Question

What is the cost of Land Improvement? a. P 0 b. P300,000 c. P115,000 d. P100,000 2.) Smile Company has determined that its furniture division

What is the cost of Land Improvement?

a. P 0

b. P300,000

c. P115,000

d. P100,000

2.)

Smile Company has determined that its furniture division is a cash generating unit. The entity calculated the value in use of the division to be P22,000,000. The entity has also determined that the fair value less cost of disposal of the building is P13,000,000. The carrying amounts of the assets are as follows: Building 16,000,000; Equipment 8,000,000; and Inventory 8,000,000. What amount of impairment loss should be allocated to Inventory?

a. 2,250,000

b. 3,500,000

c. 3,750,000

d. 9,000,000

3.)

Smile Company has determined that its furniture division is a cash generating unit. The entity calculated the value in use of the division to be P22,000,000. The entity has also determined that the fair value less cost of disposal of the building is P13,000,000. The carrying amounts of the assets are as follows: Building 16,000,000; Equipment 8,000,000; and Inventory 8,000,000. What is the carrying amount of the equipment after recognition of Impairment loss?

a. 5,750,000

b. 4,500,000

c. 4,000,000

d. 4,250,000

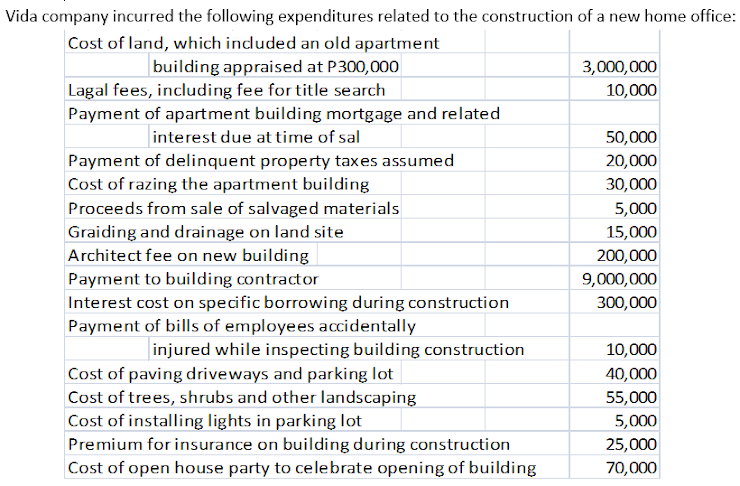

Vida company incurred the following expenditures related to the construction of a new home office: Cost of land, which included an old apartment building appraised at P300,000 3,000,000 Lagal fees, including fee for title search 10,000 Payment of apartment building mortgage and related interest due at time of sal 50,000 Payment of delinquent property taxes assumed 20,000 Cost of razing the apartment building 30,000 Proceeds from sale of salvaged materials 5,000 Graiding and drainage on land site 15,000 Architect fee on new building 200,000 Payment to building contractor 9,000,000 Interest cost on specific borrowing during construction 300,000 Payment of bills of employees accidentally injured while inspecting building construction 10,000 Cost of paving driveways and parking lot 40,000 Cost of trees, shrubs and other landscaping 55,000 Cost of installing lights in parking lot 5,000 Premium for insurance on building during construction 25,000 Cost of open house party to celebrate opening of building 70,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started