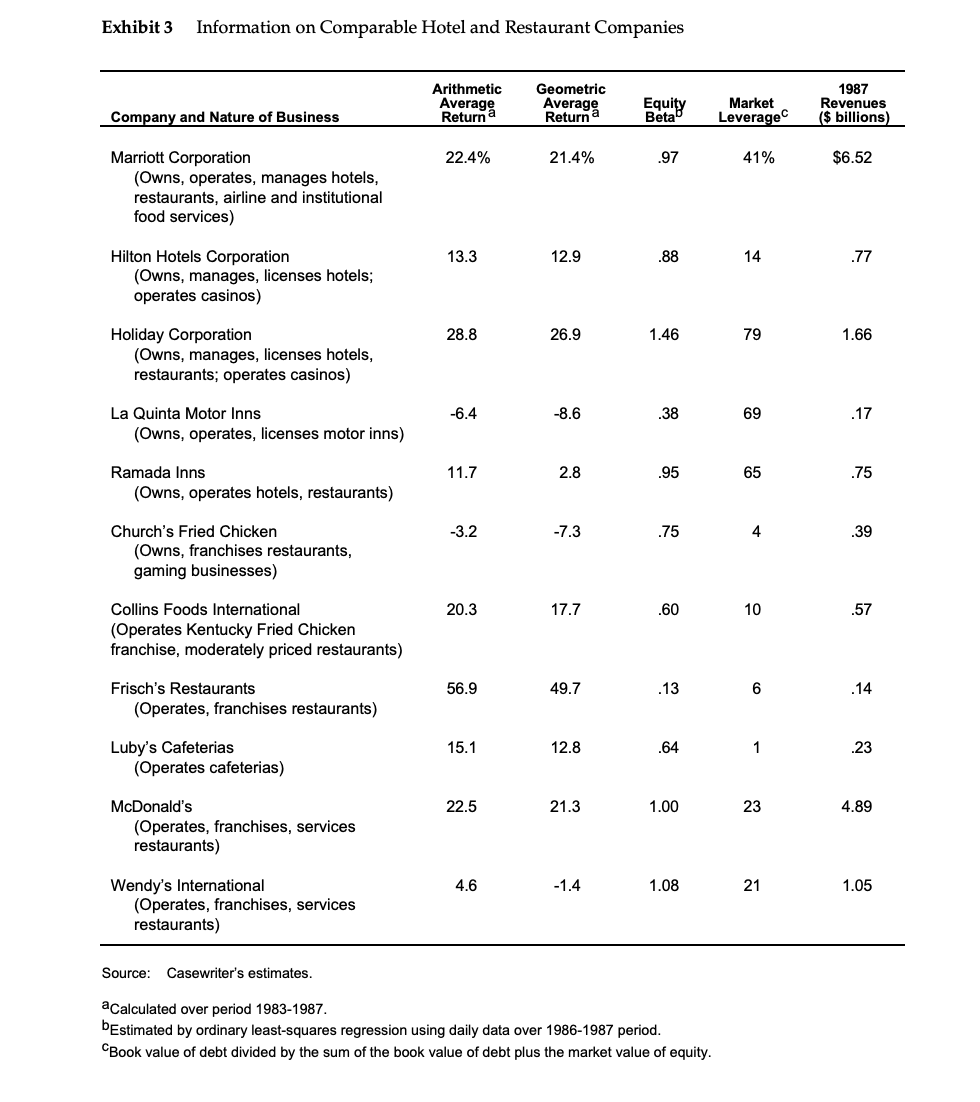

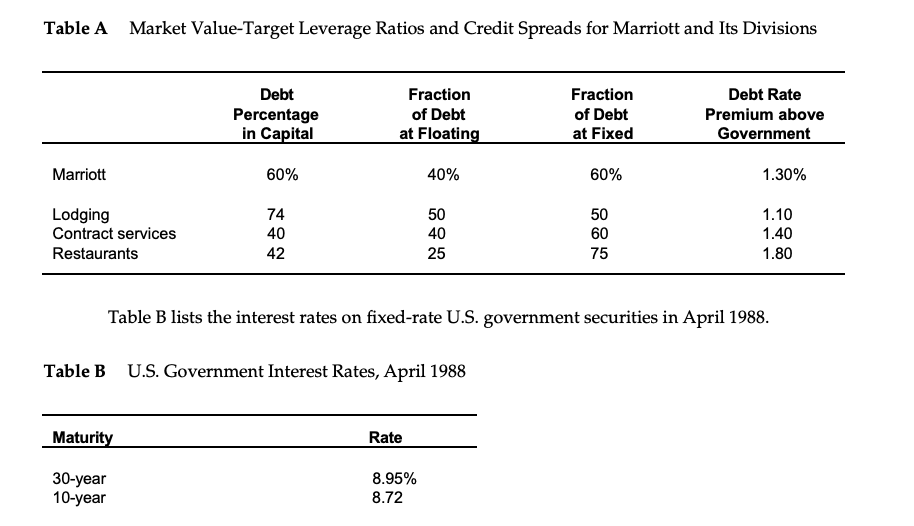

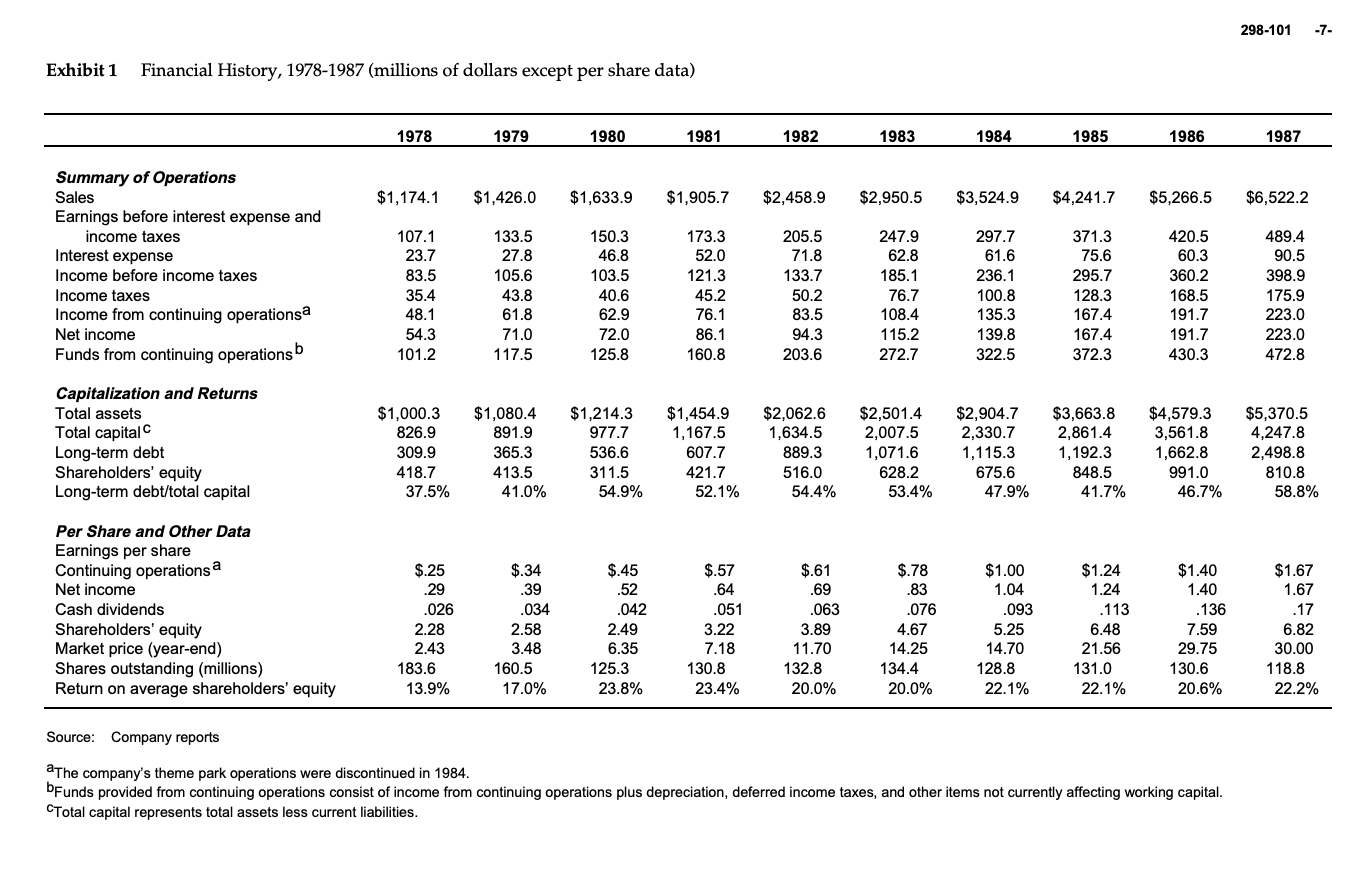

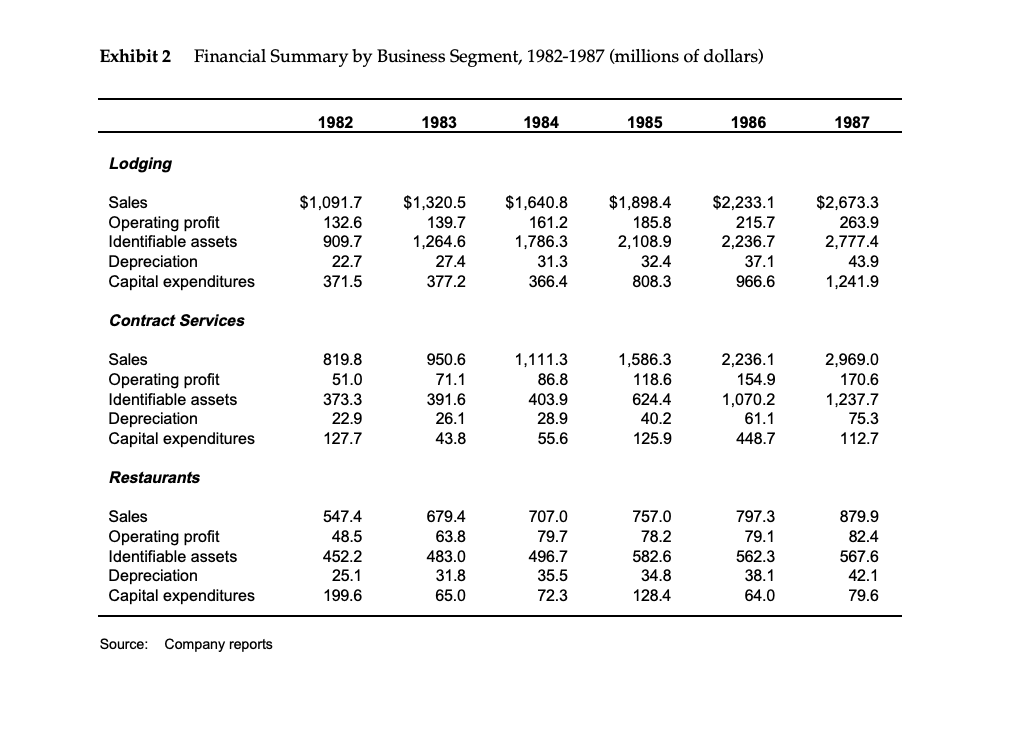

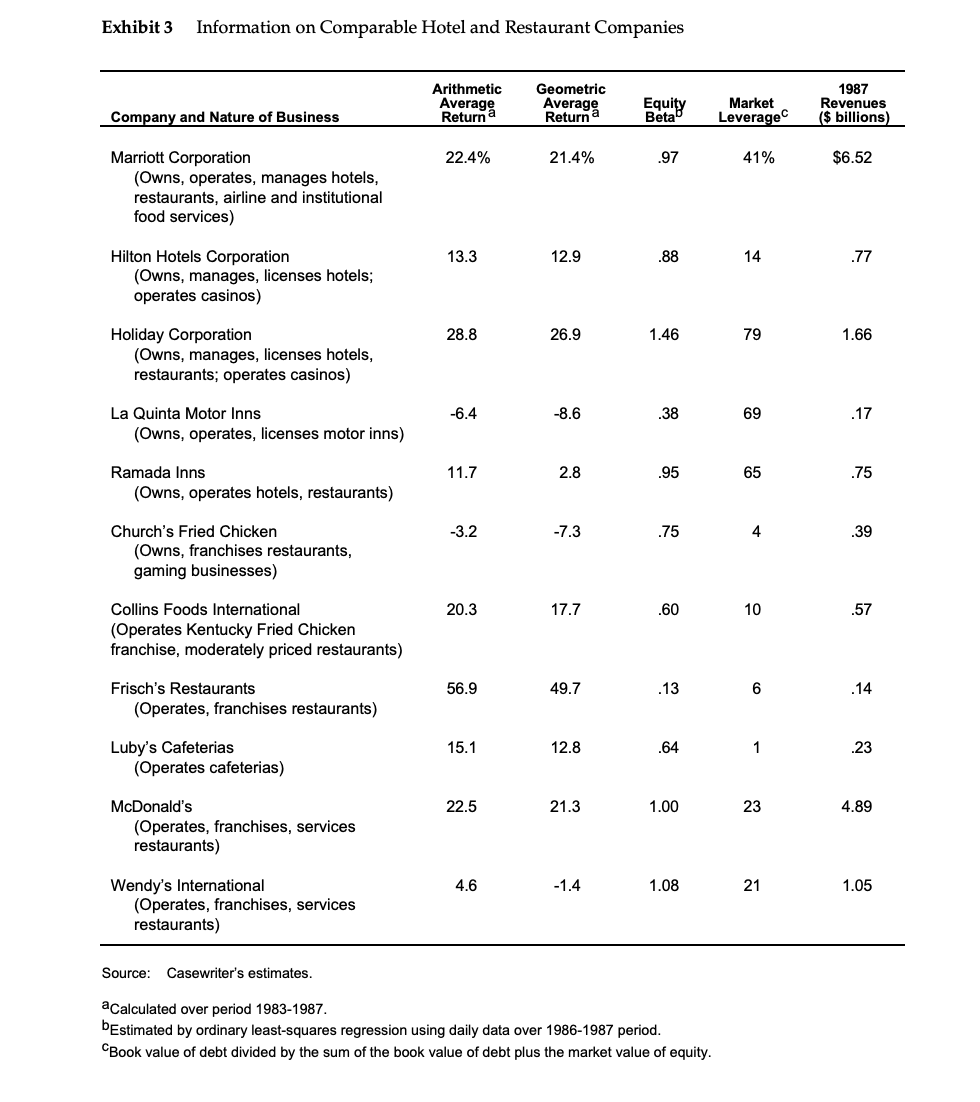

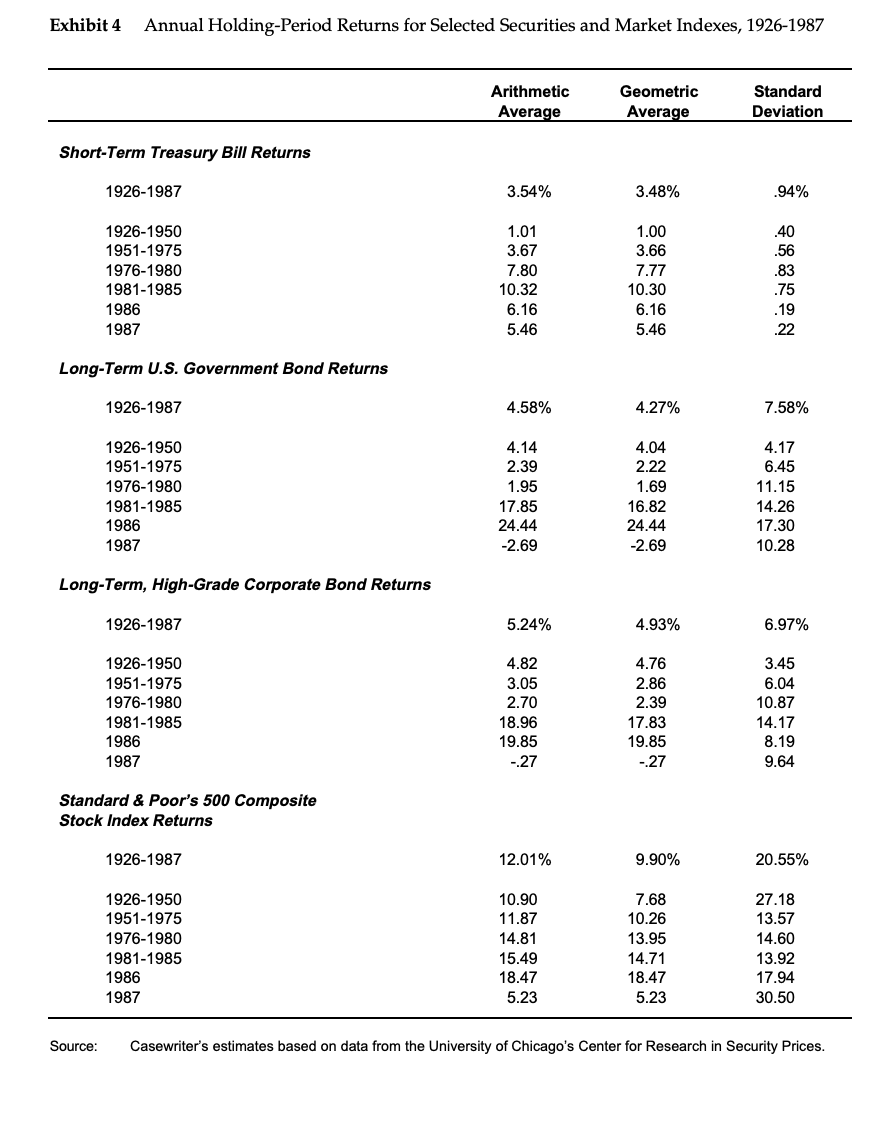

What is the cost of capital (WACC) for Marriotts Restaurants division, under target capital structure? Hints for question 4: a) Find proxy restaurants (Churchs Fried Chicken, Collins Foods International, Frischs Restaurants, Lubys Cafeterias, McDonalds, Wendys International) and their betas. See Exhibit 3. b) Compute un-levered betas of proxy firms using proxy firms capital structure. Beta un-levered= (1-L)*Beta levered. c) Calculate average of un-levered betas of proxy firms. This average is a proxy for un-levered beta of restaurant division. d) Lever the unlevered beta of restaurant division you calculated in (c) using target capital structure of restaurant division. See Table A for Target L (Debt Percentage in Capital). e) Using CAPM, calculate cost of equity. All inputs of CAPM are in question 1, except beta. Use the beta you calculated under target capital structure (in part e) here. f) (rd) Cost of debt is calculated as risk free rate (government bond return) plus Debt Rate Premium above Government. Long maturity bonds are safer choices for risk free rate. For risk free rate choose the longest maturity bonds (see Tables A and B). g) Compute the WACC for restaurant division using: WACC = wdrd(1 T) + wsrs.

What is the cost of capital (WACC) for Marriotts Lodging division, under target capital structure? Hints for question 5: a) Find proxy hotels (Hilton Hotels Corporation, Holiday Corporation, La Quinta Motor Inns, Ramada Inns) and their betas. b) Other steps are similar to the steps in question 4. Only difference is you need to use Lodging divisions target capital structure to calculate levered beta (part c) and calculate WACC (part g). See Table A for Target L (Debt Percentage in Capital).

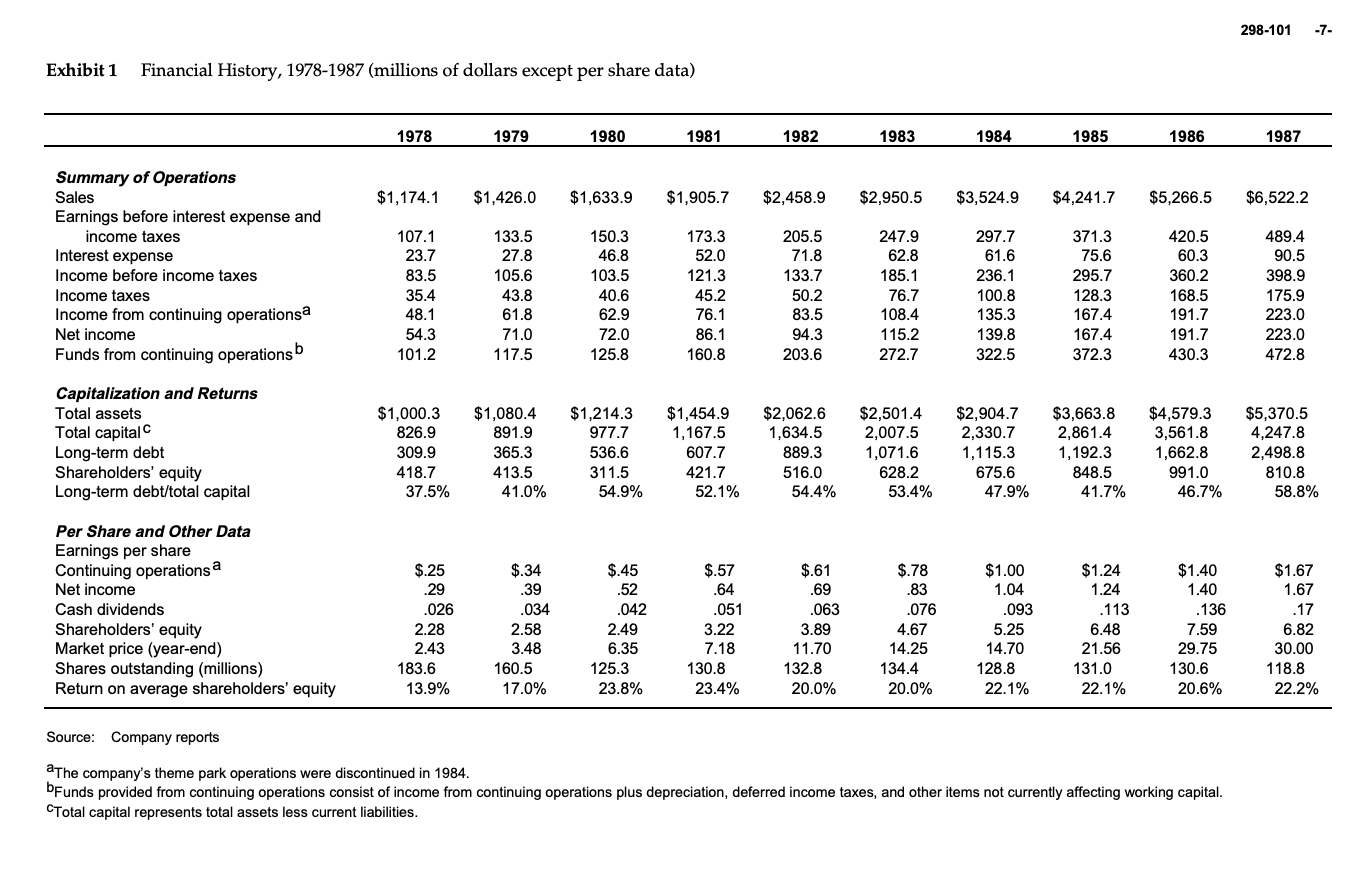

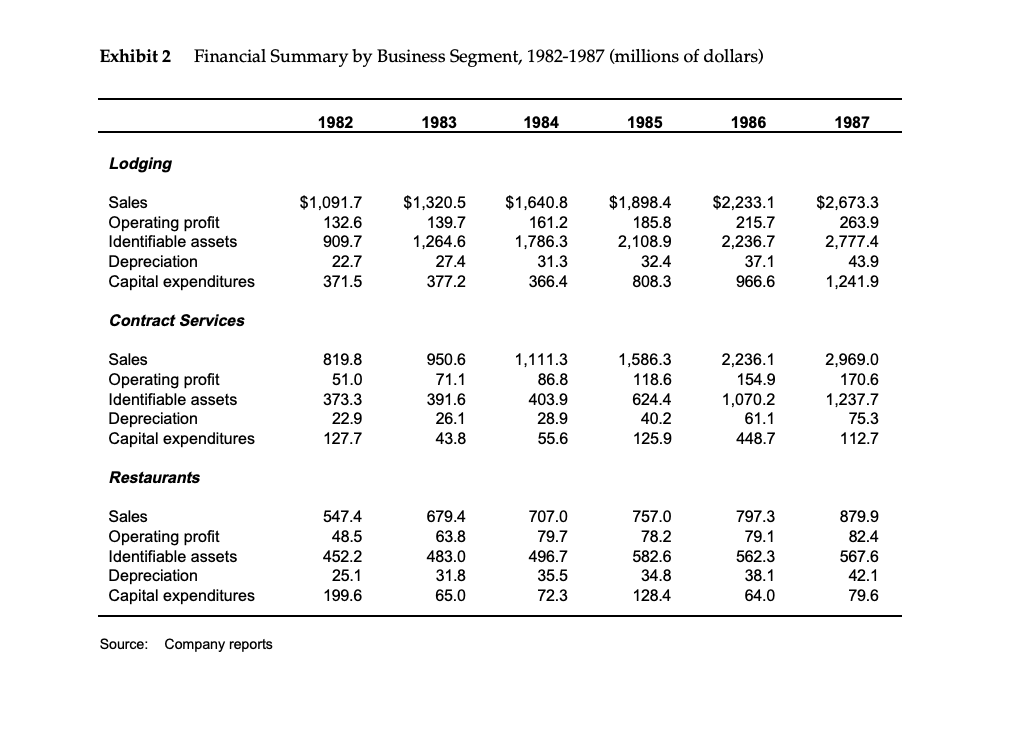

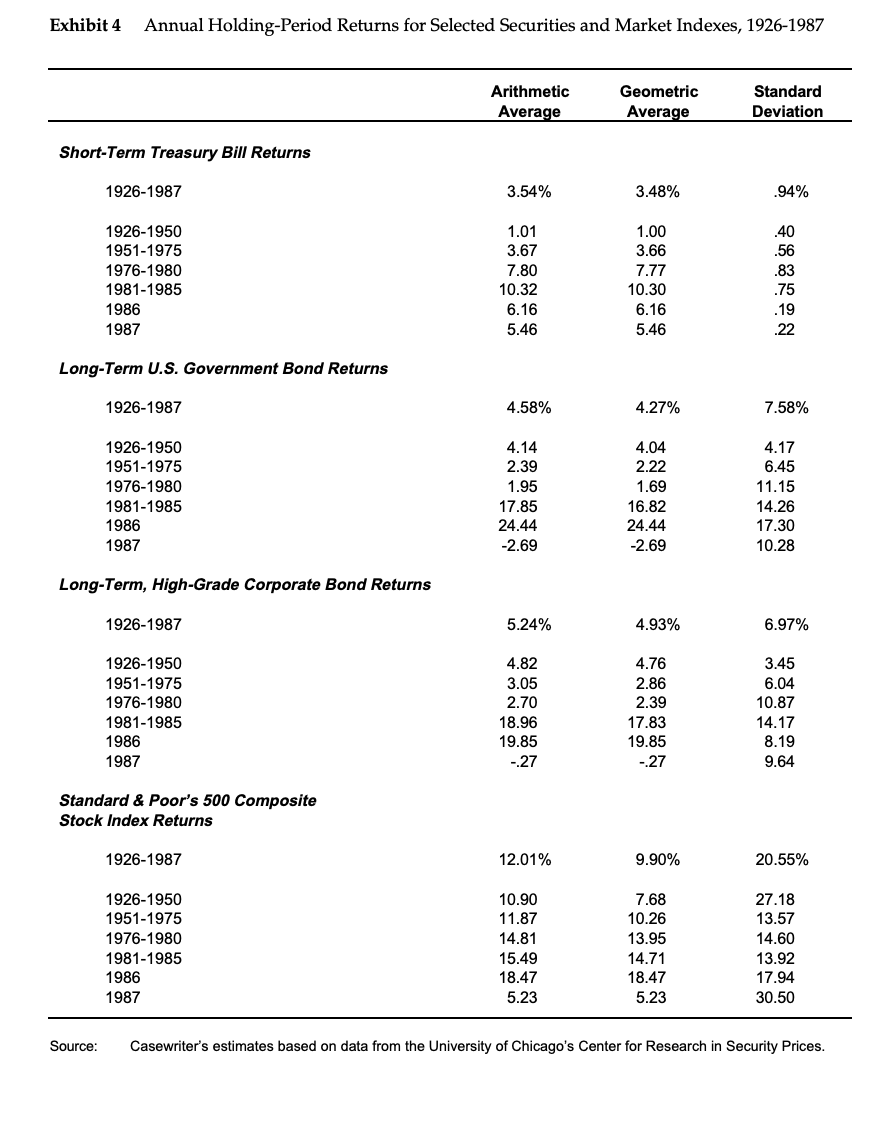

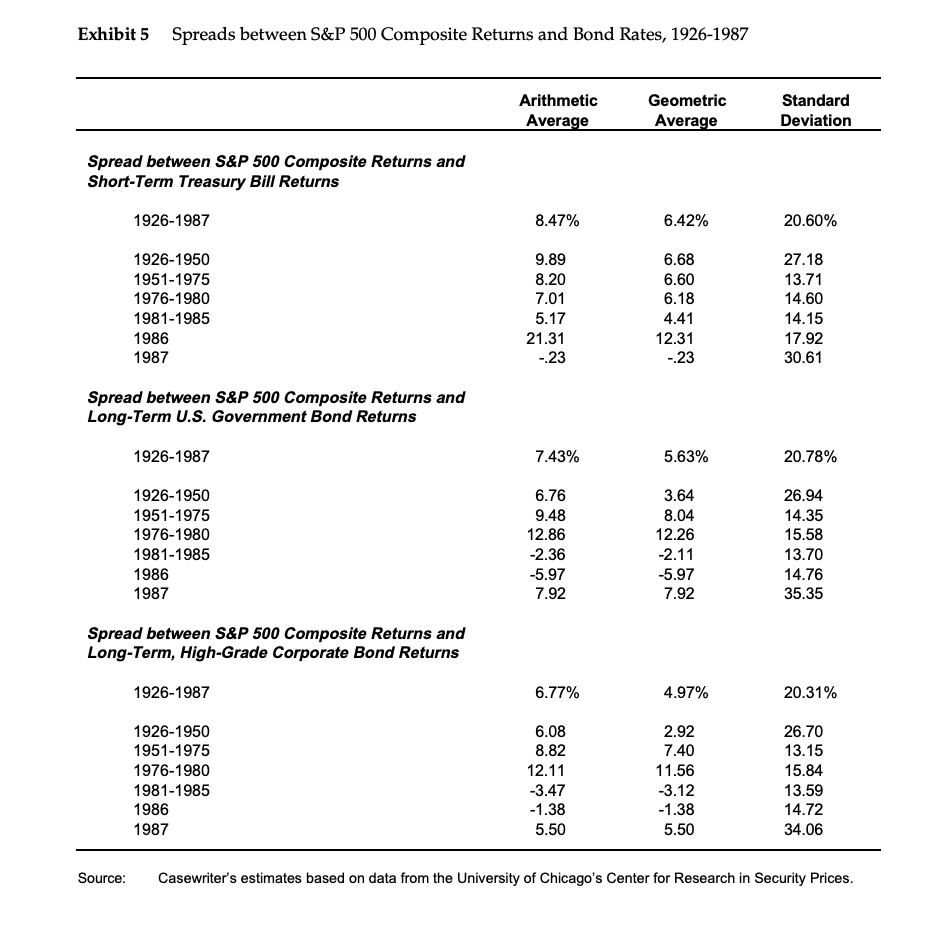

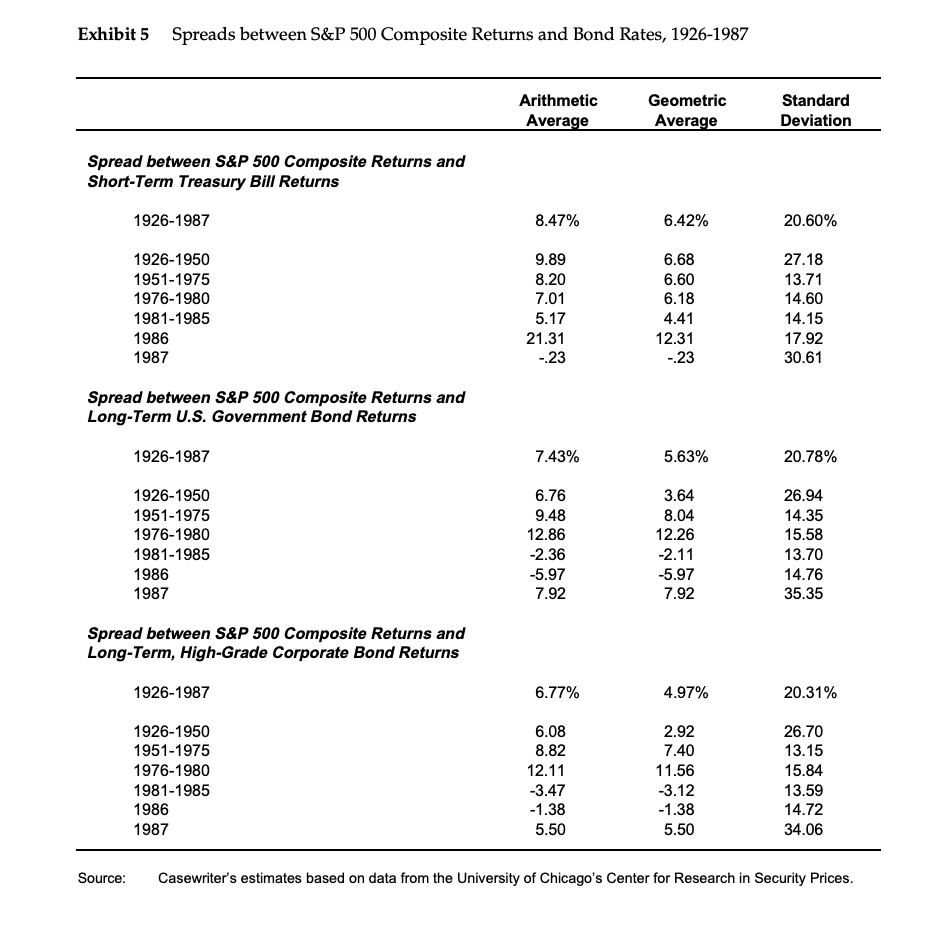

Table A Market Value-Target Leverage Ratios and Credit Spreads for Marriott and Its Divisions Debt Percentage in Capital Fraction of Debt at Floating Fraction of Debt at Fixed Debt Rate Premium above Government Marriott 60% 40% 60% 1.30% Lodging Contract services Restaurants 74 40 42 50 40 50 60 75 1.10 1.40 1.80 25 Table B lists the interest rates on fixed-rate U.S. government securities in April 1988. Table B U.S. Government Interest Rates, April 1988 Maturity Rate 30-year 10-year 8.95% 8.72 298-101 -7- Exhibit 1 Financial History, 1978-1987 (millions of dollars except per share data) 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 $1,174.1 $1,426.0 $1,633.9 $1,905.7 $2,458.9 $2,950.5 $3,524.9 $4,241.7 $5,266.5 $6,522.2 Summary of Operations Sales Earnings before interest expense and income taxes Interest expense Income before income taxes Income taxes Income from continuing operationsa Net income Funds from continuing operationsb 107.1 23.7 83.5 35.4 48.1 54.3 101.2 133.5 27.8 105.6 43.8 61.8 71.0 117.5 150.3 46.8 103.5 40.6 62.9 72.0 125.8 173.3 52.0 121.3 45.2 76.1 86.1 160.8 205.5 71.8 133.7 50.2 83.5 94.3 203.6 247.9 62.8 185.1 76.7 108.4 115.2 272.7 297.7 61.6 236.1 100.8 135.3 139.8 322.5 371.3 75.6 295.7 128.3 167.4 167.4 372.3 420.5 60.3 360.2 168.5 191.7 191.7 430.3 489.4 90.5 398.9 175.9 223.0 223.0 472.8 Capitalization and Returns Total assets Total capital Long-term debt Shareholders' equity Long-term debt/total capital $1,000.3 826.9 309.9 418.7 37.5% $1,080.4 891.9 365.3 413.5 41.0% $1,214.3 977.7 536.6 311.5 54.9% $1,454.9 1,167.5 607.7 421.7 52.1% $2,062.6 1,634.5 889.3 516.0 54.4% $2,501.4 2,007.5 1,071.6 628.2 53.4% $2,904.7 2,330.7 1,115.3 675.6 47.9% $3,663.8 2,861.4 1,192.3 848.5 41.7% $4,579.3 3,561.8 1,662.8 991.0 46.7% $5,370.5 4,247.8 2,498.8 810.8 58.8% Per Share and Other Data Earnings per share Continuing operations a Net income Cash dividends Shareholders' equity Market price (year-end) Shares outstanding (millions) Return on average shareholders' equity $.25 .29 .026 2.28 2.43 183.6 13.9% $.34 .39 .034 2.58 3.48 160.5 17.0% $.45 .52 .042 2.49 6.35 125.3 23.8% $.57 .64 .051 3.22 7.18 130.8 23.4% $.61 .69 .063 3.89 11.70 132.8 20.0% $.78 .83 .076 4.67 14.25 134.4 20.0% $1.00 1.04 .093 5.25 14.70 128.8 22.1% $1.24 1.24 .113 6.48 21.56 131.0 22.1% $1.40 1.40 .136 7.59 29.75 130.6 20.6% $1.67 1.67 .17 6.82 30.00 118.8 22.2% Source: Company reports aThe company's theme park operations were discontinued in 1984. bFunds provided from continuing operations consist of income from continuing operations plus depreciation, deferred income taxes, and other items not currently affecting working capital. Total capital represents total assets less current liabilities. Exhibit 2 Financial Summary by Business Segment, 1982-1987 (millions of dollars) 1982 1983 1984 1985 1986 1987 Lodging Sales Operating profit Identifiable assets Depreciation Capital expenditures $1,091.7 132.6 909.7 22.7 371.5 $1,320.5 139.7 1,264.6 27.4 377.2 $1,640.8 161.2 1,786.3 31.3 366.4 $1,898.4 185.8 2,108.9 32.4 808.3 $2,233.1 215.7 2,236.7 37.1 966.6 $2,673.3 263.9 2,777.4 43.9 1,241.9 Contract Services Sales Operating profit Identifiable assets Depreciation Capital expenditures 819.8 51.0 373.3 22.9 127.7 950.6 71.1 391.6 26.1 43.8 1,111.3 86.8 403.9 28.9 55.6 1,586.3 118.6 624.4 40.2 125.9 2,236.1 154.9 1,070.2 61.1 448.7 2,969.0 170.6 1,237.7 75.3 112.7 Restaurants 797.3 Sales Operating profit Identifiable assets Depreciation Capital expenditures 547.4 48.5 452.2 25.1 199.6 679.4 63.8 483.0 31.8 65.0 707.0 79.7 496.7 35.5 72.3 757.0 78.2 582.6 34.8 128.4 79.1 562.3 38.1 64.0 879.9 82.4 567.6 42.1 79.6 Source: Company reports Exhibit 3 Information on Comparable Hotel and Restaurant Companies Arithmetic Average Return a Geometric Average Returna Equity Beta 1987 Revenues ($ billions) Market Leverage Company and Nature of Business 22.4% 21.4% .97 41% $6.52 Marriott Corporation (Owns, operates, manages hotels, restaurants, airline and institutional food services) 13.3 12.9 .88 14 .77 Hilton Hotels Corporation (Owns, manages, licenses hotels; operates casinos) 28.8 26.9 1.46 79 1.66 Holiday Corporation (Owns, manages, licenses hotels, restaurants; operates casinos) -6.4 -8.6 .38 69 .17 La Quinta Motor Inns (Owns, operates, licenses motor inns) 11.7 2.8 .95 65 .75 Ramada Inns (Owns, operates hotels, restaurants) -3.2 -7.3 .75 4 .39 Church's Fried Chicken (Owns, franchises restaurants, gaming businesses) 20.3 17.7 .60 10 .57 Collins Foods International (Operates Kentucky Fried Chicken franchise, moderately priced restaurants) 56.9 49.7 .13 6 .14 Frisch's Restaurants (Operates, franchises restaurants) 15.1 12.8 .64 1 .23 Luby's Cafeterias (Operates cafeterias) 22.5 21.3 1.00 23 4.89 McDonald's (Operates, franchises, services restaurants) 4.6 -1.4 1.08 21 1.05 Wendy's International (Operates, franchises, services restaurants) Source: Casewriter's estimates. a Calculated over period 1983-1987. Estimated by ordinary least-squares regression using daily data over 1986-1987 period. Book value of debt divided by the sum of the book value of debt plus the market value of equity. Exhibit 4 Annual Holding-Period Returns for Selected Securities and Market Indexes, 1926-1987 Arithmetic Average Geometric Average Standard Deviation Short-Term Treasury Bill Returns 1926-1987 3.54% 3.48% .94% 1926-1950 1951-1975 1976-1980 1981-1985 1986 1987 1.01 3.67 7.80 10.32 6.16 1.00 3.66 7.77 10.30 6.16 5.46 40 .56 .83 .75 .19 .22 5.46 Long-Term U.S. Government Bond Returns 1926-1987 4.58% 4.27% 7.58% 1926-1950 1951-1975 1976-1980 1981-1985 1986 1987 4.14 2.39 1.95 17.85 24.44 -2.69 4.04 2.22 1.69 16.82 24.44 -2.69 4.17 6.45 11.15 14.26 17.30 10.28 Long-Term, High-Grade Corporate Bond Returns 1926-1987 5.24% 4.93% 6.97% 1926-1950 1951-1975 1976-1980 1981-1985 1986 1987 4.82 3.05 2.70 18.96 19.85 -27 4.76 2.86 2.39 17.83 19.85 -27 3.45 6.04 10.87 14.17 8.19 9.64 Standard & Poor's 500 Composite Stock Index Returns 1926-1987 12.01% 9.90% 20.55% 1926-1950 1951-1975 1976-1980 1981-1985 1986 1987 10.90 11.87 14.81 15.49 18.47 5.23 7.68 10.26 13.95 14.71 18.47 5.23 27.18 13.57 14.60 13.92 17.94 30.50 Source: Casewriter's estimates based on data from the University of Chicago's Center for Research in Security Prices. Exhibit 5 Spreads between S&P 500 Composite Returns and Bond Rates, 1926-1987 Arithmetic Average Geometric Average Standard Deviation Spread between S&P 500 Composite Returns and Short-Term Treasury Bill Returns 1926-1987 8.47% 6.42% 20.60% 1926-1950 1951-1975 1976-1980 1981-1985 1986 1987 9.89 8.20 7.01 5.17 21.31 -23 6.68 6.60 6.18 4.41 12.31 -23 27.18 13.71 14.60 14.15 17.92 30.61 Spread between S&P 500 Composite Returns and Long-Term U.S. Government Bond Returns 1926-1987 7.43% 5.63% 20.78% 1926-1950 1951-1975 1976-1980 1981-1985 1986 1987 6.76 9.48 12.86 -2.36 -5.97 7.92 3.64 8.04 12.26 -2.11 -5.97 7.92 26.94 14.35 15.58 13.70 14.76 35.35 Spread between S&P 500 Composite Returns and Long-Term, High-Grade Corporate Bond Returns 1926-1987 6.77% 4.97% 20.31% 1926-1950 1951-1975 1976-1980 1981-1985 1986 1987 6.08 8.82 12.11 -3.47 -1.38 5.50 2.92 7.40 11.56 -3.12 -1.38 5.50 26.70 13.15 15.84 13.59 14.72 34.06 Source: Casewriter's estimates based on data from the University of Chicago's Center for Research in Security Prices. Table A Market Value-Target Leverage Ratios and Credit Spreads for Marriott and Its Divisions Debt Percentage in Capital Fraction of Debt at Floating Fraction of Debt at Fixed Debt Rate Premium above Government Marriott 60% 40% 60% 1.30% Lodging Contract services Restaurants 74 40 42 50 40 50 60 75 1.10 1.40 1.80 25 Table B lists the interest rates on fixed-rate U.S. government securities in April 1988. Table B U.S. Government Interest Rates, April 1988 Maturity Rate 30-year 10-year 8.95% 8.72 298-101 -7- Exhibit 1 Financial History, 1978-1987 (millions of dollars except per share data) 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 $1,174.1 $1,426.0 $1,633.9 $1,905.7 $2,458.9 $2,950.5 $3,524.9 $4,241.7 $5,266.5 $6,522.2 Summary of Operations Sales Earnings before interest expense and income taxes Interest expense Income before income taxes Income taxes Income from continuing operationsa Net income Funds from continuing operationsb 107.1 23.7 83.5 35.4 48.1 54.3 101.2 133.5 27.8 105.6 43.8 61.8 71.0 117.5 150.3 46.8 103.5 40.6 62.9 72.0 125.8 173.3 52.0 121.3 45.2 76.1 86.1 160.8 205.5 71.8 133.7 50.2 83.5 94.3 203.6 247.9 62.8 185.1 76.7 108.4 115.2 272.7 297.7 61.6 236.1 100.8 135.3 139.8 322.5 371.3 75.6 295.7 128.3 167.4 167.4 372.3 420.5 60.3 360.2 168.5 191.7 191.7 430.3 489.4 90.5 398.9 175.9 223.0 223.0 472.8 Capitalization and Returns Total assets Total capital Long-term debt Shareholders' equity Long-term debt/total capital $1,000.3 826.9 309.9 418.7 37.5% $1,080.4 891.9 365.3 413.5 41.0% $1,214.3 977.7 536.6 311.5 54.9% $1,454.9 1,167.5 607.7 421.7 52.1% $2,062.6 1,634.5 889.3 516.0 54.4% $2,501.4 2,007.5 1,071.6 628.2 53.4% $2,904.7 2,330.7 1,115.3 675.6 47.9% $3,663.8 2,861.4 1,192.3 848.5 41.7% $4,579.3 3,561.8 1,662.8 991.0 46.7% $5,370.5 4,247.8 2,498.8 810.8 58.8% Per Share and Other Data Earnings per share Continuing operations a Net income Cash dividends Shareholders' equity Market price (year-end) Shares outstanding (millions) Return on average shareholders' equity $.25 .29 .026 2.28 2.43 183.6 13.9% $.34 .39 .034 2.58 3.48 160.5 17.0% $.45 .52 .042 2.49 6.35 125.3 23.8% $.57 .64 .051 3.22 7.18 130.8 23.4% $.61 .69 .063 3.89 11.70 132.8 20.0% $.78 .83 .076 4.67 14.25 134.4 20.0% $1.00 1.04 .093 5.25 14.70 128.8 22.1% $1.24 1.24 .113 6.48 21.56 131.0 22.1% $1.40 1.40 .136 7.59 29.75 130.6 20.6% $1.67 1.67 .17 6.82 30.00 118.8 22.2% Source: Company reports aThe company's theme park operations were discontinued in 1984. bFunds provided from continuing operations consist of income from continuing operations plus depreciation, deferred income taxes, and other items not currently affecting working capital. Total capital represents total assets less current liabilities. Exhibit 2 Financial Summary by Business Segment, 1982-1987 (millions of dollars) 1982 1983 1984 1985 1986 1987 Lodging Sales Operating profit Identifiable assets Depreciation Capital expenditures $1,091.7 132.6 909.7 22.7 371.5 $1,320.5 139.7 1,264.6 27.4 377.2 $1,640.8 161.2 1,786.3 31.3 366.4 $1,898.4 185.8 2,108.9 32.4 808.3 $2,233.1 215.7 2,236.7 37.1 966.6 $2,673.3 263.9 2,777.4 43.9 1,241.9 Contract Services Sales Operating profit Identifiable assets Depreciation Capital expenditures 819.8 51.0 373.3 22.9 127.7 950.6 71.1 391.6 26.1 43.8 1,111.3 86.8 403.9 28.9 55.6 1,586.3 118.6 624.4 40.2 125.9 2,236.1 154.9 1,070.2 61.1 448.7 2,969.0 170.6 1,237.7 75.3 112.7 Restaurants 797.3 Sales Operating profit Identifiable assets Depreciation Capital expenditures 547.4 48.5 452.2 25.1 199.6 679.4 63.8 483.0 31.8 65.0 707.0 79.7 496.7 35.5 72.3 757.0 78.2 582.6 34.8 128.4 79.1 562.3 38.1 64.0 879.9 82.4 567.6 42.1 79.6 Source: Company reports Exhibit 3 Information on Comparable Hotel and Restaurant Companies Arithmetic Average Return a Geometric Average Returna Equity Beta 1987 Revenues ($ billions) Market Leverage Company and Nature of Business 22.4% 21.4% .97 41% $6.52 Marriott Corporation (Owns, operates, manages hotels, restaurants, airline and institutional food services) 13.3 12.9 .88 14 .77 Hilton Hotels Corporation (Owns, manages, licenses hotels; operates casinos) 28.8 26.9 1.46 79 1.66 Holiday Corporation (Owns, manages, licenses hotels, restaurants; operates casinos) -6.4 -8.6 .38 69 .17 La Quinta Motor Inns (Owns, operates, licenses motor inns) 11.7 2.8 .95 65 .75 Ramada Inns (Owns, operates hotels, restaurants) -3.2 -7.3 .75 4 .39 Church's Fried Chicken (Owns, franchises restaurants, gaming businesses) 20.3 17.7 .60 10 .57 Collins Foods International (Operates Kentucky Fried Chicken franchise, moderately priced restaurants) 56.9 49.7 .13 6 .14 Frisch's Restaurants (Operates, franchises restaurants) 15.1 12.8 .64 1 .23 Luby's Cafeterias (Operates cafeterias) 22.5 21.3 1.00 23 4.89 McDonald's (Operates, franchises, services restaurants) 4.6 -1.4 1.08 21 1.05 Wendy's International (Operates, franchises, services restaurants) Source: Casewriter's estimates. a Calculated over period 1983-1987. Estimated by ordinary least-squares regression using daily data over 1986-1987 period. Book value of debt divided by the sum of the book value of debt plus the market value of equity. Exhibit 4 Annual Holding-Period Returns for Selected Securities and Market Indexes, 1926-1987 Arithmetic Average Geometric Average Standard Deviation Short-Term Treasury Bill Returns 1926-1987 3.54% 3.48% .94% 1926-1950 1951-1975 1976-1980 1981-1985 1986 1987 1.01 3.67 7.80 10.32 6.16 1.00 3.66 7.77 10.30 6.16 5.46 40 .56 .83 .75 .19 .22 5.46 Long-Term U.S. Government Bond Returns 1926-1987 4.58% 4.27% 7.58% 1926-1950 1951-1975 1976-1980 1981-1985 1986 1987 4.14 2.39 1.95 17.85 24.44 -2.69 4.04 2.22 1.69 16.82 24.44 -2.69 4.17 6.45 11.15 14.26 17.30 10.28 Long-Term, High-Grade Corporate Bond Returns 1926-1987 5.24% 4.93% 6.97% 1926-1950 1951-1975 1976-1980 1981-1985 1986 1987 4.82 3.05 2.70 18.96 19.85 -27 4.76 2.86 2.39 17.83 19.85 -27 3.45 6.04 10.87 14.17 8.19 9.64 Standard & Poor's 500 Composite Stock Index Returns 1926-1987 12.01% 9.90% 20.55% 1926-1950 1951-1975 1976-1980 1981-1985 1986 1987 10.90 11.87 14.81 15.49 18.47 5.23 7.68 10.26 13.95 14.71 18.47 5.23 27.18 13.57 14.60 13.92 17.94 30.50 Source: Casewriter's estimates based on data from the University of Chicago's Center for Research in Security Prices. Exhibit 5 Spreads between S&P 500 Composite Returns and Bond Rates, 1926-1987 Arithmetic Average Geometric Average Standard Deviation Spread between S&P 500 Composite Returns and Short-Term Treasury Bill Returns 1926-1987 8.47% 6.42% 20.60% 1926-1950 1951-1975 1976-1980 1981-1985 1986 1987 9.89 8.20 7.01 5.17 21.31 -23 6.68 6.60 6.18 4.41 12.31 -23 27.18 13.71 14.60 14.15 17.92 30.61 Spread between S&P 500 Composite Returns and Long-Term U.S. Government Bond Returns 1926-1987 7.43% 5.63% 20.78% 1926-1950 1951-1975 1976-1980 1981-1985 1986 1987 6.76 9.48 12.86 -2.36 -5.97 7.92 3.64 8.04 12.26 -2.11 -5.97 7.92 26.94 14.35 15.58 13.70 14.76 35.35 Spread between S&P 500 Composite Returns and Long-Term, High-Grade Corporate Bond Returns 1926-1987 6.77% 4.97% 20.31% 1926-1950 1951-1975 1976-1980 1981-1985 1986 1987 6.08 8.82 12.11 -3.47 -1.38 5.50 2.92 7.40 11.56 -3.12 -1.38 5.50 26.70 13.15 15.84 13.59 14.72 34.06 Source: Casewriter's estimates based on data from the University of Chicago's Center for Research in Security Prices